- Community

- Topics

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- I contributed $5,760 into my Roth IRA from 2020 to 2023. I took an early withdrawal of $5,000 last year. Do I have to pay taxes and penalties on this amount?

Announcements

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I contributed $5,760 into my Roth IRA from 2020 to 2023. I took an early withdrawal of $5,000 last year. Do I have to pay taxes and penalties on this amount?

The IRS website says no, but Turbotax is charging me a penalty.

posted

February 23, 2025

12:07 PM

last updated

February 23, 2025

12:07 PM

Connect with an expert

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

2 Replies

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I contributed $5,760 into my Roth IRA from 2020 to 2023. I took an early withdrawal of $5,000 last year. Do I have to pay taxes and penalties on this amount?

You should not have to pay taxes on the withdrawal of Roth contributions only(not earning).

You should have received a 1099-R. Here is how to report it in TurboTax Online:

- Go to Wages & Income.

- On the Your income and expenses screen, locate and select the Retirement Plans and Social Security section, then select Start or Revisit next to IRA, 401(k), Pension Plan Withdrawals (1099-R).

- Answer Yes to Did you get a 1099-R in 2024?, then Continue.

- Select how you want to enter your 1099-R (import or choose Change how I enter my form to either upload it or type it in yourself) and follow the instructions.

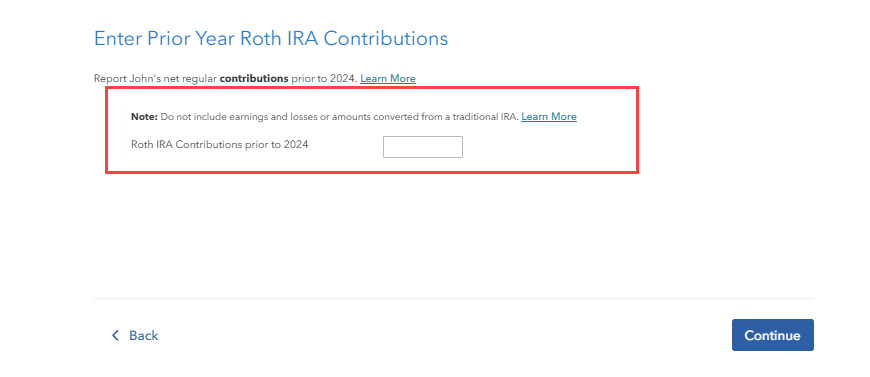

- Answer the questions on the following screens, until you reach Enter Prior Year Roth IRA Contributions. Here, enter all the amounts you contributed prior to 2024.

February 23, 2025

12:09 PM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I contributed $5,760 into my Roth IRA from 2020 to 2023. I took an early withdrawal of $5,000 last year. Do I have to pay taxes and penalties on this amount?

Mindy,

Thank you very much. I followed your instructions and the penalty was removed. I did not read the directions carefully enough. 🙂

MB

February 23, 2025

12:44 PM

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jjon12346

New Member

bees_knees254

New Member

tianwaifeixian

Level 4

az148

Level 3

soccerfan1357

Level 1