- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

QCDs allow IRA owners who are age 70 ½ or older to directly transfer up to $100,000 annually from an IRA to charity, tax-free. Please check these entries:

- Make sure you have the IRA/SEP/SIMPLE box marked on your 1099-R form (below box 7); and

- Your age is 70-1/2 or better.

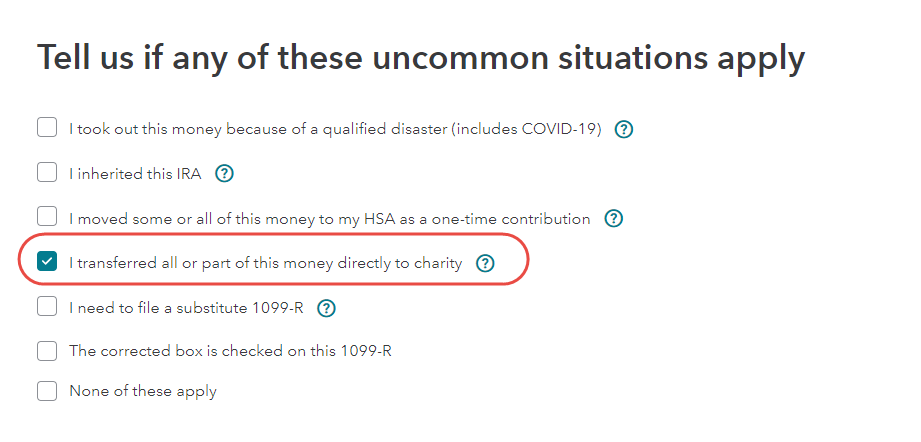

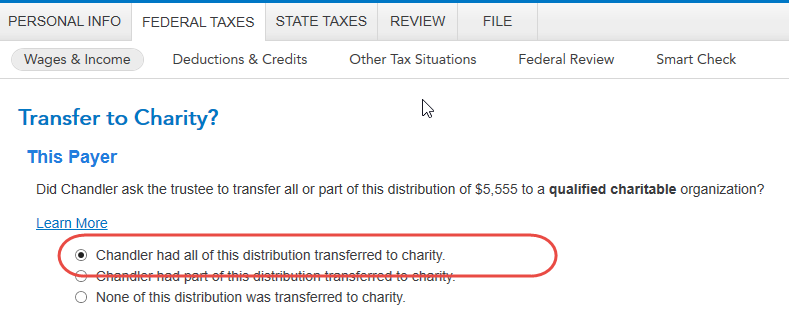

After the 1099-R entry screen, you should see the screen, Tell us if any of these uncommon situations apply. You will be able to mark the box that you transferred all or part of this money to charity. [See screenshots below.]

TURBOTAX ONLINE:

TURBOTAX DESKTOP:

January 18, 2021

6:54 AM