- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- How to enter Traditional to Roth conversion Rollover contribution in the turbotax online version ?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter Traditional to Roth conversion Rollover contribution in the turbotax online version ?

@PT313 wrote:

I and using TurboTax Premier version, 2021, and followed the instruction posted by your expert in previous questions, as the following:

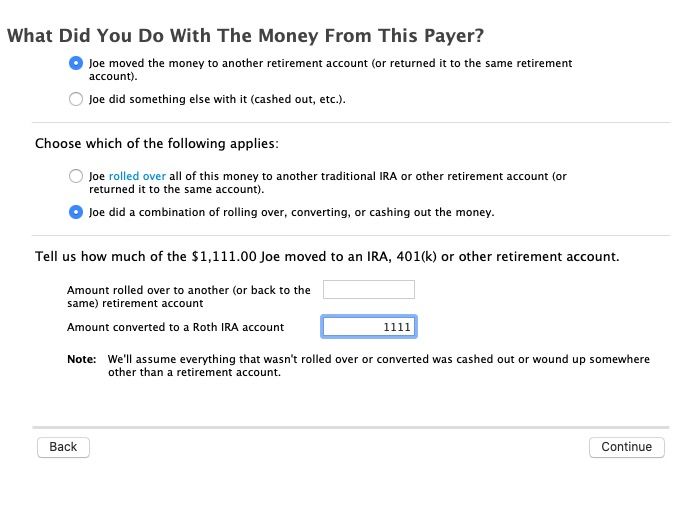

- entered form1099R. make sure there is a taxable amount listed in Box 2A

- Make sure the IRA box is checked between Box 7 . Box 8 (Other) has no entry.

- Answer the question on the next screen and continue

- the 4th question should ask Let us know about the distribution. Select Traditional IRA

- Then move through the next question about inheriting and then the next screen will ask, what you did with the money.

- Indicate you rolled it over into another retirement account

- Then another drop down will appear. Here you will say you converted to a Roth

Problem Occurred at this step. There is NO drop down to select and no way to tell TurboTax the money was converted into ROTH account!

Also, some money in this conversion was recharacterized from excessive ROTH contribution and that part was Nondeductible. That is, I should not pay tax on it. I need to use form 8606 to adjust this amount. How to do it? (should I open a new question for form 8606?) Please help.

Thanks!!

