- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- I took a distribution out of my IRA. I put a portion of the distribution back within 60 days to the IRA as a rollover. It is not recording properly in Turbo Tax, why?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I took a distribution out of my IRA. I put a portion of the distribution back within 60 days to the IRA as a rollover. It is not recording properly in Turbo Tax, why?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I took a distribution out of my IRA. I put a portion of the distribution back within 60 days to the IRA as a rollover. It is not recording properly in Turbo Tax, why?

You may want to check the data in TurboTax to make sure that it was entered correctly, While in TurboTax follow these steps:

- Select Search in the top right hand side of your screen,

- Enter 1099R,

- Select Jump to 1099R,

- Select the IRA in question,

- Select Edit,

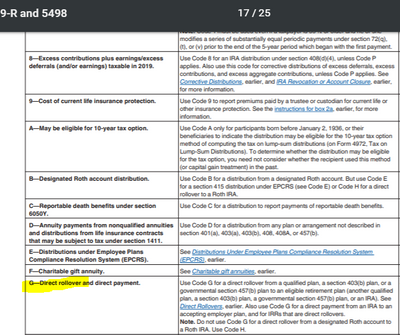

- Be sure that Box 7 shows G (this is for a direct rollover distribution). See IRS Instructions for 1099-R, page 17 for more information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I took a distribution out of my IRA. I put a portion of the distribution back within 60 days to the IRA as a rollover. It is not recording properly in Turbo Tax, why?

The Form 1099-R absolutely should NOT have code G. The Form 1099-R for a distribution from an IRA paid to you will have code 1 or code 7 depending on your age and the IRA/SEP/SIMPLE box will be marked.

After entering the Form 1099-R, make sure in the follow-up that you indicate that you moved the money to another retirement account (or returned it to the same account) and indicate the amount rolled over. TurboTax will include on Form 1040 line 4a the full amount distributed but will exclude the amount rolled over from the amount on line 4b. TurboTax will also include the word ROLLOVER next to the line.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I took a distribution out of my IRA. I put a portion of the distribution back within 60 days to the IRA as a rollover. It is not recording properly in Turbo Tax, why?

You would only use Code "G" if the ENTIRE amount in Box 1 was rolled back! And this should already have been reflected on the 1099-R provided by your investment company, if that were the case. If you only rolled back PART of the Box 1 amount, leave the Code as "7" and insure the "Taxable Amount Not Determined" box is checked. (If it isn't, get a corrected form from the investment company to which you made a partial rollback.) Now do the following: On the Form 1040 TurboTax Worksheet (using Forms Method), check that the amount of your PARTIAL rollback is reflected on Line B2 of "Rollovers, Roth Conversions, Roth Rollovers, and Recharacterizations". If the amount you rolled back is not there, then you need to revisit the 1099-R in question and make sure that you answered the question "Was the withdrawal an RMD for 2019" with "Yes, some or all of this withdrawal was an RMD" then go on to answer "Part of this distribution was an RMD" and enter the total RMD Amount by SUBTRACTING the amount of your rollover from the total reflected in Box 1. Later on, check that "I did a combination of rolling over, converting, or cashing out the money" and enter your rollover amount in "Amount rolled over to another (or back to the same) retirement account. Needlessly complicated, indeed!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I took a distribution out of my IRA. I put a portion of the distribution back within 60 days to the IRA as a rollover. It is not recording properly in Turbo Tax, why?

You would only use code G if the Form 1099-R provided by the payer has code G in box 7. Code G indicates an amount that was moved to or from a qualified retirement plan directly between trustees as a direct rollover without the money ever being paid to the participant. The code 7 indicates that the money was NOT moved directly between trustees but was instead paid to the participant and any amount later rolled over by the participant would be an indirect rollover.

"enter the total RMD Amount by SUBTRACTING the amount of your rollover from the total reflected in Box 1."

This is backwards. The amount that is RMD is determined by law, not by the amount rolled over. The amount of the distribution that is RMD determines the amount that is eligible for rollover, not the other way around.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I took a distribution out of my IRA. I put a portion of the distribution back within 60 days to the IRA as a rollover. It is not recording properly in Turbo Tax, why?

What happens if I take an investment out of an IRA worth $10,000. Can I put $10,000 cash back into the IRA and consider it a 60-day rollover?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I took a distribution out of my IRA. I put a portion of the distribution back within 60 days to the IRA as a rollover. It is not recording properly in Turbo Tax, why?

No. The law requires that the same property that was distributed from the IRA be rolled over. You are not permitted to substitute cash for some other property that was distributed in-kind. You can only put cash back if it was cash that was distributed.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ashleyjmcdonald

New Member

cbal324

New Member

HollyP

Employee Tax Expert

HollyP

Employee Tax Expert

3911

New Member