- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- My 1099-B has a code X sales total (non-covered securities, unknown holding period) - which option should I choose from the Sales Section drop down?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099-B has a code X sales total (non-covered securities, unknown holding period) - which option should I choose from the Sales Section drop down?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099-B has a code X sales total (non-covered securities, unknown holding period) - which option should I choose from the Sales Section drop down?

You may select Unknown term basis not reported to IRS at the Sales section title.

You will have to review your investment records and sales tickets to determine the proper date of purchase and/or date of sale.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099-B has a code X sales total (non-covered securities, unknown holding period) - which option should I choose from the Sales Section drop down?

That's the issue - there is no option "Unknown term basis not reported to IRS". Closest I found was long-term, not reported, but that showed up as code E, not X.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099-B has a code X sales total (non-covered securities, unknown holding period) - which option should I choose from the Sales Section drop down?

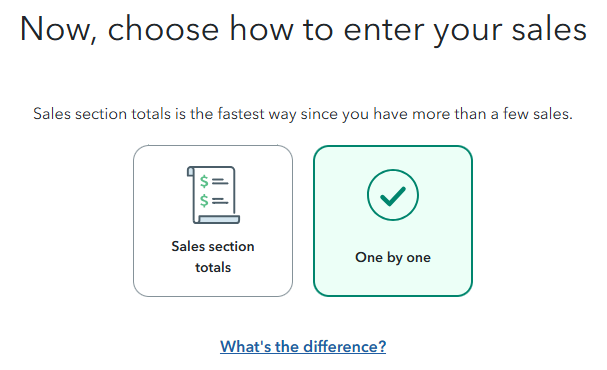

"Unknown term basis not reported to IRS" as Sales section title is available

if the One by One method is selected at the screen Now, choose how to enter your sales.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

b_benson1

New Member

frostily0495

Level 3

skonger

Returning Member

rvmsg

Returning Member

hunterbean2022

New Member