- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- If I inherited an annuity in & received a form OMB 1545-0119 with an amount in box 1 “gross distribution” & another in box 2 “Taxable amount” what r the tax implications?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

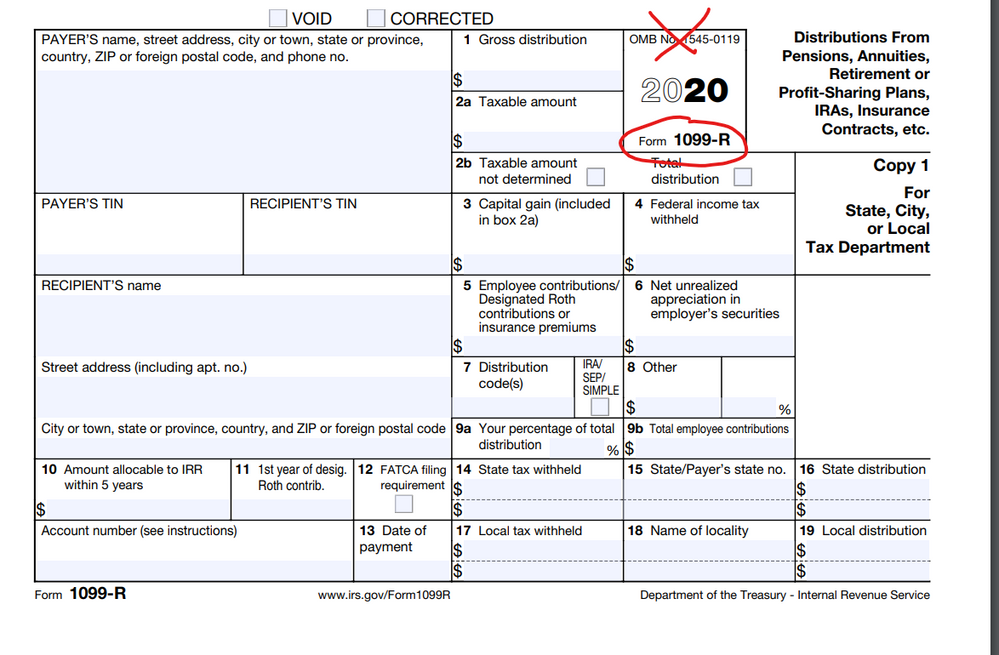

If I inherited an annuity in & received a form OMB 1545-0119 with an amount in box 1 “gross distribution” & another in box 2 “Taxable amount” what r the tax implications?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I inherited an annuity in & received a form OMB 1545-0119 with an amount in box 1 “gross distribution” & another in box 2 “Taxable amount” what r the tax implications?

You got a FORM 1099-R and of the box 1 gross distribution the amount in box 2 is what you will be taxed on if there is a number in that box ... otherwise the box 1 will be the taxable portion.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I inherited an annuity in & received a form OMB 1545-0119 with an amount in box 1 “gross distribution” & another in box 2 “Taxable amount” what r the tax implications?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I inherited an annuity in & received a form OMB 1545-0119 with an amount in box 1 “gross distribution” & another in box 2 “Taxable amount” what r the tax implications?

Yes the box 2a is taxable to the beneficiaries.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I inherited an annuity in & received a form OMB 1545-0119 with an amount in box 1 “gross distribution” & another in box 2 “Taxable amount” what r the tax implications?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I inherited an annuity in & received a form OMB 1545-0119 with an amount in box 1 “gross distribution” & another in box 2 “Taxable amount” what r the tax implications?

The named benificuary is responsible for the tax on a 1099-R that reports Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. The taxable amount must be paid to whoever receives the 1099-R and the money.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I inherited an annuity in & received a form OMB 1545-0119 with an amount in box 1 “gross distribution” & another in box 2 “Taxable amount” what r the tax implications?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I inherited an annuity in & received a form OMB 1545-0119 with an amount in box 1 “gross distribution” & another in box 2 “Taxable amount” what r the tax implications?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I inherited an annuity in & received a form OMB 1545-0119 with an amount in box 1 “gross distribution” & another in box 2 “Taxable amount” what r the tax implications?

The OMB 1545-0119 is a Statement of Survivor Annuity Paid. The Gross distribution is 32052.00 and the taxable amount is unknown. 765.60 was withheld for federal taxes. It was paid by the Office of Personnel Management, Retirement Operations, PO Box 45, Boyer, PA [social security number removed]. I don't see were to enter this on the income tax form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I inherited an annuity in & received a form OMB 1545-0119 with an amount in box 1 “gross distribution” & another in box 2 “Taxable amount” what r the tax implications?

OPM sends out a form 1099-R not a OMB 1545-0119 ...

Enter a 1099-R here:

Federal Taxes,

Wages & Income

(I'll choose what I work on - if that screen comes up)

Retirement Plans & Social Security,

IRA, 401(k), Pension Plan Withdrawals (1099-R).

OR Use the "Tools" menu (if online version left side) and then "Search Topics" for "1099-R" which will take you to the same place.

Be sure to choose which spouse the 1099-R is for if this is a joint tax return.

Be sure to pick the correct 1099-R type: Standard 1099-R, CSA-1099-R, CSF-1099-R, RRB-1099-R.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I inherited an annuity in & received a form OMB 1545-0119 with an amount in box 1 “gross distribution” & another in box 2 “Taxable amount” what r the tax implications?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

trustenforcer

New Member

robertflittle

Level 1

JLG33

New Member

fredtex1

Level 2

Click

Level 5