- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- How to enter 1099r income for a 1041 estate return in TurboTax Business?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter 1099r income for a 1041 estate return in TurboTax Business?

I am using TurboTax Business to prepare a 1041 return for an Estate for which I am the Executor. The decedent's 401K has had a distribution that is considered taxable income to the Estate. I received a 1099-R. The "Other Income or Loss" entry in TurboTax mentions 1099-R in the accompanying explanation, but it does not provide me the opportunity to enter the information from the 1099-R, notably the name of Payer, the distribution code, and the withholding amounts.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter 1099r income for a 1041 estate return in TurboTax Business?

"...it does not provide me the opportunity to enter the information from the 1099-R... "

You just need to enter the amounts from your 1099-R per the instructions below.

Click the Federal Taxes tab, click Income, and then click the Start button to the right of Other income or loss (see the first two screenshots).

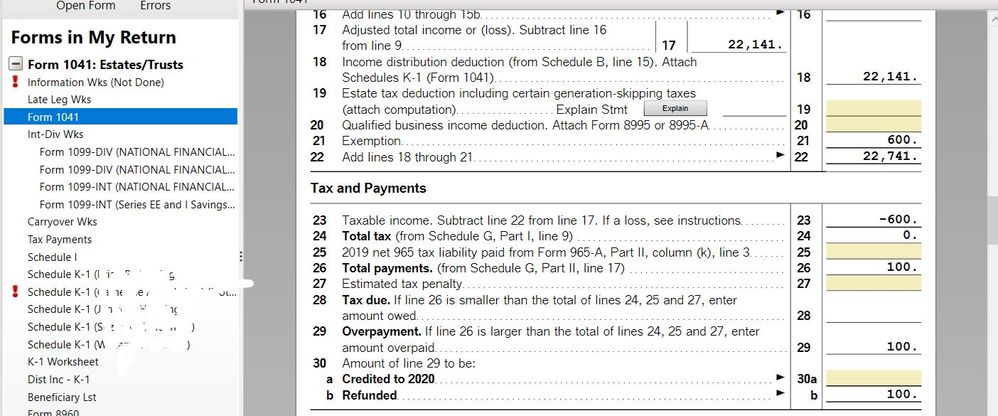

To enter the withholding, use Forms Mode (click the Forms icon in the upper right side of the screen). In Forms Mode, open Form 1041, enter the federal income tax withheld on Line 25e, and check the 1099 box (see third screenshot).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter 1099r income for a 1041 estate return in TurboTax Business?

I found it was possible to enter the data in the Step by Step mode. The income and the withholding information are entered at different steps, when the "any other" question is asked. The results appear to be the same as going to the Forms mode.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter 1099r income for a 1041 estate return in TurboTax Business?

Form 1041 in my Turbo Tax Business doesn't look anything like what you have posted as a solution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter 1099r income for a 1041 estate return in TurboTax Business?

ajaxthedog89, tagteam's post shows a 2018 Form 1041. The IRS made changes to Form 1041 for 2019, so compare by line description, not by line number.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter 1099r income for a 1041 estate return in TurboTax Business?

How do I know this is correct information since anybody can post here? Also what information from the 1099R gets entered? This is a common issue for Trusts, when is Intuit going to correct the Business software so there is a 1099R form?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter 1099r income for a 1041 estate return in TurboTax Business?

The information above comes straight from the instructions for Form 1041:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter 1099r income for a 1041 estate return in TurboTax Business?

Thanks for providing me with 51 pages to read. No where in those instructions did I find how to enter the 1099R information on a 1041. That is why we are all asking for a worksheet for the 1099R to be added to TurboTax business. It should be a very simple task for Intuit to add it for all of us trying to submit Trust returns, it is hard for many of us since they are returns for deceased family members.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter 1099r income for a 1041 estate return in TurboTax Business?

I need to enter 1099-R income AND withheld taxes on 1041. I have read the instructions for TT and entered the the income under "other income". The previous instructions (2019) said go to forms mode and enter taxes withheld on line 25e. In the 2021 version, there is no 25e. It does refer to schedule G, but there is no schedule G included in the forms list. Now what

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter 1099r income for a 1041 estate return in TurboTax Business?

You will report the state income taxes withheld on a 1099-R on line 11e or as Other Taxes under "Expenses, Taxes and Fees" if you are going through the step-by-step mode.

If there were Federal income taxes withheld, you need to report these on line 26 or as Other Tax Withholdings under the Other tab of the Federal Taxes tab.

@larry461029

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

qmanivan

New Member

Mary625

Level 2

risman

Returning Member

evltal

Returning Member

Viking99

Level 2