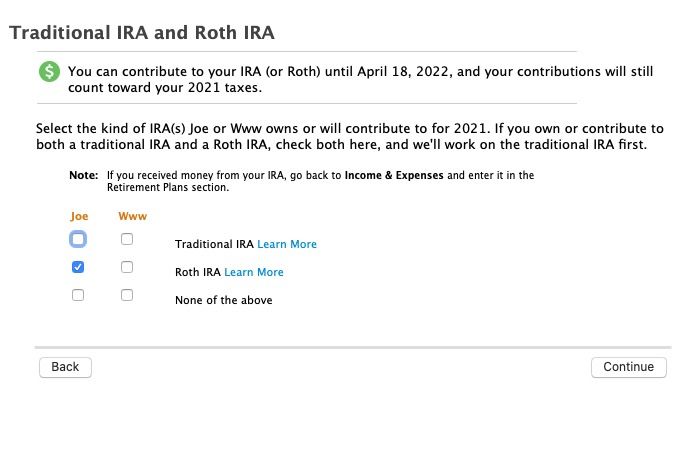

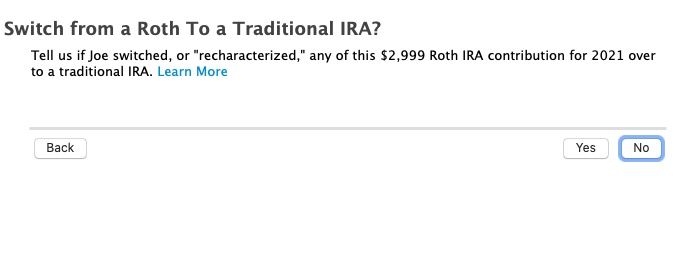

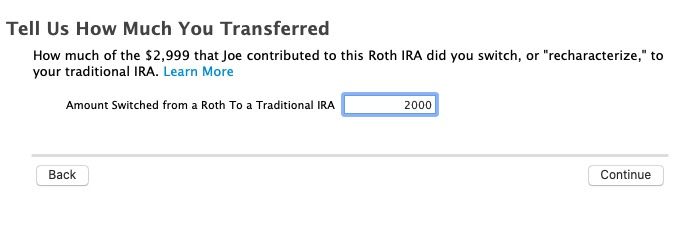

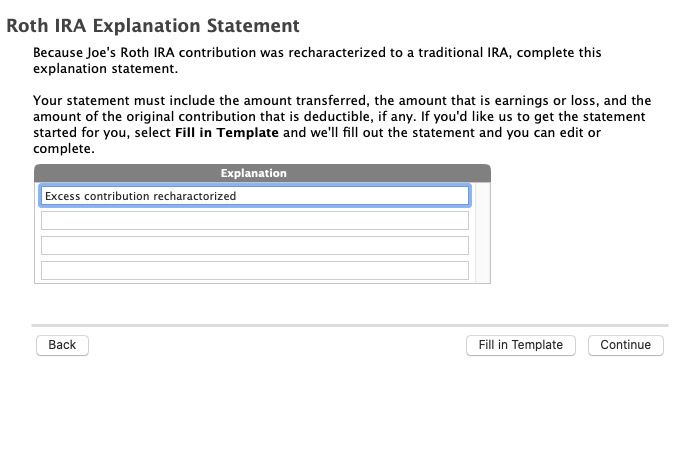

You enter the Roth IRA contribution in the IRA contributions section and say that you changed your mind and changed it to Traditional IRA instead (recharactorize), then it will ask if you want it to be non-deductible. That will create a 8606.

When entering the 1099-R be sure you keep going after the 1099-R summary screen.

I suggest deleting the 1099-R and re-enter after entering the Roth contribution.

For entering the Roth conversion see below:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter Traditional to Roth conversion Rollover contribution in the turbotax online version ?

Thanks macuser22!

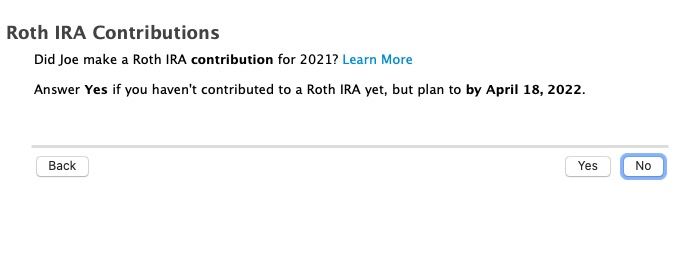

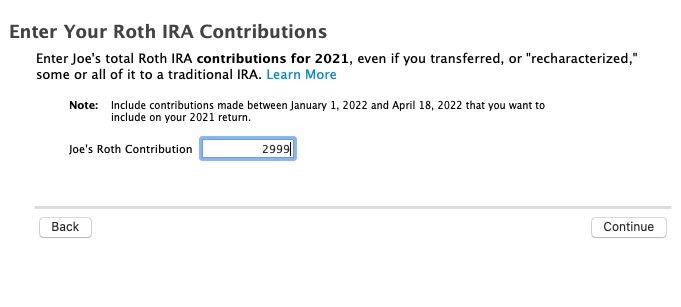

I think you solved my first problem, how to enter the amount that I converted into ROTH IRA. I entered the full amount, say $2000, into ROTH IRA frame as shown in you screen shot. Yes, it became a taxable event.

However, I got lost at the second part, how do I tell TurboTax that I changed my mind and enter the recharacterized amount, say, $300? The recharacterization occurred in year 2002, not within the last 3 years. I do not know how to fill the form 8606.

Thanks again for your help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter Traditional to Roth conversion Rollover contribution in the turbotax online version ?

The non-deductible question will not appear if your income is to high to deduct - it will automatically be non-deductible.

Also a typo onthe first screenshot - I meant to enter $2000, not 2999.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter Traditional to Roth conversion Rollover contribution in the turbotax online version ?

Thanks Macuser22!

When I tried to enter the IRA pages, TurboTax simply told me that, you don't qualify for a retirement tax break!

That's it!

Although I already told TurboTax I entered the $2000 into the RORH IRA, I don't know how to trigger these pages open. Is there a way to enter the form 8606 directly? I can open that form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter Traditional to Roth conversion Rollover contribution in the turbotax online version ?

