- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

@PT313 wrote:

I and using TurboTax Premier version, 2021, and followed the instruction posted by your expert in previous questions, as the following:

- entered form1099R. make sure there is a taxable amount listed in Box 2A

- Make sure the IRA box is checked between Box 7 . Box 8 (Other) has no entry.

- Answer the question on the next screen and continue

- the 4th question should ask Let us know about the distribution. Select Traditional IRA

- Then move through the next question about inheriting and then the next screen will ask, what you did with the money.

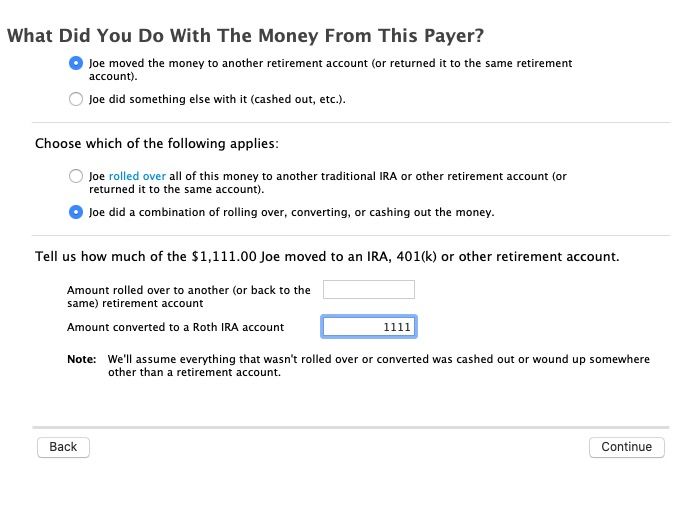

- Indicate you rolled it over into another retirement account

- Then another drop down will appear. Here you will say you converted to a Roth

Problem Occurred at this step. There is NO drop down to select and no way to tell TurboTax the money was converted into ROTH account!

Also, some money in this conversion was recharacterized from excessive ROTH contribution and that part was Nondeductible. That is, I should not pay tax on it. I need to use form 8606 to adjust this amount. How to do it? (should I open a new question for form 8606?) Please help.

Thanks!!

You enter the Roth IRA contribution in the IRA contributions section and say that you changed your mind and changed it to Traditional IRA instead (recharactorize), then it will ask if you want it to be non-deductible. That will create a 8606.

When entering the 1099-R be sure you keep going after the 1099-R summary screen.

I suggest deleting the 1099-R and re-enter after entering the Roth contribution.

For entering the Roth conversion see below: