- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- MN State - Skip Pension Subtraction Doesn't Skip

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MN State - Skip Pension Subtraction Doesn't Skip

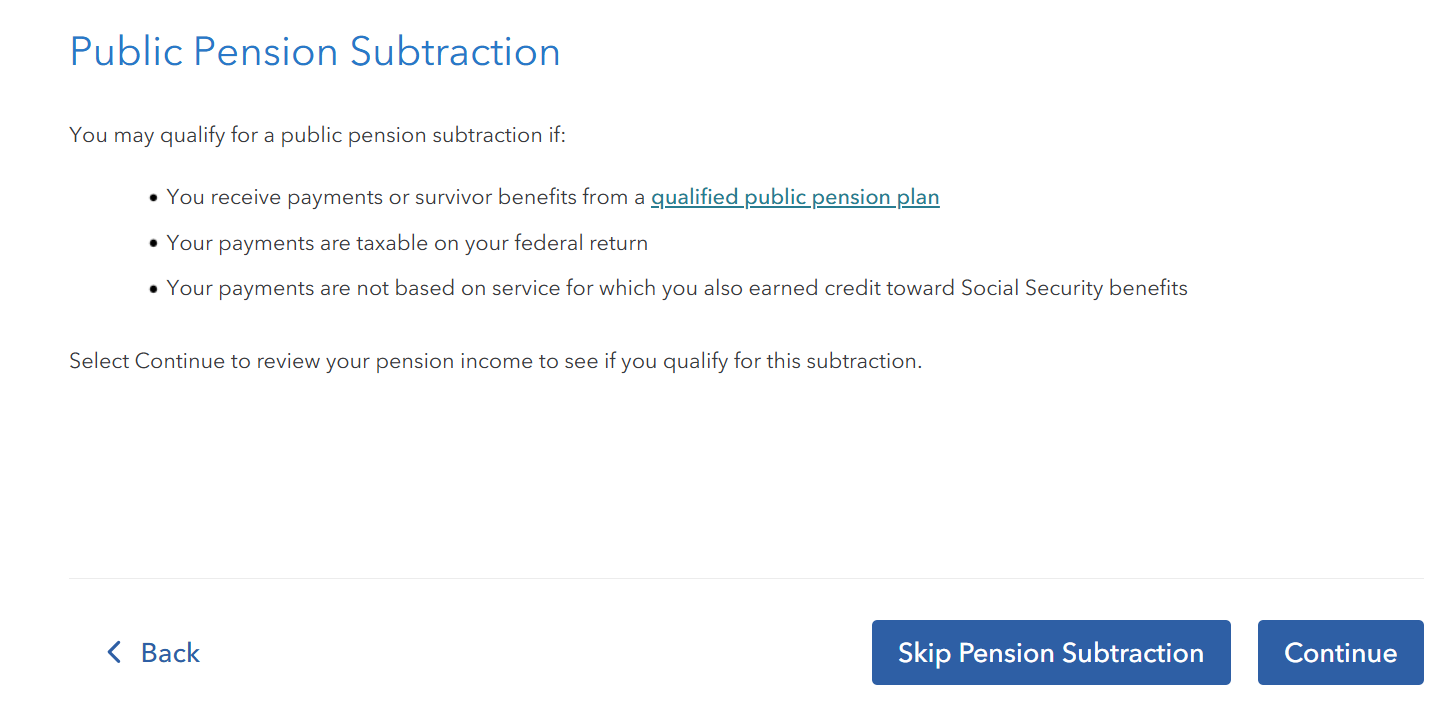

I'm trying to skip the "Public Pension Subtraction". I click the "Skip Pension Subscription" button. However, the "Smart Check" finds an error and requires me to enter info into Schedule M1QPEN (Qualified Public Pension Subtraction). The form identifies me as the pension holder even though the pension belongs to my wife. I'm in a loop and can't move forward.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MN State - Skip Pension Subtraction Doesn't Skip

First, we want to make sure that your wife's pension is attributable to her in TurboTax. On the 1099-R entry screen, make sure you've chosen that this form belongs to your wife at the top of the screen.

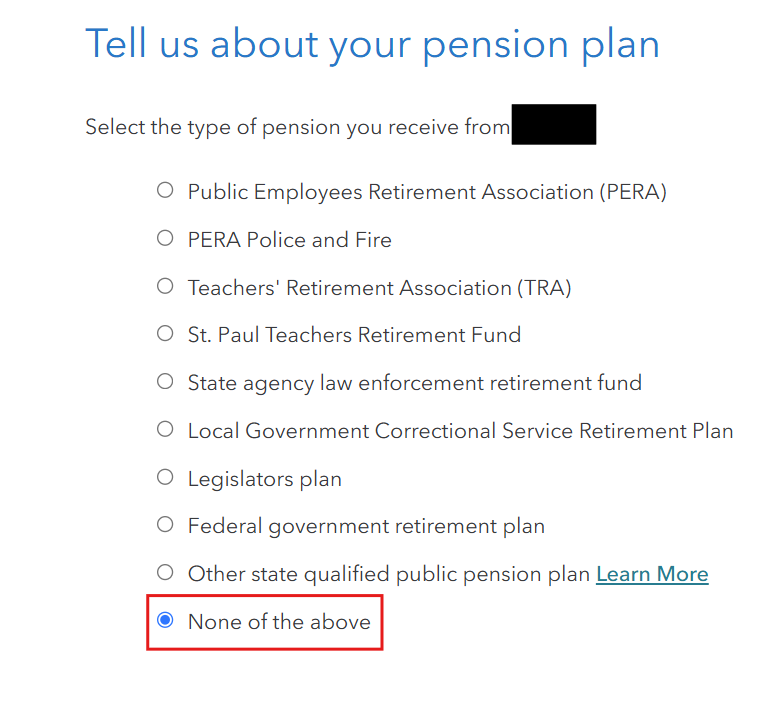

Second, to get past this loop, click Continue instead of Skip Pension Subtraction. On the next screen, click none of the above. You should then see a Public Pension summary page that shows zero subtraction.

If you're still having issues, we can look at your return and see exactly what you see to help come to a resolution. The return will be scrubbed and won't include any of your personal details.

If you're using TurboTax Online:

Once you're logged in to your account,

- on the left hand panel, click on Tax Tools and then choose Tools

- on the pop up window, select Share my file with Agent

- you'll see a message saying you'll give us a copy of your tax return. Your personal information will be changed so we can't see any private information.

- click okay and you'll get another message with a token

If you're using TurboTax Desktop:

- Click on Online in the top menu of TurboTax Desktop for Windows

- Select 'Send Tax File to Agent'

- Write down or send an image of your token number and state then place in this issue.

- We can then review your exact scenario for a solution

Please reply to this message with your token so that we can further assist you. Let us know all the states, if any, that are included on the return.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

trish2167

New Member

patty315

New Member

Zasu

Level 1

ethanol denver

Level 1

cashdlc

New Member