- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- I have contributed 1500$ towards traditional IRA in 2020.As I am not eligible for Traditional IRA, I withdrawn 1500$ in Jan 2021, can i know how to disclose this

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have contributed 1500$ towards traditional IRA in 2020.As I am not eligible for Traditional IRA, I withdrawn 1500$ in Jan 2021, can i know how to disclose this

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have contributed 1500$ towards traditional IRA in 2020.As I am not eligible for Traditional IRA, I withdrawn 1500$ in Jan 2021, can i know how to disclose this

@kiran885 wrote:

Thank you for the response. Please clarify my understanding -

- For the year 2020 return - I am not going to disclose any information about my IRA contribution.

- For the year 2021 return - I have to show the information as per 1099R. Is that ok to show withdrawal in 2021 without showing contribution in 2020

Incorrect on one, correct on the other.

1) An IRA contribution *for* 2020 that was made before April 15, 2021, MUST be reported on your 2020 tax return. You should mark it in the TurboTax IRA contributions section as a non-deductible contribution if you converted it to a Roth. The non-deductible contribution should produce a 8606-T form as part of your 2020 tax return showing the 2020 non-deductible contribution in box 1, 3 and 14.

2) The conversion in 2021 must be reported next year on your 2021 tax return. You will need the 2020 8606 line 14 value (from #1 above) when reporting the 2021 1099-R for the conversion.

A backdoor Roth is a 2 step procedure - a non-deductible contribution on a 8606 form and a Roth conversion on a 1099-R form using the 8606 information.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have contributed 1500$ towards traditional IRA in 2020.As I am not eligible for Traditional IRA, I withdrawn 1500$ in Jan 2021, can i know how to disclose this

If you withdrew it in 2021 then you will not receive the 1099-R to report it until January, 2022.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have contributed 1500$ towards traditional IRA in 2020.As I am not eligible for Traditional IRA, I withdrawn 1500$ in Jan 2021, can i know how to disclose this

Thanks for the quick response. Can i know in the current year 1040 , how should we disclose.

I have received Form 5498 from the Brokerage firm and it shows the contribution of 1500 $ and i withdrawn in Jan -2021 which comes in Jan 2022.

Can we skip the contribution and withdrawal now or need to show in the Return and need help on how to handle this in turbo tax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have contributed 1500$ towards traditional IRA in 2020.As I am not eligible for Traditional IRA, I withdrawn 1500$ in Jan 2021, can i know how to disclose this

A 5498 is only for your information and does not go on a tax return.

How you report it in TurboTax depends on how you withdrew the money and what code the financial institution puts in box 7 on your 2021 1099-R and if they also returned any earnings attributed to the excess.

You should have had it returned as a "return of contribution" along with any earnings and not just removed it yourself as a normal distribution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have contributed 1500$ towards traditional IRA in 2020.As I am not eligible for Traditional IRA, I withdrawn 1500$ in Jan 2021, can i know how to disclose this

Thank you for the response. Please clarify my understanding -

- For the year 2020 return - I am not going to disclose any information about my IRA contribution.

- For the year 2021 return - I have to show the information as per 1099R. Is that ok to show withdrawal in 2021 without showing contribution in 2020

Please correct me if I am wrong.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have contributed 1500$ towards traditional IRA in 2020.As I am not eligible for Traditional IRA, I withdrawn 1500$ in Jan 2021, can i know how to disclose this

@kiran885 wrote:

Thank you for the response. Please clarify my understanding -

- For the year 2020 return - I am not going to disclose any information about my IRA contribution.

- For the year 2021 return - I have to show the information as per 1099R. Is that ok to show withdrawal in 2021 without showing contribution in 2020

Incorrect on one, correct on the other.

1) An IRA contribution *for* 2020 that was made before April 15, 2021, MUST be reported on your 2020 tax return. You should mark it in the TurboTax IRA contributions section as a non-deductible contribution if you converted it to a Roth. The non-deductible contribution should produce a 8606-T form as part of your 2020 tax return showing the 2020 non-deductible contribution in box 1, 3 and 14.

2) The conversion in 2021 must be reported next year on your 2021 tax return. You will need the 2020 8606 line 14 value (from #1 above) when reporting the 2021 1099-R for the conversion.

A backdoor Roth is a 2 step procedure - a non-deductible contribution on a 8606 form and a Roth conversion on a 1099-R form using the 8606 information.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have contributed 1500$ towards traditional IRA in 2020.As I am not eligible for Traditional IRA, I withdrawn 1500$ in Jan 2021, can i know how to disclose this

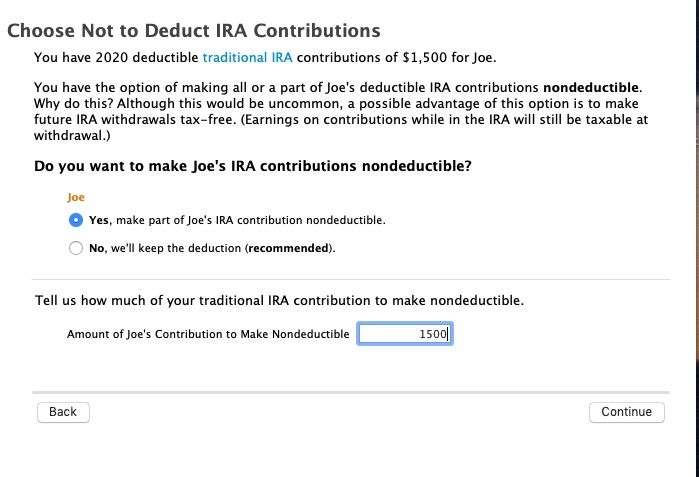

Thanks for the response. I have entered the IRA amount in the 2020 return and the entered the entire Non deductible amount as 1500 since i withdrew entire amount in Jan -2021.

