in [Event] Ask the Experts: Biz Recordkeeping & 1099-NEC Filing

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- My contribution to my HSA showed on last years return but does not show on this year as a deduction. Showed as employer contribution but I made the contribution

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My contribution to my HSA showed on last years return but does not show on this year as a deduction. Showed as employer contribution but I made the contribution

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My contribution to my HSA showed on last years return but does not show on this year as a deduction. Showed as employer contribution but I made the contribution

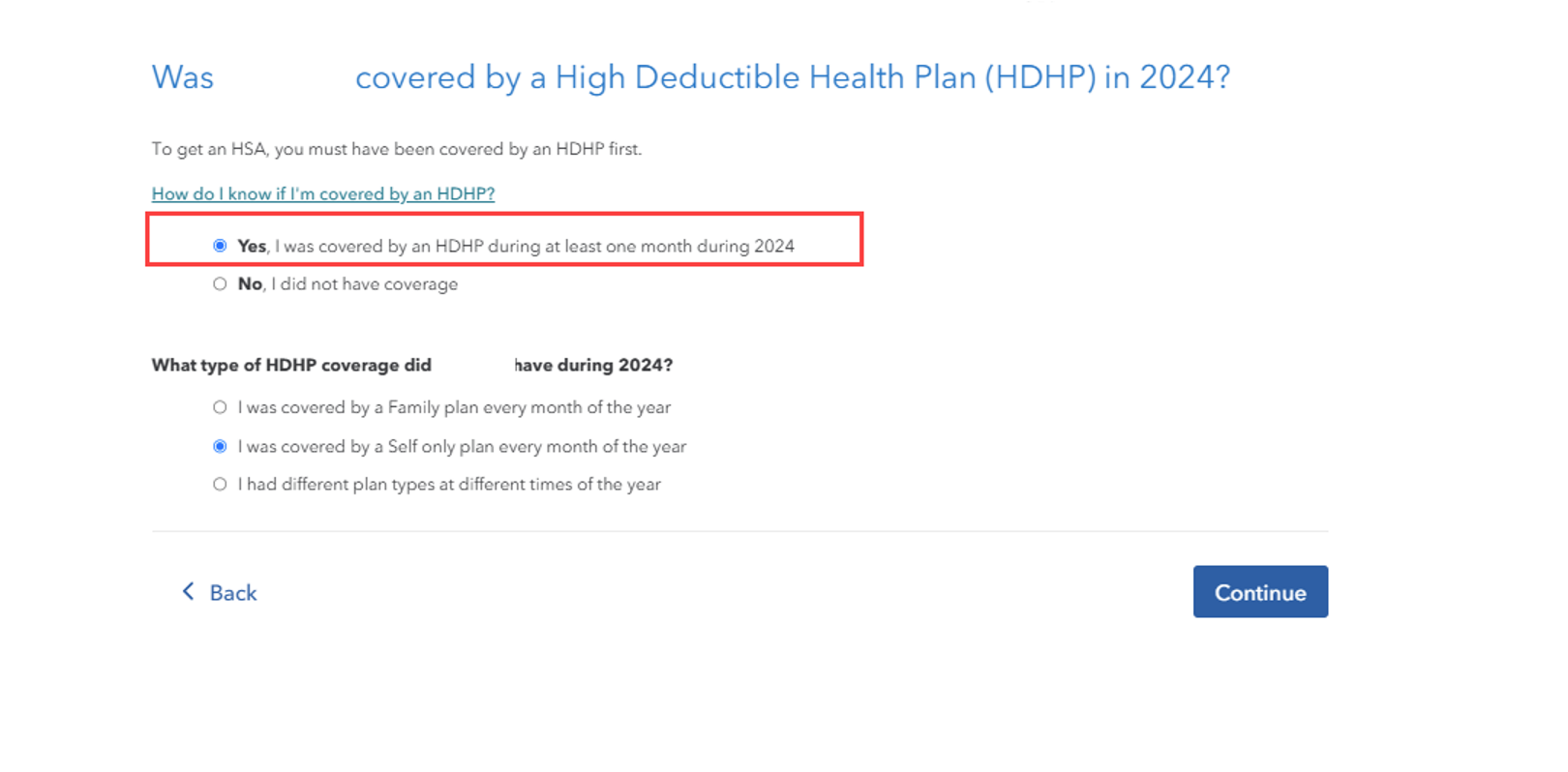

It is already a "deduction", because it is not included in Box 1 of your W-2. You and your employer's contributions both appear in Box 12 Code W on your W-2. You do need to make sure to enter that you have carried a high-deductible plan so the contributions are not added back to your income. This can be checked in Federal Taxes > Deduction & Credits > HSA, MSA Contributions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My contribution to my HSA showed on last years return but does not show on this year as a deduction. Showed as employer contribution but I made the contribution

If the entire amount of 2023 HSA contributions appeared with code W in box 12 of your 2023 W-2 and your 2023 tax return shows a deduction on Schedule 1 line 13, you've filed an incorrect 2023 tax return and you need to amend it to remove this deduction to which you were not entitled.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17629581143

Level 1

Karl26

Level 1

HollyP

Employee Tax Expert

jawckey

Level 4

gymochin

Returning Member