in Events

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- I can't seem to find the link for the 1099-G question.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can't seem to find the link for the 1099-G question.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can't seem to find the link for the 1099-G question.

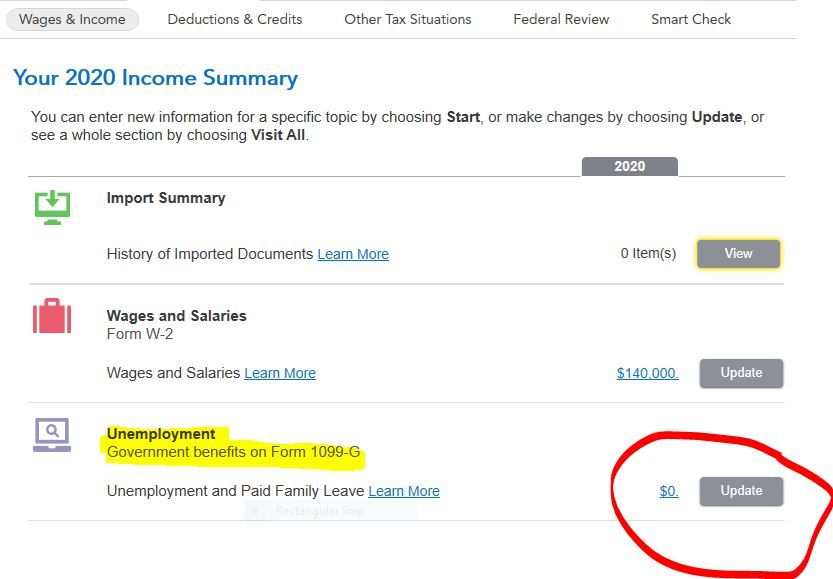

To enter unemployment compensation

- Click on Federal Taxes (Personal using Home and Business)

- Click on Wages and Income (Personal Income using Home and Business)

- Click on I'll choose what I work on (if shown)

- Under Unemployment

- On Unemployment and Paid Family Leave, click the start or update button

Or enter unemployment compensation in the Search box located in the upper right of the program screen. Click on Jump to unemployment compensation

If you had taxes withheld from the unemployment compensation -

On the screen What's the total amount you received on your 1099-G? check the box Federal or state income tax was withheld on this payment.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can't seem to find the link for the 1099-G question.

Your answer is incorrect, I am in the same position, had unemployment income, taxes were withheld, but because a bill has passed stating any unemployment under 10,200 will not be taxed, TT when you go to the 1099G screen does not even list income from unemployment.

They do tell you if you have unemployment to answer NO to the 1099G question, but then they never take you to another screen. If taxes had not been withheld, both Fed & State and you received less than 10200.00 this would not be a problem. But this is a HUGE problem for people who had tax withheld and now can not claim it back - I managed to do a LOT of overriding and input manually the unemployment and the taxes withheld but when you run error check - it kicks the return out. Plus no way of knowing if that carries over to the state or not.

This is a HUGE mess again this year, TT seems to have a major issue now every year - we pay for these programs I am using the Home and Business version, and yet I cannot get a human to help, cannot find answers here - just ridiculous.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can't seem to find the link for the 1099-G question.

You can call TurboTax and speak with an agent. TurboTax customer service/support does not have a single phone number but has many different phone numbers based on the type of platform used. So that we can direct your call to the best person/department to help you:

- Click on this link: https://support.turbotax.intuit.com/contact/

- Select your TurboTax platform.

- Ask your question / state your problem. Do NOT use the word "refund' or you will get a phone number for tax refunds.

- Click Submit.

- On the next screen, choose the Call option and follow the instructions. You will be given the approximate wait time.

You'll get a toll-free number to a TurboTax expert who is specially-trained to handle your particular issue.

As an alternative, you can go into Forms Mode check to see if Form 1099-G has been started. If so you can finish entering the information, or you can create the 1099-G.

- Go into Forms Mode by clicking on the Forms icon in the top right of the blue bar.

- In the Forms in My Return list on the left, click Form 1099-G and the form will appear on the right.

- If Form 1099-G does not appear in the list, above the Forms in My Return list on the left, click on Open Form. [It takes a few seconds to open.]

- In the Search window, type 1099-G.

- Double-click on the form in the results list.

- If there is a form in the return already, it will appear in the window that pops up - click to open it.

- If there is no form 1099-G, you will see the screen Add Form 1099-G. Enter the Payer's (state's) name and click Add Form.

- Enter the information from your form. Don't worry about the exclusion. TurboTax will take care of this automatically.

- To return to the interview, click on the Step-By-Step icon in the top right of the blue bar.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can't seem to find the link for the 1099-G question.

@SeaLady321 Have no idea where you are seeing instructions for answering NO if you received unemployment compensation.

Follow the steps I posted to enter the Unemployment Compensation

IF you received unemployment compensation reported on a Form 1099-G, then when asked if you received unemployment on a Form 1099-G, answer YES. After entering the amount received the TurboTax program will calculate the exclusion.

The exclusion is reported on Schedule 1 Line 8 as a negative number. The unemployment compensation received is on Line 7 of Schedule 1. The result flows to Form 1040 Line 8.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can't seem to find the link for the 1099-G question.

Because that is what my screen said to answer NO if unemployment - but gave me no other option as to where to enter - I did another manual update today and I now have a place to enter for 1099G Unemployment that was not there before.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Raph

Community Manager

VAer

Level 4

Raph

Community Manager

in Events

Raph

Community Manager

in Events

Raph

Community Manager

in Events