@PT313 wrote:

Thanks Macuser22!

When I tried to enter the IRA pages, TurboTax simply told me that, you don't qualify for a retirement tax break!

That's it!

Although I already told TurboTax I entered the $2000 into the RORH IRA, I don't know how to trigger these pages open. Is there a way to enter the form 8606 directly? I can open that form.

Are you trying to enter the contribution in the correct place?

Also, I am assuming that this was a 2021 contribution, if it was a 2020 contribution, even is made in 2021 then you have amend 2020 and file a 2020 8606.

Enter IRA contributions here:

Federal Taxes,

Deductions & Credits,

I’ll choose what I work on (if that screen comes up),

Retirement & Investments,

Traditional & Roth IRA contribution.

OR Use the "Tools" menu (if online version under My Account) and then "Search Topics" for "ira contributions" which will take you to the same place.

Enter a 1099-R here:

Federal Taxes,

Wages & Income

(I'll choose what I work on - if that screen comes up)

Retirement Plans & Social Security,

IRA, 401(k), Pension Plan Withdrawals (1099-R).

OR Use the "Tools" menu (if online version left side) and then "Search Topics" for "1099-R" which will take you to the same place.

Be sure to choose which spouse the 1099-R is for if this is a joint tax return.

Be sure to pick the correct 1099-R type: Standard 1099-R, CSA-1099-R, CSF-1099-R, RRB-1099-R.

[NOTE: When you get to the "Your 1099-R Entries" screen where you can add another 1099-R, use "continue" to keep going as there are additional interview questions after that screen in most cases. You can always return as shown above.]

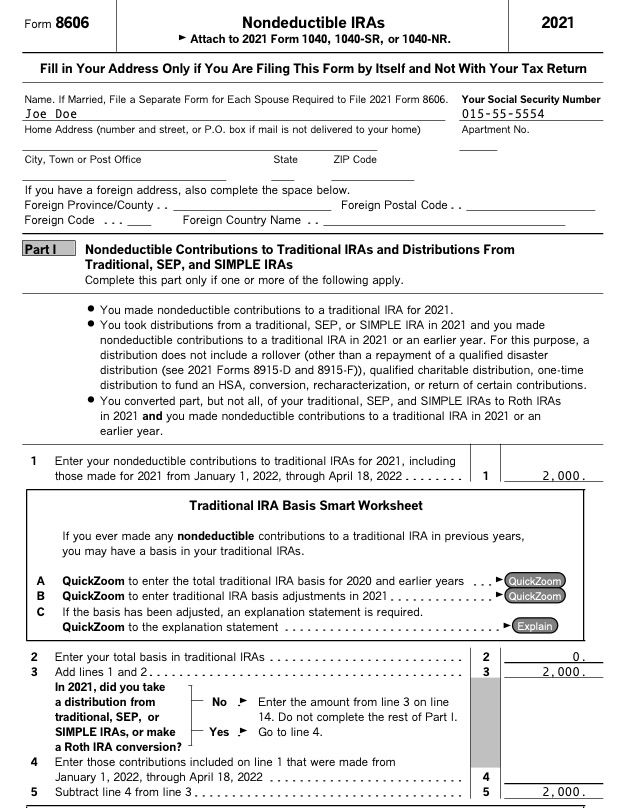

You will be asked of you had and tracked non-deductible contributions - say yes. The enter the amount from the last filed 8606 form line 14 if it did not transfer. Then enter the total value of any Traditional, SEP and SIMPLE IRA accounts that existed on December 31, 2021.

That will produce a new 8606 form with the taxable amount calculated on lines 6-15 and the remaining carry-forward basis on line 14.

NOTE: If there is an * next to line 15 then 6-14 will be blank and the calculations will be on the "Taxable IRA Distributions worksheet instead.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter Traditional to Roth conversion Rollover contribution in the turbotax online version ?

Thanks Macuser22!

Let me make my case clear:

1. I am not entering a new contribution to ROTH IRA, but convert from Traditional IRA to Roth.

2. The IRA fund I am converting, contains part of recharacterized money which had been taxed and should now be tax free. After I entered the total amount I withdraw from IRA account($2000), I should use form 8606 to adjust the non-taxable amount ($300), which was recharacterized in year 2002.

