- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- How do I indicate the amount on one of the 1099-R that my wife received was rolled over soon after receiving it and therefore I have to report that it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I indicate the amount on one of the 1099-R that my wife received was rolled over soon after receiving it and therefore I have to report that it.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I indicate the amount on one of the 1099-R that my wife received was rolled over soon after receiving it and therefore I have to report that it.

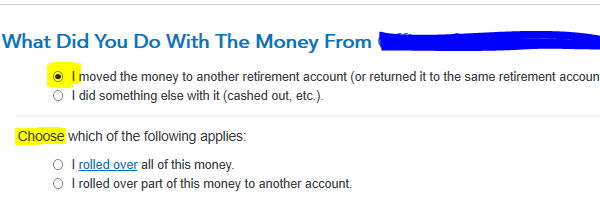

Enter the 1099-R in the retirement income section. Do not indicate that any portion of the income was an RMD (because those were waived in 2020). After you enter all of the details, TurboTax will ask you what you did with the money. Indicate that you returned some or all of the distribution. TurboTax will list the full amount of the distribution on 4a with the word ROLLOVER and only the taxable portion will show up on Line 4b. If you are not getting the questions, delete the 1099-R and re-enter it carefully. Go slowly when entering and answering the follow-up questions as it is easy to skip over something important.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Newby1116

New Member

pv3677

Level 2

wado-sanchez2014

New Member

galintheboonies

New Member

hamdiyankk

New Member