- Community

- Topics

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- My husband has a 1099-R with a payer's name that is not "on the list" and is not recognized when I try to enter it. How else can I input the information?

Announcements

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My husband has a 1099-R with a payer's name that is not "on the list" and is not recognized when I try to enter it. How else can I input the information?

The 1099-R shows state tax withheld but not Federal income tax. Does that mean Federal tax is not required?

Topics:

posted

April 6, 2025

4:05 PM

last updated

April 06, 2025

4:05 PM

Connect with an expert

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

1 Reply

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My husband has a 1099-R with a payer's name that is not "on the list" and is not recognized when I try to enter it. How else can I input the information?

You can enter the information manually or upload a pdf. No, the lack of withholding for federal purposes doesn't mean that it's not taxable.

Here is how to do input the 1099-R manually in TurboTax Online:

- Navigate to Federal > Wages & Income > IRA, 401(k), Pension Plan Withdrawals (1099-R) Add/Edit

- Add a 1099-R

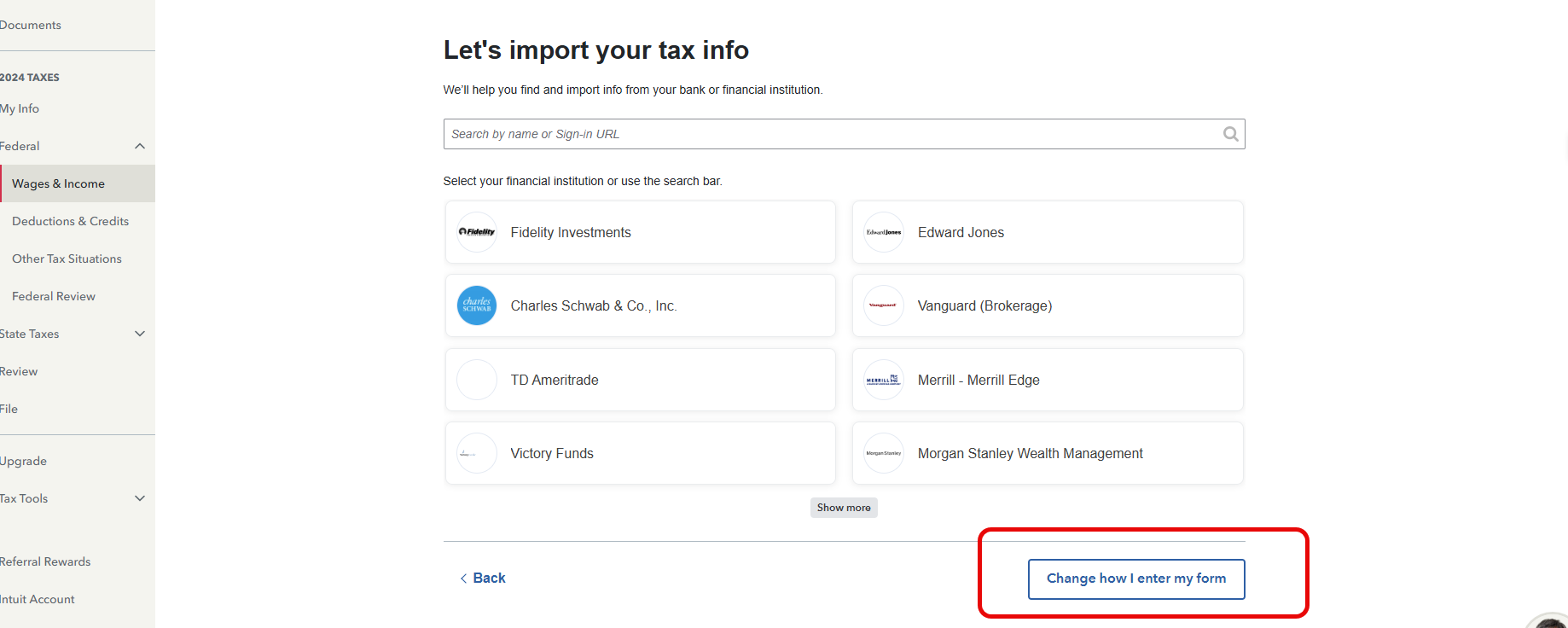

- Select "Change how I enter my form"