However, since I am retired and don't have earned income, I am not qualify to contribute to either IRA or ROTH IRA, according to TurboTax. Under this situation, TurboTax doesn't let me go through the IRA contribution steps as you suggested!

I think this is a bug in TurboTax design, because I have already reported that I have converted $2000 into ROTH IRA. TurboTax should let me continue working on this money and let me adjust the non-taxable amount ($300). As I understand, this amount can't be deducted this time (not $2000-$300) because I only made a partial conversion from this IRA to ROTH IRA account. The deduction should only take a percentage, based on the recharacterized Amount/My total IRA contribution (or the total value of my all IRA accounts at the time of withdraw)? I need TurboTax to help me calculate the percentage !

I know that I have to fill the form 8606 for this purpose, but TurboTax does NOT guide me through this process!

Or, I forgot to say, I am using TurboTax Premier version on PC and updated to the newest version, not online version. I tried "StepByStep", "Forms", and I also checked "Tools" but neither way, I can find the IRA or ROTH IRA related topics, AFTER I entered the $2000 converted IRA withdraw into ROTH IRA account.

Any one else have any ideas or any of you have any experiences on "getting tax free on the recharacterized IRA contribution"?

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter Traditional to Roth conversion Rollover contribution in the turbotax online version ?

If you made a contribution for 2020, but converted to Roth in 2021, then you have to list your basis from 2020(the amount you contributed in 2020). This should be on your 2020 8606. Then your tax amount should be $0 on 2021 (assuming you didn’t over contribute in 2020 and 2021).

You should’ve gotten 1099 R for 2021that shows 2020 contribution as well, import that in and follow previous instructions from other users.

Also, if you’re doing a back door Roth, then do not choose “recharacterization.”

I was able to use turbo tax to do the above for this tax year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter Traditional to Roth conversion Rollover contribution in the turbotax online version ?

No, I did not make any IRA or ROTH IRA contribution this year or last three year. My IRA and ROTH IRA were accumulated in the past many years.

I only converted IRA into ROTH IRA this year. The amount converted (say, $2,000) is countered as regular income and I have to pay tax on it!

Since there was a recharacterization occurring in year 2002 on my IRA account, so, say $300 in this account was non-deductible contribution, which is already taxed. In that year, no one told me to file form 8606. I only have form 5489 and 1099-R to record the recharacterization.

I have been trying many ways using TurboTax to work on the conversion and find a way to get tax back from the recharacterized $300, but there is no way which makes sense!

Here are the 4 numbers: The value of my IRA account is $10,000, the converted amount is $2,000, and $300 was pre-taxed, the total contribution in all these years is $3,000. Please help me using the TurboTax to file form 8606 and calculate the amount that should be taxed.

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter Traditional to Roth conversion Rollover contribution in the turbotax online version ?

@PT313 wrote:

Thanks Macuser22!

Let me make my case clear:

1. I am not entering a new contribution to ROTH IRA, but convert from Traditional IRA to Roth.

2. The IRA fund I am converting, contains part of recharacterized money which had been taxed and should now be tax free. After I entered the total amount I withdraw from IRA account($2000), I should use form 8606 to adjust the non-taxable amount ($300), which was recharacterized in year 2002.

However, since I am retired and don't have earned income, I am not qualify to contribute to either IRA or ROTH IRA, according to TurboTax. Under this situation, TurboTax doesn't let me go through the IRA contribution steps as you suggested!

I think this is a bug in TurboTax design, because I have already reported that I have converted $2000 into ROTH IRA. TurboTax should let me continue working on this money and let me adjust the non-taxable amount ($300). As I understand, this amount can't be deducted this time (not $2000-$300) because I only made a partial conversion from this IRA to ROTH IRA account. The deduction should only take a percentage, based on the recharacterized Amount/My total IRA contribution (or the total value of my all IRA accounts at the time of withdraw)? I need TurboTax to help me calculate the percentage !

I know that I have to fill the form 8606 for this purpose, but TurboTax does NOT guide me through this process!

Or, I forgot to say, I am using TurboTax Premier version on PC and updated to the newest version, not online version. I tried "StepByStep", "Forms", and I also checked "Tools" but neither way, I can find the IRA or ROTH IRA related topics, AFTER I entered the $2000 converted IRA withdraw into ROTH IRA account.

