- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- I do not understand the three year rule for my NJ state taxes. What goes in Annuity cost and cost recovered in prior years?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I do not understand the three year rule for my NJ state taxes. What goes in Annuity cost and cost recovered in prior years?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I do not understand the three year rule for my NJ state taxes. What goes in Annuity cost and cost recovered in prior years?

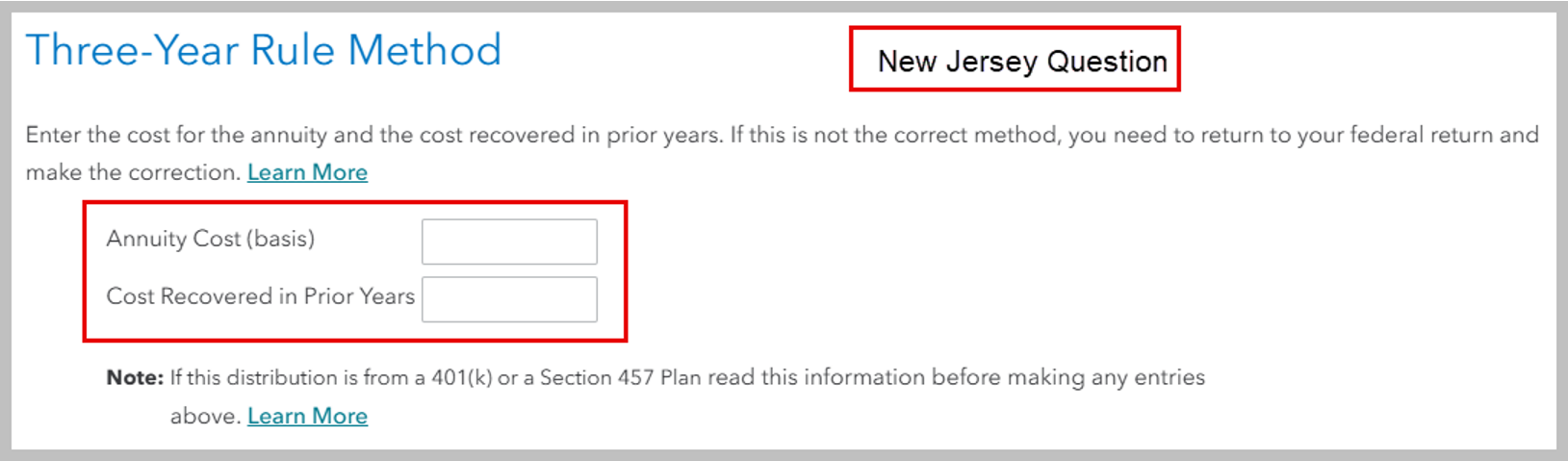

It depends. New Jersey (NJ) does allow the three year rule to be used. This means that you expect to recover your cost in the retirement plan in the first three years when distribution begins. Your cost is the amount you put into the plan with 'after tax' dollars. If you are not sure, check with your plan administrator. See the instructions to enter your cost and, if this is not your first year, the cost you already did recover in a prior year or years.

This is answered in the federal return under the 1099-R section after you enter the information. NJ Three-Year Rule Method

- Open your TurboTax return > Search (upper right) > 1090r > Click the Jump to... link

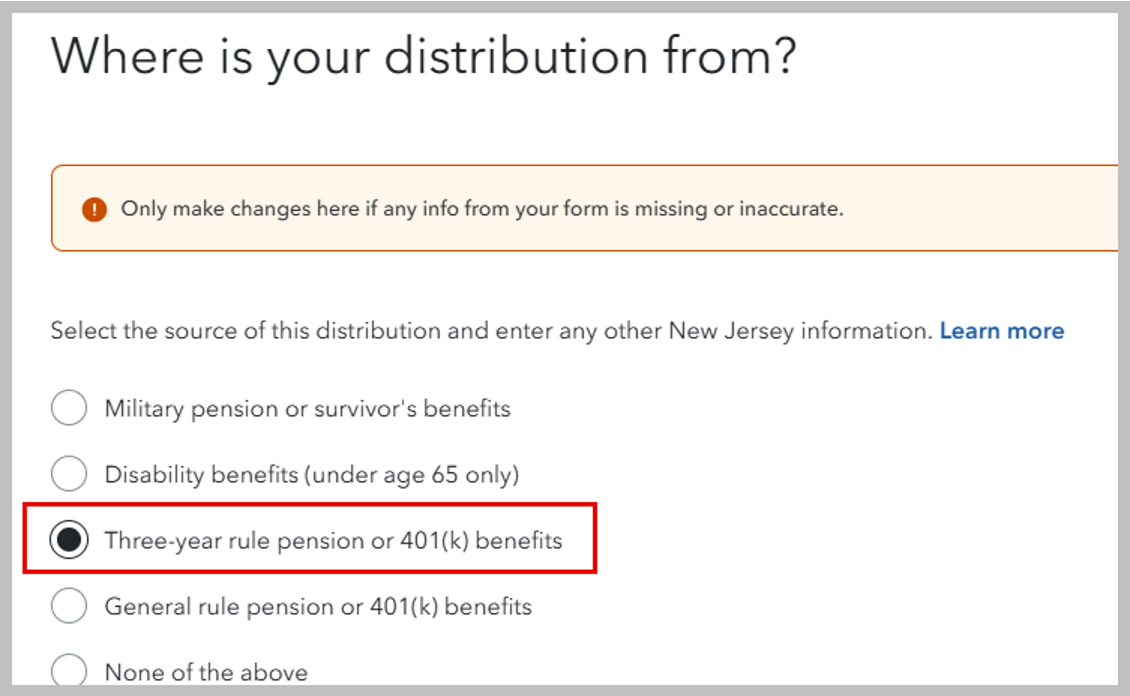

- Continue to the screen titled 'Where is your distribution from?' > Select 'Three-year rule pension or 401(k) benefits'

- Once this is selected in your federal return, you will see a place to make entries for this in your NJ return.

- See the images below for assistance.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kickitagain

Level 1

egallag

New Member

CTS39

New Member

wmtj27-25

New Member

judiedigby

Level 1