- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Problem with reporting IRA rollovers

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Problem with reporting IRA rollovers

@gap-phd What code is in box 7? Was it for a RMD? If it asks if you took the RMD say NO it was NOT RMD since the RMD was waived for 2020.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Problem with reporting IRA rollovers

I had several accounts that I needed to roll over when I went to my new job. I put that the entire amount was rolled over but it looks like they are being added to my income and I am being taxed on the total amount. How can I get this checked out to see if it is a program glitch?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Problem with reporting IRA rollovers

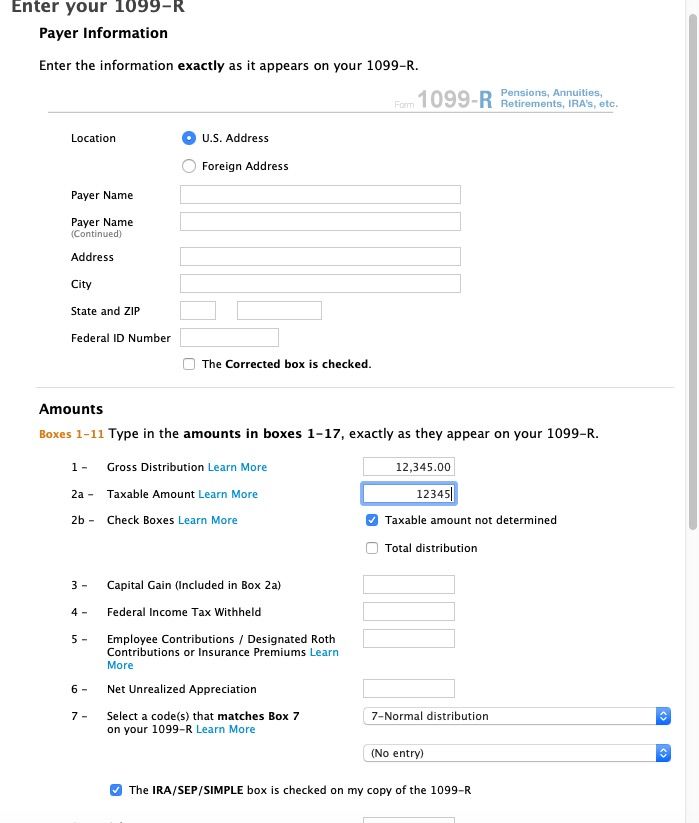

@cousincarmona If you received a 1099-R to report the rollover, the Code in Box 7 may indicate that when you enter your 1099-R.

Enter your 1099-R as shown, and pay close attention to the follow-up questions asked by TurboTax.

If you indicate a rollover from a 401K or Individual IRA to a Roth account, the amount is taxable.

If you are looking at a summary screen or review screen those show the full amount as income and lump a lot of stuff together. You need to check the actual 1040 and make sure it’s right.

For 1099R check 1040 line 4b or 5b for any taxable amount. If it was a rollover it should say ROLLOVER by it and 0 taxable.

You could delete/re-enter your 1099-R if you believe you may have answered a question incorrectly.

Click this link for more info on How to Enter a Rollover.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Problem with reporting IRA rollovers

My Premier program will not open anything for IRA/RMD entries. It keeps saying the IRS hasn't decided...whatever... and to "check back later" . This has been going on for 6 weeks. It's your programs fault, isn't it . What do I do ? I even started from scratch again and ended up with the same results. Your 6 minute updates have npot helped. HELP !! maestrowlf, [email address removed]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Problem with reporting IRA rollovers