Any one else have any ideas or any of you have any experiences on "getting tax free on the recharacterized IRA contribution"?

Thanks!

I told you above how to enter the Roth contribution that you recharacterized and produce the 8606 form and how to enter the 1099-R form to show the basis.

If you recharacterized in 2002 then you should have a 2002 8606 with the basis on line 14 to enter. If you never filed a 2002 8606 then you must download the 2002 8606 form and file it with the non deductible amount on line 1, 3 and 14.

You can find the 2002 8606 here:

https://apps.irs.gov/app/picklist/list/priorFormPublication.html

You can only do that in the step-by-step mode. I posted screenshots of what to do. What part of that does not work for you?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter Traditional to Roth conversion Rollover contribution in the turbotax online version ?

Thanks MacUser22.

Yes, I did follow you way to enter the numbers. Here is what I did,

I used "search" to find the IRA area, and opened the StepStep Page.

When Asked: "If you contributed to IRA or ROTH IRA in 2021", if the answer is no, it's finished although it is the truth! If I answered Yes, I can go through to the next page. "Is this a Repayment or Retirement distribution" Weather I answered "yes" or "no", it goes to the next page, military, answer is no.

The next page is the one you mentioned, "have you transferred the money into regular IRA"

- if the answer is no (which is true), and I went through the rest of the pages, TurboTax told me that 'you have a penalty because you shouldn't contribute to ROTH IRA! " Of cause I knew it! I have no earned income. But the money I put in was transferred from IRA to ROTH Conversion! Why TurboTax can't work on it!

- If I answered "yes" TurboTax askes me the details about the transfer, and went through a few more pages like, track the IRA basis, previous contribution, withdraws, excess contribution in 2021, Etc. etc. Finally it told me: "Your IRA contribution isn't permitted!" It was frustrating!

I didn't see anything else, no 8606 form, no instruction on how to work on the $2000 which I entered when I followed your instruction on your first reply.

I shall check your link and find the old 2002 8606 form. Hopefully I can find it from my old tax return. God, it was 20 years ago! The finical institute who manages my IRA had told me at that time, all I need was the 5498 and 1099R forms!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter Traditional to Roth conversion Rollover contribution in the turbotax online version ?

@PT313 wrote:

Thanks MacUser22.

Yes, I did follow you way to enter the numbers. Here is what I did,

I used "search" to find the IRA area, and opened the StepStep Page.

When Asked: "If you contributed to IRA or ROTH IRA in 2021", if the answer is no, it's finished although it is the truth! If I answered Yes, I can go through to the next page. "Is this a Repayment or Retirement distribution" Weather I answered "yes" or "no", it goes to the next page, military, answer is no.

The next page is the one you mentioned, "have you transferred the money into regular IRA"

- if the answer is no (which is true), and I went through the rest of the pages, TurboTax told me that 'you have a penalty because you shouldn't contribute to ROTH IRA! " Of cause I knew it! I have no earned income. But the money I put in was transferred from IRA to ROTH Conversion! Why TurboTax can't work on it!

- If I answered "yes" TurboTax askes me the details about the transfer, and went through a few more pages like, track the IRA basis, previous contribution, withdraws, excess contribution in 2021, Etc. etc. Finally it told me: "Your IRA contribution isn't permitted!" It was frustrating!

I didn't see anything else, no 8606 form, no instruction on how to work on the $2000 which I entered when I followed your instruction on your first reply.

I shall check your link and find the old 2002 8606 form. Hopefully I can find it from my old tax return. God, it was 20 years ago! The finical institute who manages my IRA had told me at that time, all I need was the 5498 and 1099R forms!

If you cannot prove your 2002 non-deductible contribution and have or file a 2002 8606 form then the non-deduction can be disallowed as if it never happened. The IRS usually does not keep records that old so if you enter the basis inn the 1099-R interview they might never catch it, but that is up to you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter Traditional to Roth conversion Rollover contribution in the turbotax online version ?

Thanks Macuser 22!

I think I can find something to prove the recharacterization. I just don't know why TurboTax cannot handle it!