But I am getting below error during final review -

IRA Contribution Worksheet Line 15- Amount of tax payers' contribution elected to make non deductible should not be more than 820$.

Deductible Traditional IRA - 820

Non Deductible Traditional IRA - 680.

Please advise. FYI- I withdrew entire 1500$ in Jan -2021.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have contributed 1500$ towards traditional IRA in 2020.As I am not eligible for Traditional IRA, I withdrawn 1500$ in Jan 2021, can i know how to disclose this

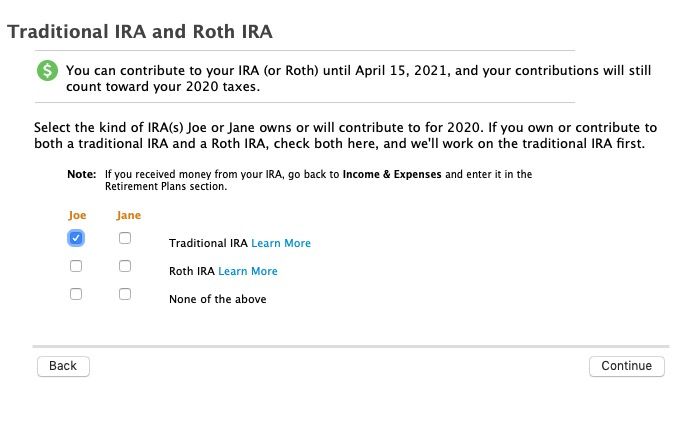

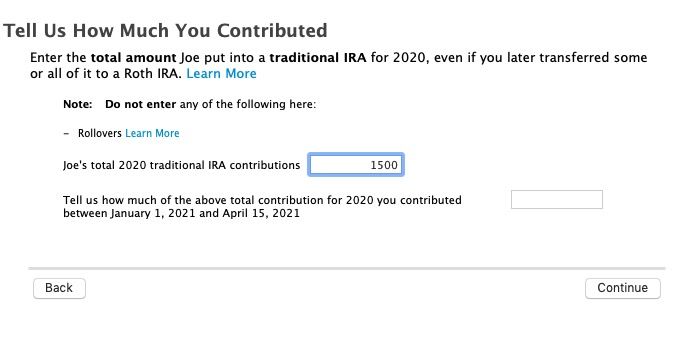

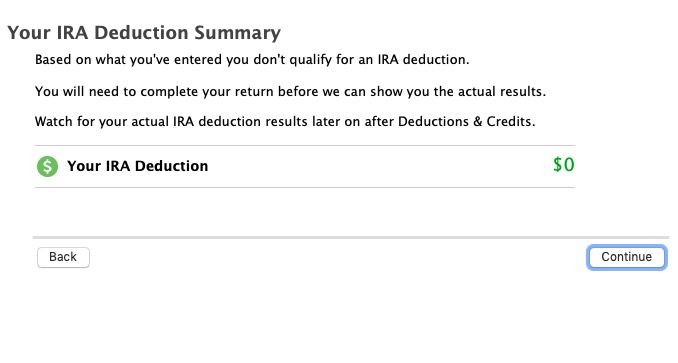

When you entered the contribution did it look like this and what did the LAST screen say?

Line 15 on the worksheet would seem to say that you made an excess contribution and your taxable compensation (earned income for W-2 or net self-employed income minus half the SE tax) was only $820 so a $1,500contribution was not allowed and is an excess unless removed and return to you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have contributed 1500$ towards traditional IRA in 2020.As I am not eligible for Traditional IRA, I withdrawn 1500$ in Jan 2021, can i know how to disclose this

Hi,

Thanks for detailed screenshots, I followed the same steps and completed the deduction section.

When I am in the review before filling am getting a review that your non deductible amount cannot be more than 820$. Is it ok to ignore that as I already withdrew the entire amount.

Thanks,

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have contributed 1500$ towards traditional IRA in 2020.As I am not eligible for Traditional IRA, I withdrawn 1500$ in Jan 2021, can i know how to disclose this

No. you cannot ignore it. If your contribution was not allowed because your income was too low to make the contribution then. If that is the case then you must have the excess contribution returned to you before April 15 to avoid a penalty that will repeat each year until removed.

Again. when you go through the IRA contribution interview, what does the last screen say?

Is there a 5329 form included in your tax return? - If there is what line is there an entry on?

Is there a 8606-T form? What is on line 1?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have contributed 1500$ towards traditional IRA in 2020.As I am not eligible for Traditional IRA, I withdrawn 1500$ in Jan 2021, can i know how to disclose this

Hi,

I see the below in the final review -

Nondeductible traditional IRA contributions, to Form 8606, ln 1

Thanks,

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

chinyoung

New Member

user17557017943

New Member

georgiesboy

New Member

puiyeehung

New Member

PCD21

Level 3