- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

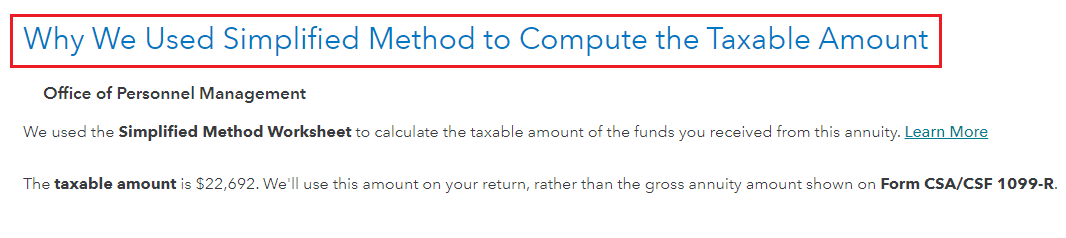

The pension income from Form CSA-1099R uses the Simplified Method for calculating the taxable portion of the amount each year. It's important to answer all of the follow-up questions such as 'Yes' to periodic payments.

- Payment Start Year

- Describe the Taxable Amount - No, a different amount was taxable.

- Tell Us the Taxable Amount Method - Select Simplified Method

- Enter Annuity Information - Complete all fields

- Tell Us About Your Joint Annuity - Select Joint or Single Life Annuity

- Enter Ages - At the start date, the first payment when your annuity began

- Select Yes or No 'I am under retirement age for this plan'

- See the image below once you complete the process

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 23, 2022

7:55 AM