- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

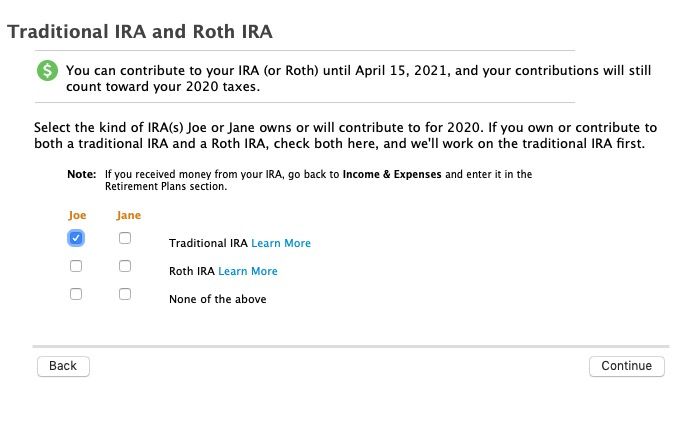

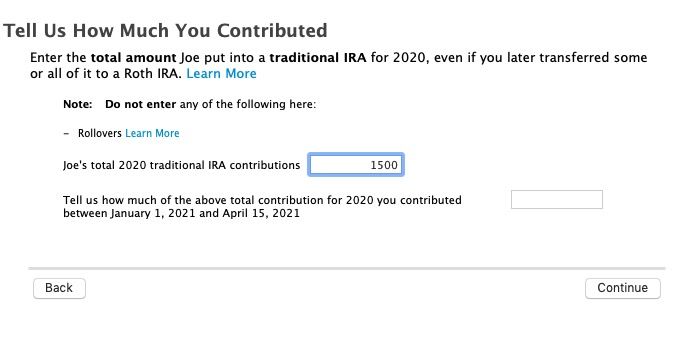

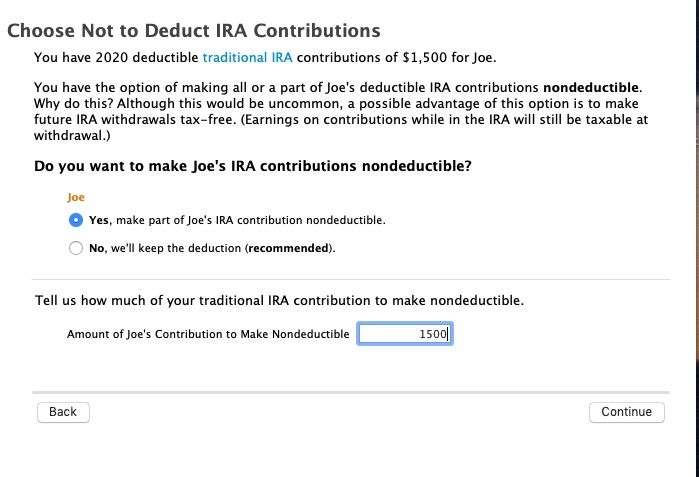

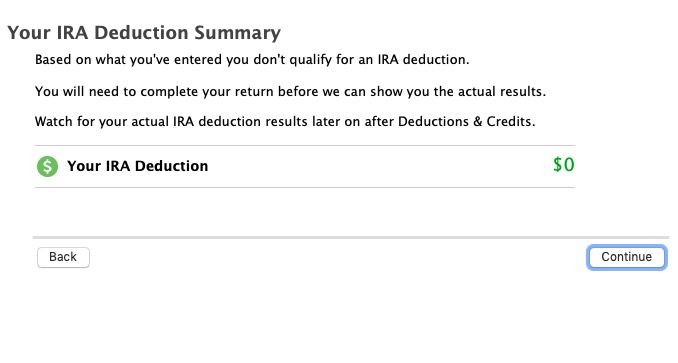

When you entered the contribution did it look like this and what did the LAST screen say?

Line 15 on the worksheet would seem to say that you made an excess contribution and your taxable compensation (earned income for W-2 or net self-employed income minus half the SE tax) was only $820 so a $1,500contribution was not allowed and is an excess unless removed and return to you.

**Disclaimer: This post is for discussion purposes only and is NOT tax advice. The author takes no responsibility for the accuracy of any information in this post.**

January 29, 2021

9:35 AM