I have used TurboTax for so many years, ever since their first version! I kept recommend it to all my friends. Now I can't believe that it cannot handle this problem! I am so disappointed!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter Traditional to Roth conversion Rollover contribution in the turbotax online version ?

@PT313 wrote:

Thanks Macuser 22!

I think I can find something to prove the recharacterization. I just don't know why TurboTax cannot handle it!

I have used TurboTax for so many years, ever since their first version! I kept recommend it to all my friends. Now I can't believe that it cannot handle this problem! I am so disappointed!

Did you see my prior post how to enter a Traditional IRA distribution with a basis? More than likely the IRS does not have records of 2002 8606 forms so just enter the basis that you know is correct.

Here it is again:

Enter a 1099-R here:

Federal Taxes,

Wages & Income

(I'll choose what I work on - if that screen comes up)

Retirement Plans & Social Security,

IRA, 401(k), Pension Plan Withdrawals (1099-R).

OR Use the "Tools" menu (if online version left side) and then "Search Topics" for "1099-R" which will take you to the same place.

Be sure to choose which spouse the 1099-R is for if this is a joint tax return.

Be sure to pick the correct 1099-R type: Standard 1099-R, CSA-1099-R, CSF-1099-R, RRB-1099-R.

[NOTE: When you get to the "Your 1099-R Entries" screen where you can add another 1099-R, use "continue" to keep going as there are additional interview questions after that screen in most cases. You can always return as shown above.]

You will be asked of you had and tracked non-deductible contributions - say yes. The enter the amount from the last filed 8606 form line 14 if it did not transfer. Then enter the total value of any Traditional, SEP and SIMPLE IRA accounts that existed on December 31, 2020.

That will produce a new 8606 form with the taxable amount calculated on lines 6-15 and the remaining carry-forward basis on line 14.

NOTE: If there is an * next to line 15 then 6-14 will be blank and the calculations will be on the "Taxable IRA Distributions worksheet instead.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter Traditional to Roth conversion Rollover contribution in the turbotax online version ?

Hi MacUser22,

Yes, I did tired both ways you said.

however, from the StepByStep:

Federal Taxes,

Wages & Income

(I'll choose what I work on - if that screen comes up)

Retirement Plans & Social Security,

IRA, 401(k), Pension Plan Withdrawals (1099-R).

I created a new 1099-R and entered the information similar to that I received from my financial institute where I did the conversion.

I entered box 1, $2000, Box 2, taxable amount is not determined. Box 7, normal distribution. Checked the box of "IRA/SEP..." and most other boxes are empty.

next, the important page, as you showed me on your first reply: "what did you do with the money:

I chose "a combination of roll over, converting....

and chose "Money converted to ROTH account, $2000.

There is no more interview, but went to ask "Did the money enter into HSA", or "did the withdraw qualify for disaster distribution. " Both answers were no. Then the form creation was finished and returned to the page that shows all the 1099-R forms I have created.

That's it! I did not see anywhere asking for :if you had and tracked non-deductible contributions!

I also tried to use I need to "create a substitute 1099-R". The process was the same.

I have created 3 new 1099-R but all went through the same process and none of them got into the 8606 form.

I tried to use "form" and created a new 8606 form. But I do not know how to file it. It does not have a row that let me enter the 300 previously tracked non-deductible contribution, and no where instructed me to calculate the taxable percentage based on the total contribution and the non-deductible contribution.

Thanks for your help. I have been using TurboTax for so many year. I thought I was pretty much an expert myself. But I do not know it anymore!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter Traditional to Roth conversion Rollover contribution in the turbotax online version ?

Please make sure you click "Continue" after you enter all of your 1099-R (step 5) then you will get the question about if you had and tracked non-deductible contributions:

- Click on "Search" on the top right and type “1099-R”

- Click on “Jump to 1099-R”

- Click "Continue" and enter the information from your 1099-R

- Answer questions until you get to “Tell us if you moved the money through a rollover or conversion” and choose “I converted some or all of it to a Roth IRA”

- On the "Your 1099-R Entries" screen click "continue"

- Answer "yes" to "Any nondeductible Contributions to your IRA?" if you had any nondeductible contributions in prior years.

- Answer the questions about the basis and value

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ChickenBurger

New Member

HollyP

Employee Tax Expert

LMTaxBreaker

Level 2

clw26

Level 2

user17610862872

Level 2