- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- If you rollover retirement money, should you owe in PA taxes?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If you rollover retirement money, should you owe in PA taxes?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If you rollover retirement money, should you owe in PA taxes?

No. Pennsylvania (PA) taxes the money when you put it into the 401(k) because they do not recognize any deferral. Follow the steps below so that none of the retirement money is taxable on PA.

- First in the federal return be sure to select 'I converted some or all of it to a Roth IRA' on the screen 'Tell us if you moved the money through a rollover or conversion'. It will be taxable on your federal return without any penalty.

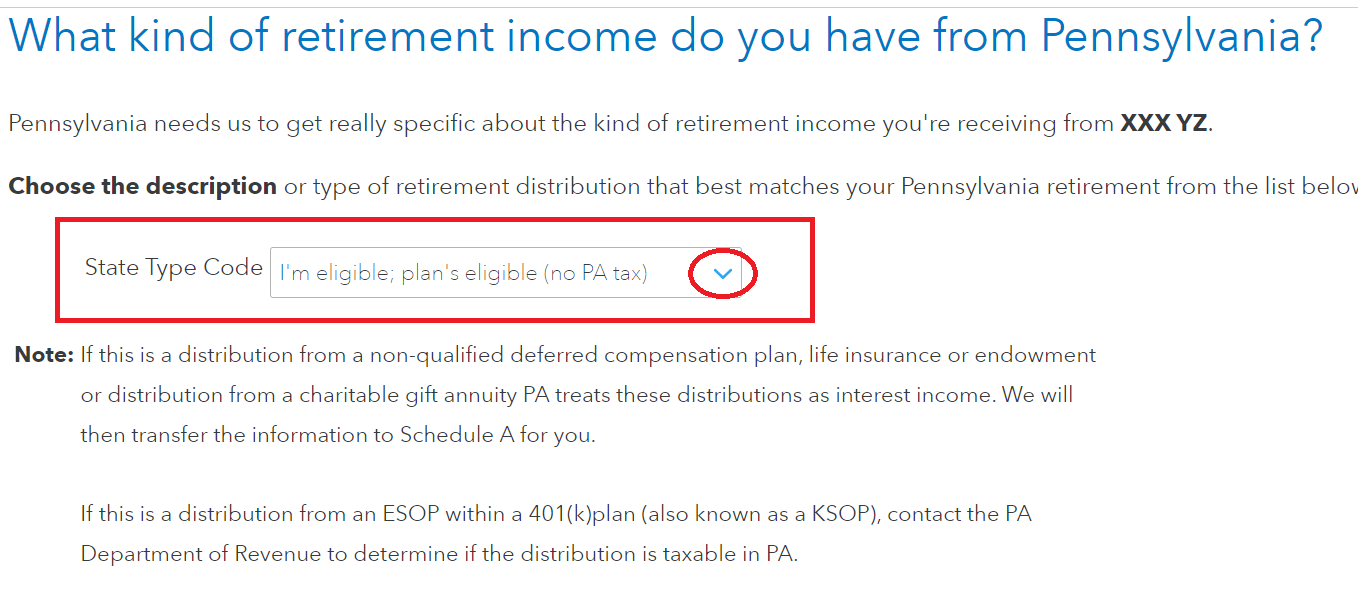

- When you go through the PA return watch for the question 'what kind of retirement income do you have from PA? Make the selection 'I'm eligible, plan is eligible (no PA tax)'

- Next select the 'Entire amount of this distribution is not taxable to PA' if this screen comes up a second time. If not, continue to finish your PA return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If you rollover retirement money, should you owe in PA taxes?

I am not seeing those type of questions. I have two types of rollovers. A 401k and a Roth. The 401k asked me if I moved it from a 401k to a Roth. Which we did not. We rolled straight over to another 401k.

in my pa state tax return it is asking for a “basis” on the Roth. I entered the total amount of the Roth we rolled over and it took the amount I owed to PA away. Is that the right thing to do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If you rollover retirement money, should you owe in PA taxes?

To clarify, please give us some more details regarding the Roth rollover.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If you rollover retirement money, should you owe in PA taxes?

I'm facing the same dilemma for a family member. I am being instructed by Turbotax to handle this $450,000 rollover on Schedule D because it is a section 1035 transaction. On Schedule D, I have to choose either to enter a basis or click "this sale is not taxable in PA." This is not really a sale, but it's also not a $450,000 basis.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If you rollover retirement money, should you owe in PA taxes?

It is not taxable. Net Gains (Losses) from the Sale, Exchange, or Disposition states:

exchanges of insurance contracts under IRC Section 1035 that are tax exempt for federal income tax purposes are also tax exempt for Pennsylvania personal income tax purposes.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

waynelandry1

Returning Member

Lukas1994

Level 2

briannanash1997

New Member

tcondon21

Returning Member

rdemick54

New Member