- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

JamesG1,

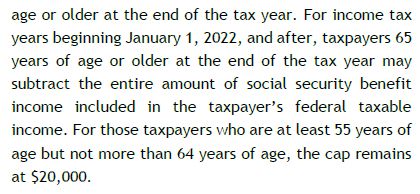

You are referencing a 2020 document. For taxpayers over 65 Colorado may now exclude the entire amount of federal taxable Social Security.

The Pension and Annuity Exclusion Worksheet line 6 verbiage in TTax 2022 is incorrect. In my return the amounts were not calculated though the exclusions reported on Form 104AD are correct.

I am not able to find the above worksheet in the CO forms and documents though TurboTax is still using it.

This is from Income Tax Topics: Social Security, Pensions, and Annuities, dated February 2023. It includes a "Joint social security benefits worksheet" that appears to replace the older Exclusion Worksheet

February 17, 2023

4:34 PM