- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- If box 2a on 1099r reads unknown what do I do ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If box 2a on 1099r reads unknown what do I do ?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If box 2a on 1099r reads unknown what do I do ?

If your 1099-R has UNKNOWN as the taxable amount, you probably have a CSA 1099-R. If you have not indicated that this is a CSA form, go back into TurboTax in the 1099-R section and enter your CSA 1099-R, making sure to indicate before you enter the form that it is a CSA 1099-R. Then leave the taxable amount box blank and TurboTax will guide you through the interview to determine the taxable amount. Make sure to delete the incorrect 1099-R.

Either way, if Box 2a reads unknown, leave it blank and TurboTax will provide you with follow-up questions.

Please feel free to post any additional details or questions in the comment section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If box 2a on 1099r reads unknown what do I do ?

What is the nature of your spouse's pension or annuity?

The IRS has rules for using the Simplified Method and the General Rule. They may be found in IRS Publication 575 and Publication 939.

Who must use the Simplified Method

You must use the Simplified Method if your annuity starting date is after November 18, 1996, and you meet both of the following conditions.

(1) You receive your pension or annuity payments from any of the following plans.

- A qualified employee plan.

- A qualified employee annuity.

- A tax-sheltered annuity plan (403(b) plan).

(2) On your annuity starting date, at least one of the following conditions applies to you.

- You are under age 75.

- You are entitled to less than 5 years of guaranteed payments.

Who can't use the Simplified Method

You can not use the Simplified Method if you receive your pension or annuity from a nonqualified plan or otherwise do not meet the conditions described in the preceding discussion. See General Rule, later.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If box 2a on 1099r reads unknown what do I do ?

If your 1099-R has UNKNOWN as the taxable amount, you probably have a CSA 1099-R. If you have not indicated that this is a CSA form, go back into TurboTax in the 1099-R section and enter your CSA 1099-R, making sure to indicate before you enter the form that it is a CSA 1099-R. Then leave the taxable amount box blank and TurboTax will guide you through the interview to determine the taxable amount. Make sure to delete the incorrect 1099-R.

Either way, if Box 2a reads unknown, leave it blank and TurboTax will provide you with follow-up questions.

Please feel free to post any additional details or questions in the comment section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If box 2a on 1099r reads unknown what do I do ?

I did what you said by not leaving the box2a blank but Turbo tax automatically input the same gross distribution amount. Mine 1099 is csa for disability retirement. could i put $0 in box2a while filing tax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If box 2a on 1099r reads unknown what do I do ?

No you will not put in a "0" Be sure to pick the correct 1099-R type: Standard 1099-R, CSA-1099-R, CSF-1099-R, RRB-1099-R. After you enter the 1099R in the screen, turbo tax will ask additional questions about your 1099R to determine how much of that distribution is taxable.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If box 2a on 1099r reads unknown what do I do ?

I don't see a place to Be sure to pick the correct 1099-R type: Standard 1099-R, CSA-1099-R, CSF-1099-R, RRB-1099-R. Where/how would I do that?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If box 2a on 1099r reads unknown what do I do ?

Did you get to this screen?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If box 2a on 1099r reads unknown what do I do ?

I logged into my online account and wrote down the steps.

Enter a 1099R under

Federal Taxes on left

Wages & Income at the top

Then scroll way down to Retirement Plans and Social Security

Then IRA, 401(k), Pension Plan Withdrawals (1099-R) – Click Start

Don't type the bank name or try to import it.

At the bottom pick - Change How I enter my Form

Then on the next screen pick - I'll Type it in Myself

If you are filing a Joint return be sure to pick which person it is for.

Next screen is Who gave you a 1099R? Pick the right box.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If box 2a on 1099r reads unknown what do I do ?

I don't see that screen. Are you using the online version? I bought the CD...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If box 2a on 1099r reads unknown what do I do ?

That was for the online version but Desktop should be the same. I'll make screen shots from my Desktop program later.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If box 2a on 1099r reads unknown what do I do ?

Thank you MichaelDC for this answer.

Still, I need help.

I chose the CSA 1099-R and then filled it out and left box 2a blank and continued to where I chose yes for the taxable annuity amount was used as the taxable amount.

When I do this TT shows Taxable amount as $0 on box 5b on the form 1040 and on box 2a on the Form (CSA)1099 R.

