- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

No. Pennsylvania (PA) taxes the money when you put it into the 401(k) because they do not recognize any deferral. Follow the steps below so that none of the retirement money is taxable on PA.

- First in the federal return be sure to select 'I converted some or all of it to a Roth IRA' on the screen 'Tell us if you moved the money through a rollover or conversion'. It will be taxable on your federal return without any penalty.

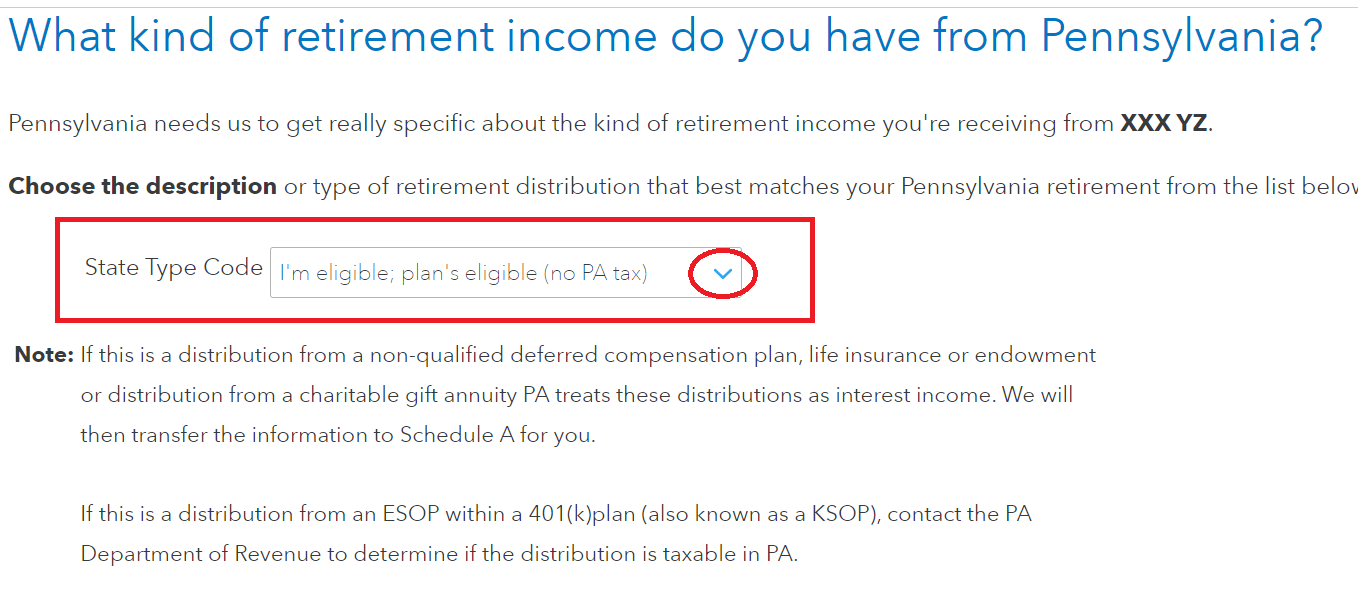

- When you go through the PA return watch for the question 'what kind of retirement income do you have from PA? Make the selection 'I'm eligible, plan is eligible (no PA tax)'

- Next select the 'Entire amount of this distribution is not taxable to PA' if this screen comes up a second time. If not, continue to finish your PA return.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 5, 2024

7:22 AM