- Community

- Topics

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Is my federal retirement annuity exempt from state tax in Kansas?

Announcements

Attend our Ask the Experts event about Tax Law Changes - One Big Beautiful Bill on Aug 6! >> RSVP NOW!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is my federal retirement annuity exempt from state tax in Kansas?

It appeared that retirement annuities are exempt from state tax but my return isn't showing a Kansas pension deduction. How can I correct this?

Topics:

posted

March 7, 2024

5:41 PM

last updated

March 07, 2024

5:41 PM

Connect with an expert

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

1 Reply

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is my federal retirement annuity exempt from state tax in Kansas?

To properly reflect the excludable amount of your Kansas pension deduction, you will need to make entries in the state interview section of TurboTax.

To do this in TurboTax online, log back into your return.

- Select State Taxes

- Proceed through the state interview screens until you see a screen titled "Here's the income that Kansas handles differently." On this screen, scroll down to the section titled Retirement and select start/edit to the right of Pension Exemption.

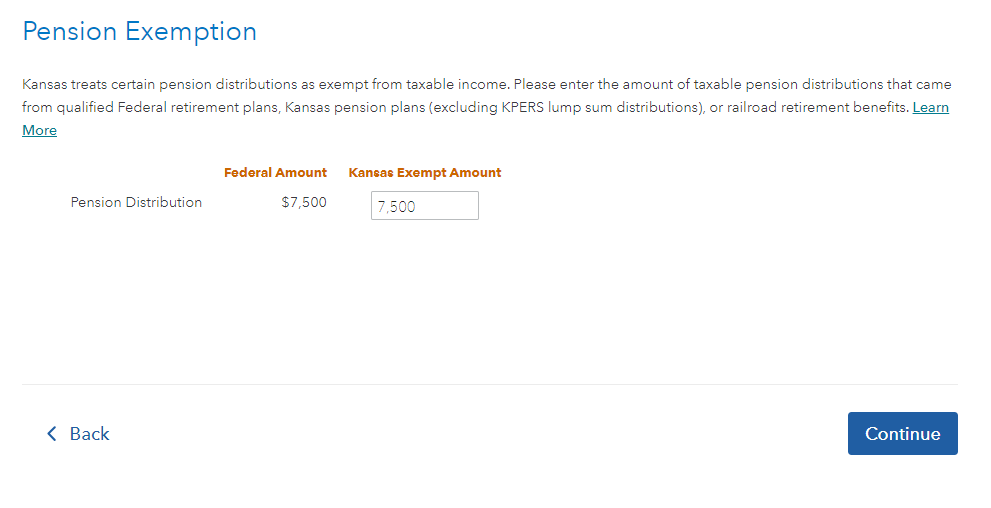

- The next screen will be titled Pension Exemption. Be sure to enter the amount of your pension that is exempt from taxation in Kansas in the column titled Kansas Exempt Amount.

Proceed through the state interview screens and answer the questions as applicable.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 7, 2024

7:18 PM

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dfv331

New Member

tomodwyer2005

New Member

alrobin12

Level 1

swimjim819

New Member

MBBU88

Returning Member