- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- How can I account for my contributions made into an IRA without my 5498 form? This is in attempt to meet the 60 day rule for some of my distributions and avoid that fee.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I account for my contributions made into an IRA without my 5498 form? This is in attempt to meet the 60 day rule for some of my distributions and avoid that fee.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I account for my contributions made into an IRA without my 5498 form? This is in attempt to meet the 60 day rule for some of my distributions and avoid that fee.

When you enter your 1099-R indicating a Distribution from a Retirement Account, the follow-up questions in TurboTax will ask if you rolled over all of part of the distribution within 60 days, so pay close attention to your entries here.

The Form 5498 is for your information only and is not required to be entered in TurboTax.

Click the link for more detailed info on Form 5498

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I account for my contributions made into an IRA without my 5498 form? This is in attempt to meet the 60 day rule for some of my distributions and avoid that fee.

The follow up questions after inputting my 1099-R did not ask if I rolled any over (or replenished those funds) within 60 days. I was only asked if I paid back Hurricane Funds in 2016 and 2017, and if I used this money for significant or tragic occurrences, to try and reduce my penalty. Any extra help would be much appreciated!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I account for my contributions made into an IRA without my 5498 form? This is in attempt to meet the 60 day rule for some of my distributions and avoid that fee.

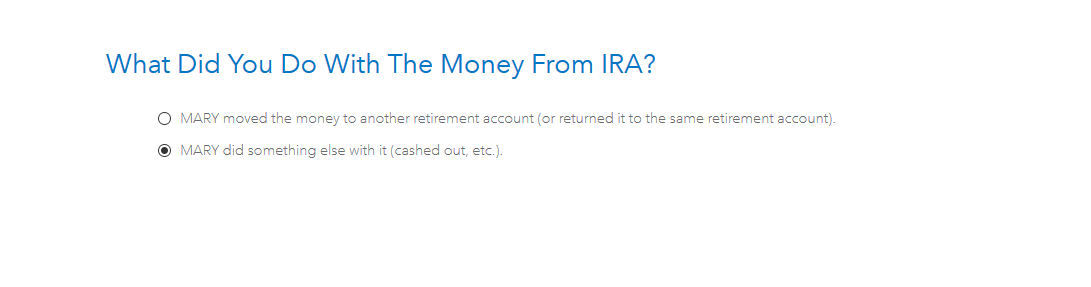

Look for the page as below: Select you moved the money to another retirement account. @rossorsak

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jays1951-gmail-c

Level 2

PCD21

Level 3

xhxu

New Member

christoft

Returning Member

CRAM5

Level 2