- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- My teacher’s retirement pension changed from pension to wages when transferred to Oklahoma state form. How do I change this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My teacher’s retirement pension changed from pension to wages when transferred to Oklahoma state form. How do I change this?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My teacher’s retirement pension changed from pension to wages when transferred to Oklahoma state form. How do I change this?

My teacher’s retirement pension changed from pension to wages when transferred to Oklahoma state form.

I prepared an Oklahoma state income tax return and teacher's retirement pension was not changed to wages.

The Pension Exclusion is reported on line 2 of the Oklahoma state tax form 511.

Please clarify what is happening in your Oklahoma state income tax return.

You may deduct up to $10,000 (for each eligible taxpayer) of these retirement benefits from your Oklahoma income:

- Civil Service retirement from the United States

- Oklahoma Public Employees Retirement System of Oklahoma

- Oklahoma Teacher's Retirement System

- Oklahoma Law Enforcement Retirement System

- Oklahoma Fire Fighters Pension and Retirement System

- Oklahoma Police Pension and Retirement System

- Employee retirement systems created by counties

- The Uniform Retirement System for Justices and Judges

- Oklahoma Employment Security Commission Retirement Plan

- Employee retirement systems created by municipalities

- United States Retirement Board benefits included in your federal income

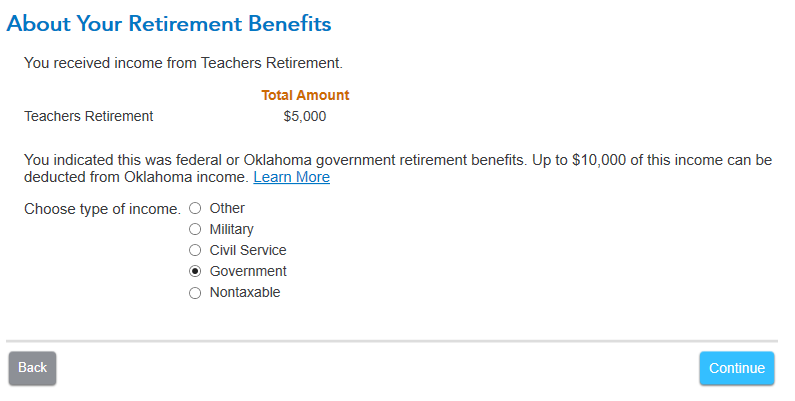

In the Oklahoma state income tax return, see the screen About Your Retirement Benefits.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

manwithnoplan

Level 2

carchasecity

New Member

therealnancydrew

Returning Member

mbms2018

Returning Member

whitty05

New Member