- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- On the 1099R entry, where do I report a QCD?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On the 1099R entry, where do I report a QCD?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On the 1099R entry, where do I report a QCD?

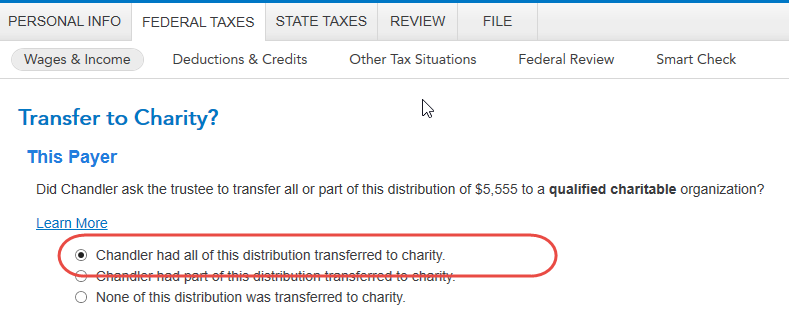

When you enter your 1099-R, one of the screens asks 'was this withdrawal an RMD', then another asks 'Transfer to Charity?'.

If you missed these on your original entry, you could delete your 1099-R and re-enter it to get those screens to come up for you.

Click this link for info on Qualified Charitable Deductions on 1099-R.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On the 1099R entry, where do I report a QCD?

After multiple re-entrys, the RMD, screen has 3 choices, all RMD, partial RMD, not a RMD. There never was any quetion about QCD or charity. The program needs to be fixed. How does one notify TT tech support to fix this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On the 1099R entry, where do I report a QCD?

QCDs allow IRA owners who are age 70 ½ or older to directly transfer up to $100,000 annually from an IRA to charity, tax-free. Please check these entries:

- Make sure you have the IRA/SEP/SIMPLE box marked on your 1099-R form (below box 7); and

- Your age is 70-1/2 or better.

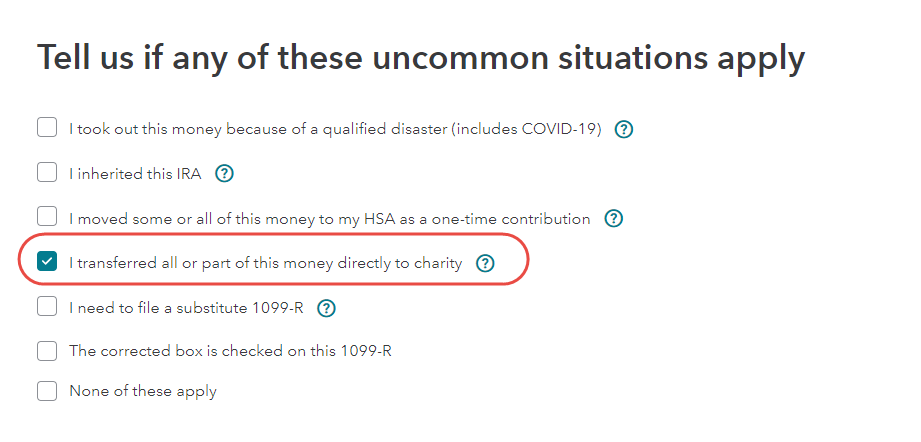

After the 1099-R entry screen, you should see the screen, Tell us if any of these uncommon situations apply. You will be able to mark the box that you transferred all or part of this money to charity. [See screenshots below.]

TURBOTAX ONLINE:

TURBOTAX DESKTOP:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On the 1099R entry, where do I report a QCD?

I am 70 1/2 born oct 1949. This is the screen I see.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On the 1099R entry, where do I report a QCD?

There is still a bug. I had to change my birthday to be over 72 in order for that screen asking about charity to appear.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On the 1099R entry, where do I report a QCD?

It is possible to simply repeat the path through the 1099R. On the screen "Do any of these situations apply?", check the box for "I transferred all or part of this money directly to a charity." No need to delete and repeat. But thanks for the clue.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

mdktech24

Level 3

foxstarfarm

Returning Member

HelpMeLawd

Returning Member

syoung123

Level 5

user08181992

Level 2