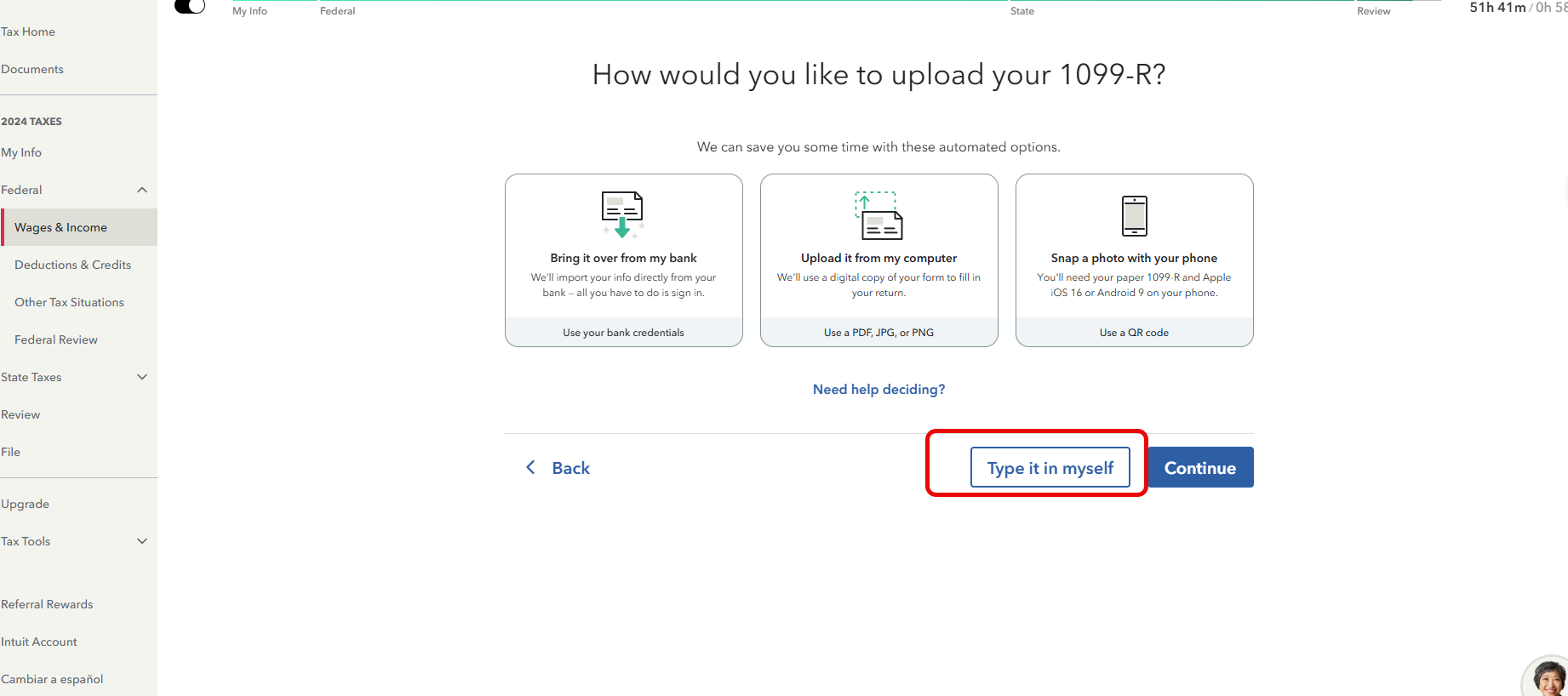

- On the next screen, it asks "How would you like to upload your 1099-R?" Select "Type it in myself"

