- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

It depends.

If you are listed as the main taxpayer, you will use Form 5329T. If you are listed as the spouse on your tax return, you will use Form 5329S. (Essentially T is for taxpayer and S is for spouse.)

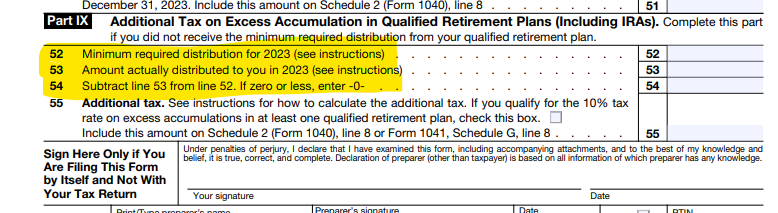

I'm not sure what you are referring to when you are asking about "A". However, your will complete Part IX and put the amount of the RMD you should have received on line 52. Line 53 would be the amount you actually received. Then following the form instructions, you will enter the difference between line 52 and 53 on line 54. Be sure to write in (RC) on the dotted line for line 54 to the left of the amount entered. Be sure to include the statement with your reasoning for the waiver request. You will need to attach it to the filing of Form 5329.

**Mark the post that answers your question by clicking on "Mark as Best Answer"