- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Here are the Maryland exemptions to military retirement a...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I’m trying to locate Maryland’s Form 502R retirement deductions

military retirement

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I’m trying to locate Maryland’s Form 502R retirement deductions

Here are the Maryland exemptions to military retirement and pensions:

Military Retirement Pay Income Tax DeductionIf you receive or the spouse of a military retiree receives military retirement income, you will be able to subtract up to $5,000, with an increase to the first $10,000 for individuals who are at least 65 years old on the last day of the taxable year, of your military retirement income from your federal adjusted gross income before determining your Maryland tax. The retirement income must have been received as a result of any of the following military service:

- Induction into the U.S. Armed forces for training and service under the Selective Training and Service Act of 1940 or a subsequent Act of similar nature

- Membership in a reserve component of the U.S. armed forces

- Membership in an active component of the U.S. armed forces

- Membership in the Maryland National Guard

The benefit also applies to persons separated from active duty employment with the commissioned corps of the Public Health Service, the National Oceanic and Atmospheric Administration, or the Coast and Geodetic Survey.

Maryland Pension ExclusionIf you are 65 or older or totally disabled (or your spouse is totally disabled), you may qualify for Maryland’s maximum pension exclusion of $27,100 under the conditions described in Instruction 13 of the Maryland resident tax booklet. If you’re eligible, you may be able to subtract some of your taxable pension and retirement annuity income from your federal adjusted gross income.

This subtraction applies only if:

- You were 65 or older or totally disabled, or your spouse was totally disabled, on the last day of the tax year; and

- You included on your federal return income received as a pension, annuity or endowment from an “employee retirement system.” A traditional IRA, a Roth IRA, a simplified employee plan (SEP), a Keogh Plan or an ineligible deferred compensation plan does not qualify.

For more information visit a local office for tax payer assistance. For locations, go to the Maryland Comptroller website.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I’m trying to locate Maryland’s Form 502R retirement deductions

Has the turbo tax software been updated to reflect Maryland's tax law that allows tax payers to subtract up to $15,000 (vice old deduction of $5000) if you or the spouse receives military retirement income?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I’m trying to locate Maryland’s Form 502R retirement deductions

Yes, the program is updated and will automatically subtract the $15,000 on the Income and Adjustments worksheet, line 9. You must have marked that it was military in the federal section when you entered the W2. Thank you for your service.

Click the blue link for more on the MD Pension Exclusion

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I’m trying to locate Maryland’s Form 502R retirement deductions

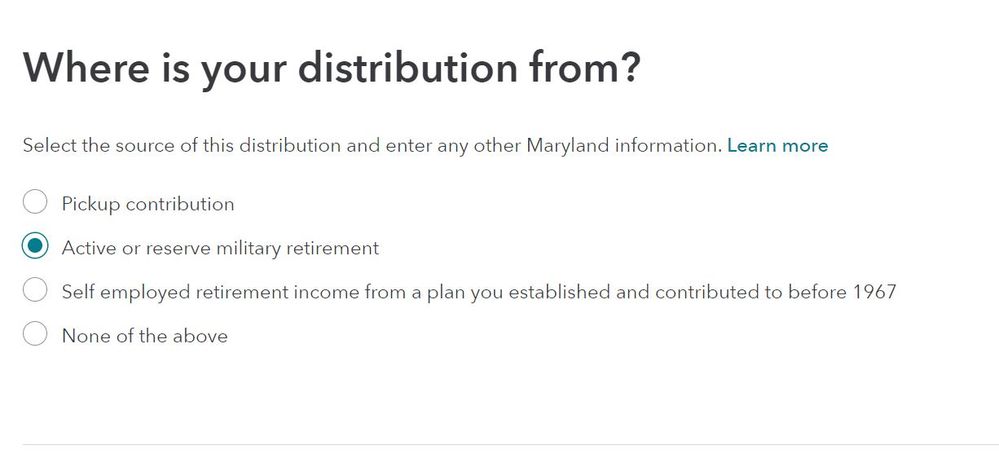

AmyC is spot on with her advice...after you enter the DFAS details on the Federal Tax input screen, a few more clicks it will ask where was this 1099-R from -- the second selection is for MILITARY RETIREMENT -- select this option and you will see the details flow through to your Maryland Taxes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I’m trying to locate Maryland’s Form 502R retirement deductions

I have not been able to get Turbo Tax to see it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I’m trying to locate Maryland’s Form 502R retirement deductions

As AmyC mentions you need to indicate that it was a military retirement in the federal interview for it to flow to the Maryland return.

Please follow these steps:

- Login to your TurboTax Account

- Click on "Search" on the top right and type “1099-R”

- Click on “Jump to 1099-R”

- Enter you 1099-R information

- On the "Where is your distribution from?" screen select "Active or reserve military retirement"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rfunger

New Member

alice-danclar

New Member

mary1947beth

New Member

mary1947beth

New Member

mary1947beth

New Member