- Next it asks "Who gave you a 1099-R?", you can click "Financial institution or other provider" and select continue

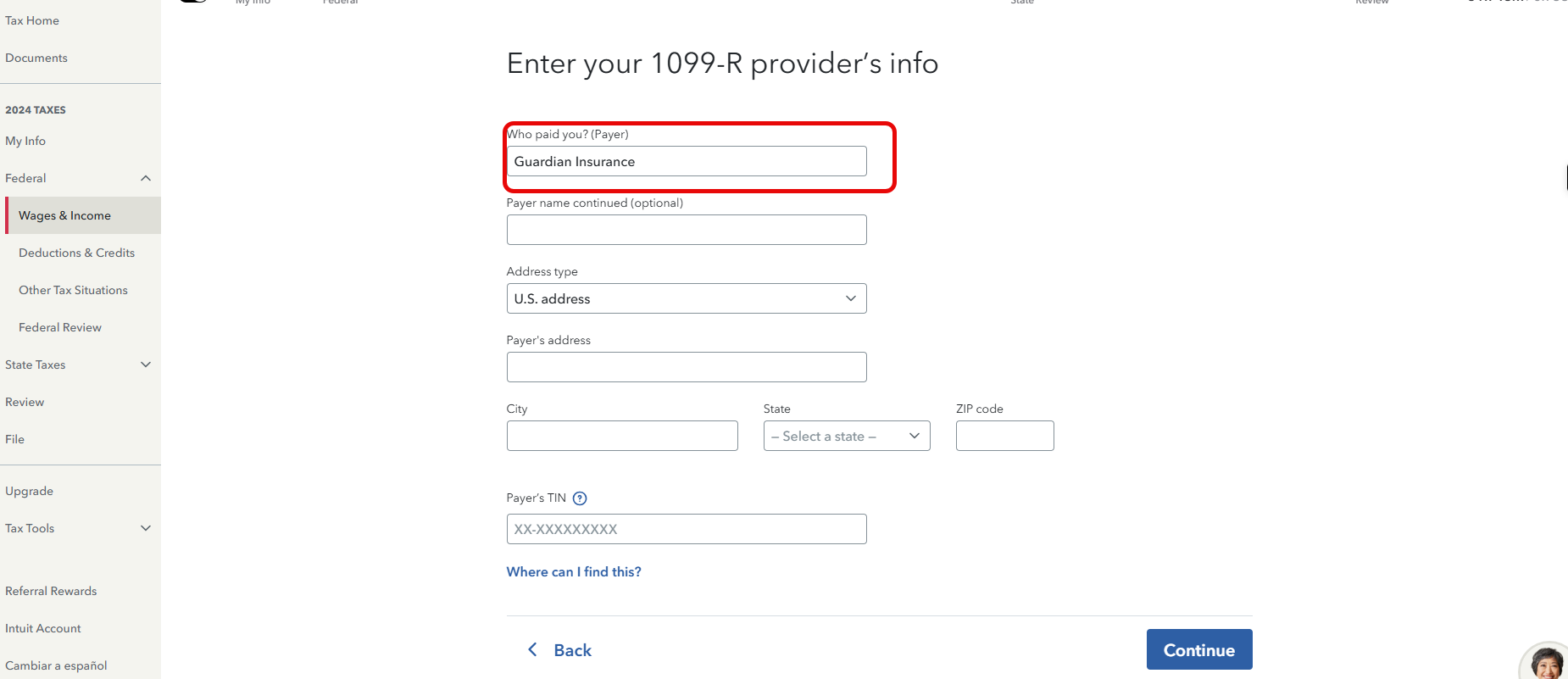

- Now, you can input your 1099-R provider's info, and continue through the rest of the interview

April 6, 2025

4:07 PM

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

JustmeBG

New Member

redbullcaddy

New Member

Ciao4

Level 3

ronhowco

New Member

sarah-mccabe-tx

New Member