What would you suggest.?

Thank you in advance for this and for all the many questions you have answered here.

John

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If box 2a on 1099r reads unknown what do I do ?

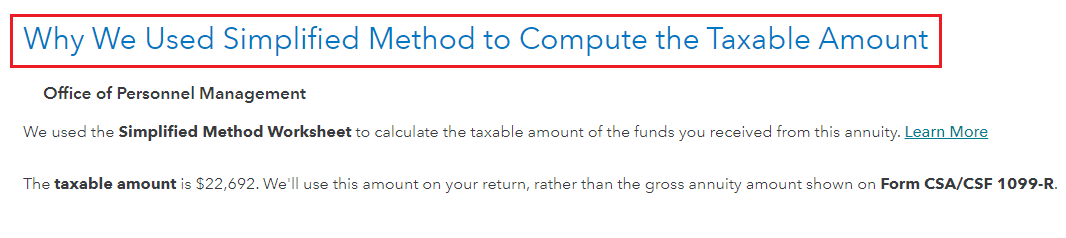

The pension income from Form CSA-1099R uses the Simplified Method for calculating the taxable portion of the amount each year. It's important to answer all of the follow-up questions such as 'Yes' to periodic payments.

- Payment Start Year

- Describe the Taxable Amount - No, a different amount was taxable.

- Tell Us the Taxable Amount Method - Select Simplified Method

- Enter Annuity Information - Complete all fields

- Tell Us About Your Joint Annuity - Select Joint or Single Life Annuity

- Enter Ages - At the start date, the first payment when your annuity began

- Select Yes or No 'I am under retirement age for this plan'

- See the image below once you complete the process

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If box 2a on 1099r reads unknown what do I do ?

Hi DianeW777

Thank you for your prompt and thorough reply. I am so grateful for doing this for us! This looks like the right answer.

When it asks for plan cost at annuity starting date is that the cost on the day the annuity began originally so many years back? Or is it, 1 Jan 2021? The original start date was in 1995.

Many thanks!

John

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If box 2a on 1099r reads unknown what do I do ?

Here are the answers to your questions.

Question: When it asks for plan cost at annuity starting date is that the cost on the day the annuity began originally so many years back?

- Yes, but it should also be on your CSA-1099R in box 9b.

And you definitely use the 1995 starting date - the first month you began receiving this pension.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If box 2a on 1099r reads unknown what do I do ?

Again, many thanks for sharing your expert knowledge and so quickly...last question:

Is this yes or no to this question?

I am under retirement age for this plan.

Seems like the answer would be no....but I am not sure. Sorry to take up even more of your time.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If box 2a on 1099r reads unknown what do I do ?

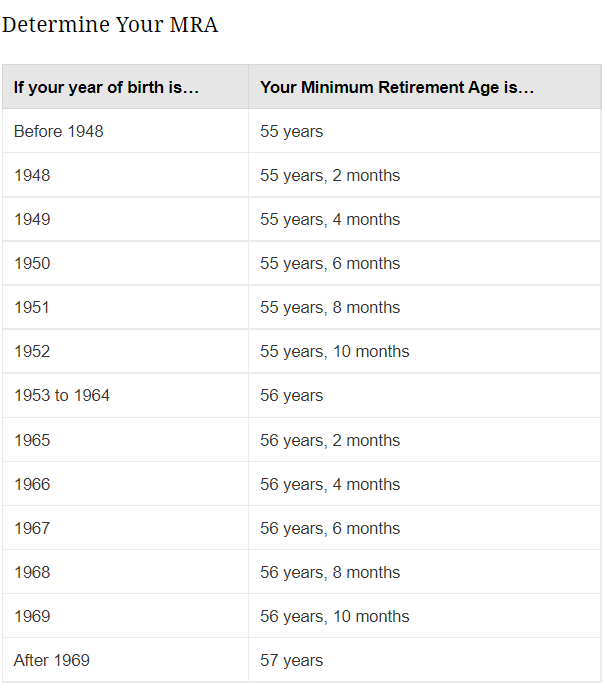

It is probably no.

For federal employees the Minimum Retirement Age (MRA) ranges from 55 to 57 if you are not disabled. Check the chart below for a more exact answer.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

johamill

Level 2

jhoban808

New Member

tfox37380

Level 1

Missgidgett

Returning Member

Missgidgett

Returning Member