- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Is Social Security Income qualify for the Colorado pension and annuity exclusion

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Social Security Income qualify for the Colorado pension and annuity exclusion

Both my wife and I are over 65, retired and both receive Social Security Benefits. Do those benefits qualify for the Colorado pension and annuity exclusion?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Social Security Income qualify for the Colorado pension and annuity exclusion

Yes. Colorado taxpayers between the ages of 55 and 64 can exclude up to

$20,000 of retirement earnings from taxes, which may include Social

Security, pensions and other income. Colorado residents over the age of

64 can exclude up to $24,000. Turbo Tax will go through this exclusion when you complete your Colorado return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Social Security Income qualify for the Colorado pension and annuity exclusion

Yes. Colorado taxpayers between the ages of 55 and 64 can exclude up to

$20,000 of retirement earnings from taxes, which may include Social

Security, pensions and other income. Colorado residents over the age of

64 can exclude up to $24,000. Turbo Tax will go through this exclusion when you complete your Colorado return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Social Security Income qualify for the Colorado pension and annuity exclusion

I am filing a joint return with my wife. We are both over 55 and received social security payments in 2020. Is the $20,000 exclusion per person?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Social Security Income qualify for the Colorado pension and annuity exclusion

Yes, the exclusion is per person, but it is calculated separately for each individual. This means that each person can qualify up to the maximum amount, but for a joint return the maximum exclusion is not necessarily twice the maximum unless each person fully qualifies based on age and income.

The following document from the Colorado Department of Revenue contains more information: Pension and Annuity Subtraction

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Social Security Income qualify for the Colorado pension and annuity exclusion

TurboTax is increasing my tax liability and not showing me how the exclusion applies to me. I am 65 years old and TurboTax is showing my entire social security and pension income of less than $24,000 as being taxed. Please help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Social Security Income qualify for the Colorado pension and annuity exclusion

In you Colorado return, choose 'Revisit' at Pension and Annuity Exclusion (screenshot). Say NO you did not receive benefits due to death.

The next screen displays the amount of Social Security that is taxed on your Federal return as being excluded (screenshot).

At the next screen you are shown the amount Federal Pension Income, where you enter the amount being excluded in Colorado (screenshot).

If this doesn't resolve your issue, you can Contact TurboTax Support.

@ziskinkuriyama

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Social Security Income qualify for the Colorado pension and annuity exclusion

Turbo tax is not calculating the exclusion amount correctly for Colorado.

There is a pension worksheet that calculates the limit correctly, but the Form 104AD does not apply the limit to the taxable social security amount if it is over 20,000 and is subtracting the entire amount. My taxable social security is over 24,000. The form excluded the rest of my retirement income, but brought the entire SSA amount over to form 104 when it should have been limited to 20,000. It is understating my Colorado taxable income and the program will not let me correct it. I called support, and they agreed with me that it looks incorrect.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Social Security Income qualify for the Colorado pension and annuity exclusion

To clarify, what is the total of all of your pensions including social security and how much is the social security?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Social Security Income qualify for the Colorado pension and annuity exclusion

The total amount is over $100K including SSA. The Pension worksheet correctly has the limit of $20,000, however form 104AD is incorrect.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Social Security Income qualify for the Colorado pension and annuity exclusion

What are you seeing on the Colorado 104AD that concerns you?

Colorado Pension and Annuity Exclusion here.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Social Security Income qualify for the Colorado pension and annuity exclusion

JamesG1,

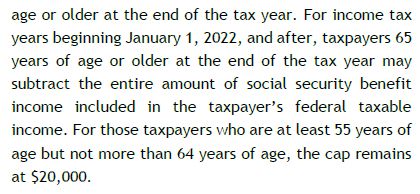

You are referencing a 2020 document. For taxpayers over 65 Colorado may now exclude the entire amount of federal taxable Social Security.

The Pension and Annuity Exclusion Worksheet line 6 verbiage in TTax 2022 is incorrect. In my return the amounts were not calculated though the exclusions reported on Form 104AD are correct.

I am not able to find the above worksheet in the CO forms and documents though TurboTax is still using it.

This is from Income Tax Topics: Social Security, Pensions, and Annuities, dated February 2023. It includes a "Joint social security benefits worksheet" that appears to replace the older Exclusion Worksheet

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Social Security Income qualify for the Colorado pension and annuity exclusion

Colorado taxpayers that are age 65 and older, can fully deduct their Social Security benefits from their state income, effective with the 2022 tax returns that will they file in 2023.

In previous years, people in this age group could deduct up to $24,000 in retirement income, including Social Security payments, but a 2021 state law repealed that cap.

Enter your SSA-1099 as shown in TurboTax, and the information will flow properly through to your Colorado State Tax Return.

Click here for information regarding social security benefits from the Colorado Department of Revenue. See under adjustment to taxable income.

Click here for instruction on how to enter your Form SSA-1099.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Social Security Income qualify for the Colorado pension and annuity exclusion

Reviewing the exclusion text for 2022 SSA and Pension exclusion the wording is:

"Coloradans age 65 and older can fully deduct Social Security benefits from their state income, effective with the 2022 tax returns they file in 2023."

Reviewing the TTax22 Pension Annuity Exclusion Worksheet, Lines 3a, 3b show the values we received from our SSA-1099s. However, Line 3c, shows both values of Line 3b reduced by 15%. Further, Line 1c shown on Line 5 was reduced about 23%.

Why would the full amounts be reduced?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Social Security Income qualify for the Colorado pension and annuity exclusion

I suspect that your reported income is high enough to make 85% of your Social Security benefits taxable income on your Federal 1040 tax return.

You should be able to confirm that calculation by looking at box 6a and 6a on the Federal 1040 tax return. View the entries at Tax Tools / Tools / View Tax Summary / Preview my 1040.

Only the 85% taxable portion of your Social Security flows to your adjusted gross income and taxable income and Colorado is picking up the Federal taxable income to begin the Colorado state income tax return.

Since Colorado starts with its computation with only the 85% portion, only the 85% portion is deducted to accomplish 'fully deduct(ing) Social Security benefits from the state income".

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Social Security Income qualify for the Colorado pension and annuity exclusion

My Form 104AD for Colorado is using entire taxed Soc Sec amount, not the capped 24K per filer over 65.

Need to fix.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

hijyoon

New Member

WDM67

Level 3

CourtneyDee

New Member

nvogel31

New Member

lozzakozza

New Member