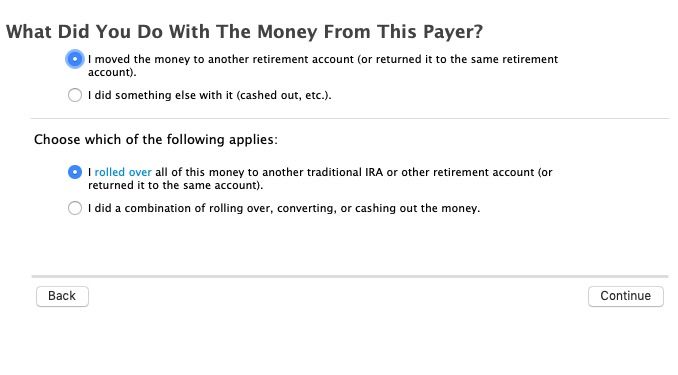

I only have the 1099R page to input the withdrawal. I don't have the page asking "what to do with fund". In Box 7 to select normal distribution, there is an option to select from the drop down. The dropdown only asks about Roth IRA. Nothing indicates INDIRECT rollover

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Problem with reporting IRA rollovers

I don't have the question "what did you do with the money". I am using Premier 2020. It only has input space for 1099R .. I can't indicated the fund was an indirect rollover

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Problem with reporting IRA rollovers

I am having the same problem that I see the question "What Did You Do With The Money From This Payer?" or any questions using Premier 2020. There is no questions. Only spaces to enter info from 1099R form. This is so frustrating.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Problem with reporting IRA rollovers

@Gee059 wrote:

I am having the same problem that I see the question "What Did You Do With The Money From This Payer?" or any questions using Premier 2020. There is no questions. Only spaces to enter info from 1099R form. This is so frustrating.

What code is in box 7?

Delete the 1099-R you entered and re-enter.

Answer the RMD question that "None of this distribution was a RMD" or "RMD not required" depending on the TurboTax version - because it was NOT a RMD, there were no 2020 RMD's.

If this is an inherited IRA then answer the "Is this IRA inherited" with NO. The purpose of that question is to PREVENT rolling an inherited IRA over, but is allowed for 2020 only.

Then you will get the screen to say it was "moved" and all rolled over.

Also check the box that this was NOT a COVID related distributions - it was a RMD that was returned.

That will put the 1099-R box 1 amount on the 1040 form line 4a with the word ROLLOVER next to it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Problem with reporting IRA rollovers

I am using paid "downloaded" premier 2020 purchased on Amazon.

I only see a page to enter only information from form 1099-R with NO questions to answer.

In Box 7 for distribution code. 1st code is 7 for me. 2nd code is the opportunity to select rollover. However, there is NO option for indirect rollover. I selected G for direct rollover (which is not correct; though best out of all), it allows me to select BUT smart check tells me that's an error!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Problem with reporting IRA rollovers

Do you have 2 codes in box 7 on your 1099R? Don't make one up. Enter exactly what's there. If you don't have a second code do not pick one. After you fill out all the 1099R boxes keep going. The questions come later.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Problem with reporting IRA rollovers

There is not code for an indirect rollover.

Enter the 1099-R and answer the followup questions about what you did with the money. Say you "moved" it to another or same account.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Problem with reporting IRA rollovers

If you have an indirect rollover do NOT efile. Intuit has an issue where it doesn't efile a correct return with indirect rollover. Basically the return is efiled without the correct ROLLOVER notation and the taxable amount box left blank.

When you print copies it will show correctly. However if efiled,the return submitted will not. I'm dealing with two years of returns where this was an issue. I requested copy from IRS and sure enough efiled return doesn't match the printed copy.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Problem with reporting IRA rollovers

After you enter it'll ask. Do not enter direct rollover as the IRS will detect this as misreported.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Problem with reporting IRA rollovers

no it doesnt.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Problem with reporting IRA rollovers

I agree....it is taking my 403B as income....I see no other place to post the 1099-R as a complete rollover of money/transfer to a Traditional IRA. Taxes are due tomorrow and I have tried to fix this problem for over a couple of weeks....

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Tomzee

Level 2

JDSchachte

New Member

navipod

Returning Member

jonelaker

New Member

osirhc

Level 1