- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Michigan taxes my pension at 50% I was born in 53? I now see MI Schd 1 line 26, 24C & 24D are blank. Taxed at the full rate! Anyone else experience this? How to fix?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Michigan taxes my pension at 50% I was born in 53? I now see MI Schd 1 line 26, 24C & 24D are blank. Taxed at the full rate! Anyone else experience this? How to fix?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Michigan taxes my pension at 50% I was born in 53? I now see MI Schd 1 line 26, 24C & 24D are blank. Taxed at the full rate! Anyone else experience this? How to fix?

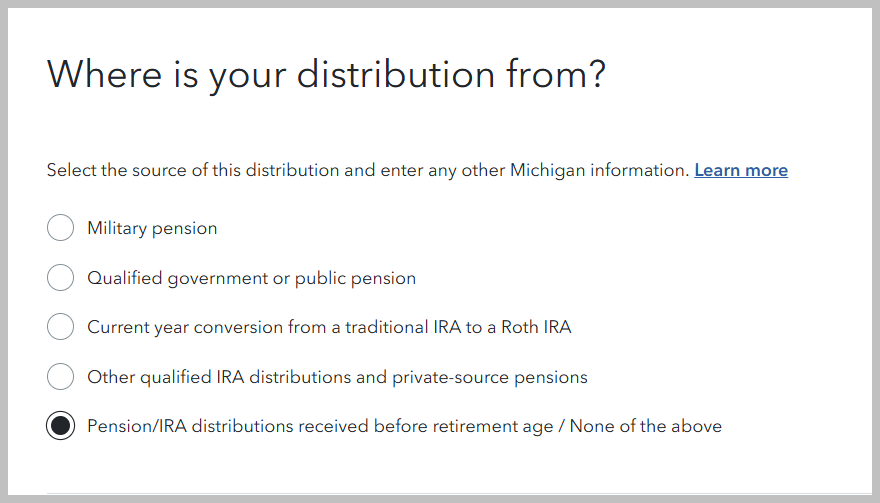

It could be due to how you entered your pension in TurboTax. There are some questions in the federal section of your return, after form 1099-R asking where your distribution is from.

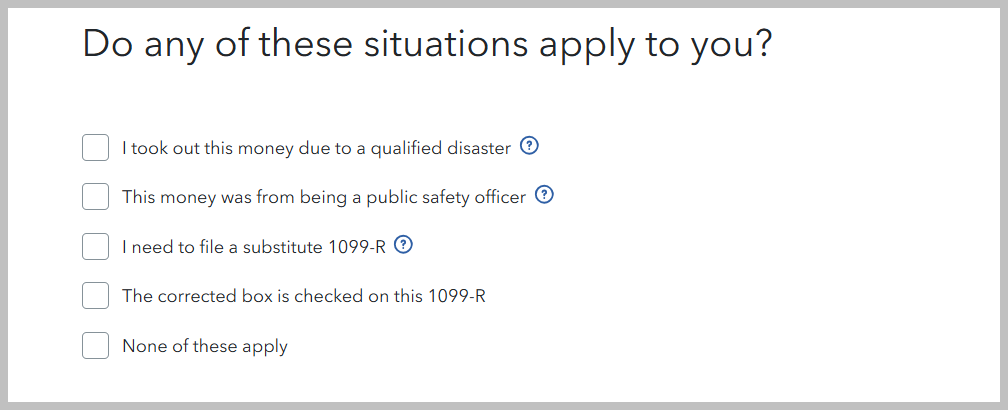

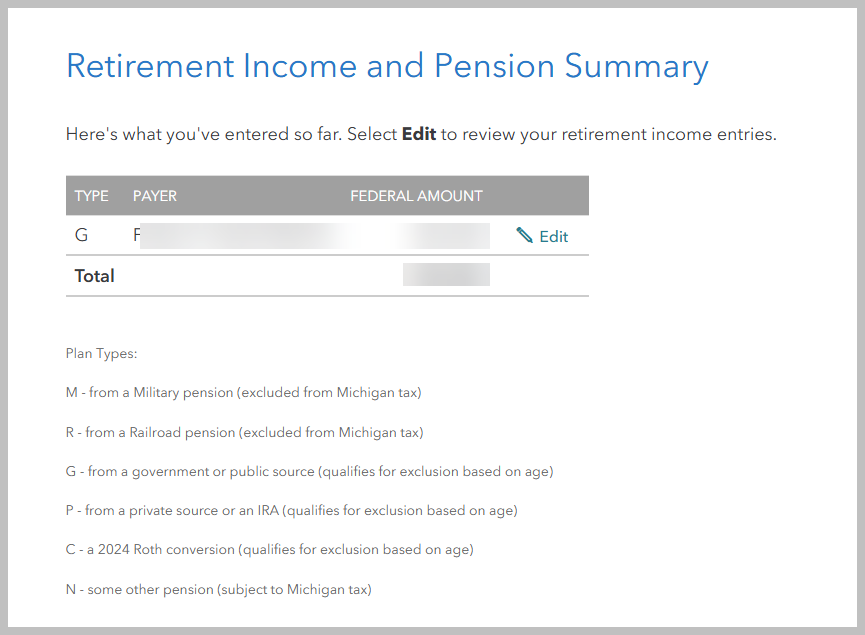

Then in the Michigan return, there are additional questions to classify your pension. The questions are to determine what type of pension you have. There are some codes depending on what the source of your pension is. See the codes below:

G - if the pension is from a government or public source

P - if it is from a private source or an IRA

C - if it is a 2024 Roth conversion

N - if it is an other pension subject to Michigan tax (including ALL Section 457 plan distributions)

M - if it is a Military pension

R - if it is a Railroad pension

If you entered the income incorrectly on the return and you already filed, you will need to amend your return. See the following TurboTax help article for more information.

How do I amend my federal tax return for a prior year?

How do I amend my state tax return?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

SterlingSoul

New Member

fpho16

New Member

rob_taylor81

New Member

libs45

New Member

rich.bolterstein

New Member