- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Missed 2023 RMD payment from annuity due to lack of funds

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Missed 2023 RMD payment from annuity due to lack of funds

Have an annuity which for years make automatic withdrawals for RMD.

Surrender value is $950

RMV is $14000

Rmd for 2023 was $1400.

Rmd was not taken since amount in surrender value was less than RMD.

Only way to make RMD payments going forward is to annuitize policy.

This will result in automatic RMD payments for 10 years.

But the annuity company says there is no way to pay for the missed 2023 RMD.

What to do?

Many thanks in advance for helping me break out of this circle.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Missed 2023 RMD payment from annuity due to lack of funds

RMD's are not required until you reach a certain age. For 2023, that is 72 years old, but it was 70.5 in 2020. If you haven't reached this age yet, you may not be required to take an RMD from the annuity.

However, if you are above that age, and assuming you are trying to take steps to remedy not taking the RMD, you can request a waiver of the penalty on Form 5329. You will need to submit a letter of explanation as well.

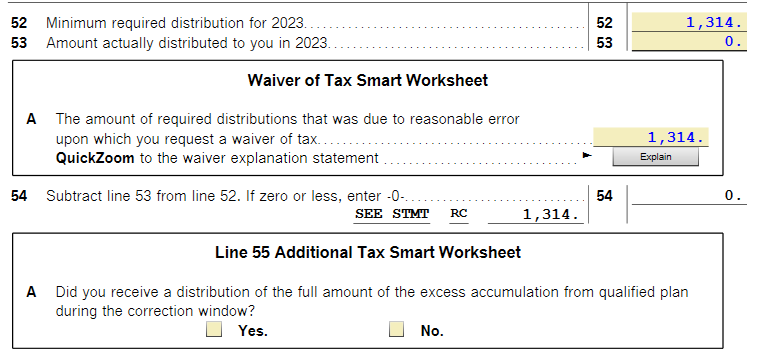

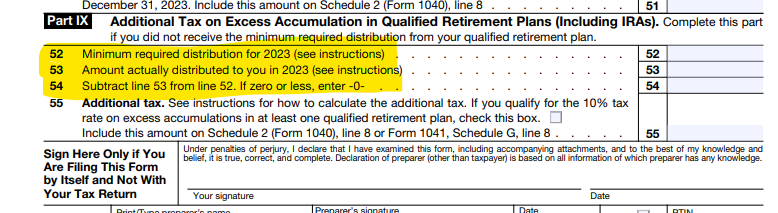

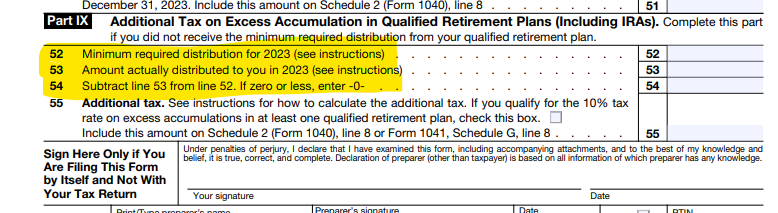

When filing Form 5329, be sure to complete lines 52 (minimum RMD for 2023) and 53 (RMD actually distributed) as prompted. You will need to enter "RC" and the amount of the RMD that wasn't taken but should have been taken on line 54. The difference will be reported on line 55 and tax is paid on amounts on line 55. You will also need to attach a statement letting the IRS know the reason for the shortfall and showing that you are working to remedy the issue going forward.

The IRS will review your information and if they disagree, will send a notice assessing additional tax. Please see this excerpt from the instructions for Form 5329.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Missed 2023 RMD payment from annuity due to lack of funds

That's okay. You can still file and request a penalty waiver. In the meantime, I suggest working with the plan administrator to see what steps you can take to avoid this situation from occuring again in 2024.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Missed 2023 RMD payment from annuity due to lack of funds

It depends.

If you are listed as the main taxpayer, you will use Form 5329T. If you are listed as the spouse on your tax return, you will use Form 5329S. (Essentially T is for taxpayer and S is for spouse.)

I'm not sure what you are referring to when you are asking about "A". However, your will complete Part IX and put the amount of the RMD you should have received on line 52. Line 53 would be the amount you actually received. Then following the form instructions, you will enter the difference between line 52 and 53 on line 54. Be sure to write in (RC) on the dotted line for line 54 to the left of the amount entered. Be sure to include the statement with your reasoning for the waiver request. You will need to attach it to the filing of Form 5329.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Missed 2023 RMD payment from annuity due to lack of funds

Don't have other annuities or IRAs to use for the 2023 RMD

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Missed 2023 RMD payment from annuity due to lack of funds

RMD's are not required until you reach a certain age. For 2023, that is 72 years old, but it was 70.5 in 2020. If you haven't reached this age yet, you may not be required to take an RMD from the annuity.

However, if you are above that age, and assuming you are trying to take steps to remedy not taking the RMD, you can request a waiver of the penalty on Form 5329. You will need to submit a letter of explanation as well.

When filing Form 5329, be sure to complete lines 52 (minimum RMD for 2023) and 53 (RMD actually distributed) as prompted. You will need to enter "RC" and the amount of the RMD that wasn't taken but should have been taken on line 54. The difference will be reported on line 55 and tax is paid on amounts on line 55. You will also need to attach a statement letting the IRS know the reason for the shortfall and showing that you are working to remedy the issue going forward.

The IRS will review your information and if they disagree, will send a notice assessing additional tax. Please see this excerpt from the instructions for Form 5329.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Missed 2023 RMD payment from annuity due to lack of funds

I see I forgot to mention I am 92 years old. I am grateful for your answer but the 2023 RMD was not taken and according to the Annuity company will never be taken.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Missed 2023 RMD payment from annuity due to lack of funds

That's okay. You can still file and request a penalty waiver. In the meantime, I suggest working with the plan administrator to see what steps you can take to avoid this situation from occuring again in 2024.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Missed 2023 RMD payment from annuity due to lack of funds

Many thanks for your help with this. I am very grateful.

I am working with company to resolve this issue for this and future years.

Am I to use form 5329 T or S?

What number do I put in A on the Form 5329?

53 is the RMD amount missed

54 is 0

Then waiver of Tax Smart Worksheet has A amount of distributions that were due to reasonable error or upon which you request a waver -- enter the same number as line 52?

Thank you again!

John

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Missed 2023 RMD payment from annuity due to lack of funds

It depends.

If you are listed as the main taxpayer, you will use Form 5329T. If you are listed as the spouse on your tax return, you will use Form 5329S. (Essentially T is for taxpayer and S is for spouse.)

I'm not sure what you are referring to when you are asking about "A". However, your will complete Part IX and put the amount of the RMD you should have received on line 52. Line 53 would be the amount you actually received. Then following the form instructions, you will enter the difference between line 52 and 53 on line 54. Be sure to write in (RC) on the dotted line for line 54 to the left of the amount entered. Be sure to include the statement with your reasoning for the waiver request. You will need to attach it to the filing of Form 5329.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Missed 2023 RMD payment from annuity due to lack of funds

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Missed 2023 RMD payment from annuity due to lack of funds

The screenshot above it what I see....maybe I stop at line 54? Thank you again for your expert and timely advice.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Missed 2023 RMD payment from annuity due to lack of funds

Yes, it looks like you entered everything correctly.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

rpruiz23

Returning Member

fbeaty11-gmail-c

New Member

chestnut

Level 2

joabrady

Level 2

joabrady

Level 2