- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- HELP! Can’t remove incorrect SEP donation amount for TurboTax Online Self-Employed version

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

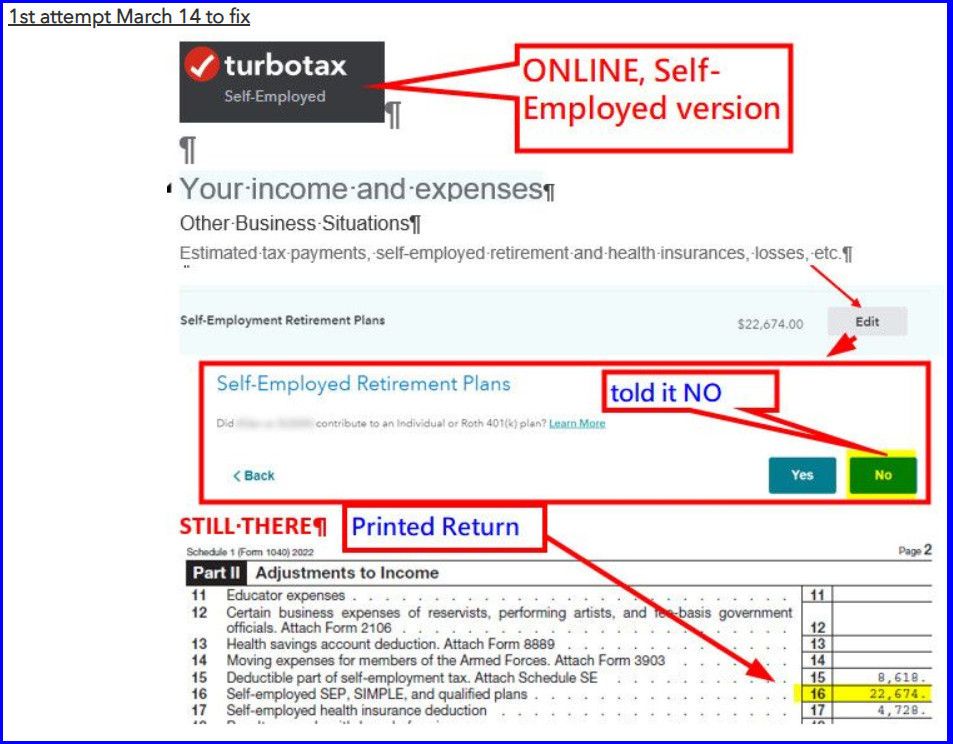

HELP! Can’t remove incorrect SEP donation amount for TurboTax Online Self-Employed version

HELP!

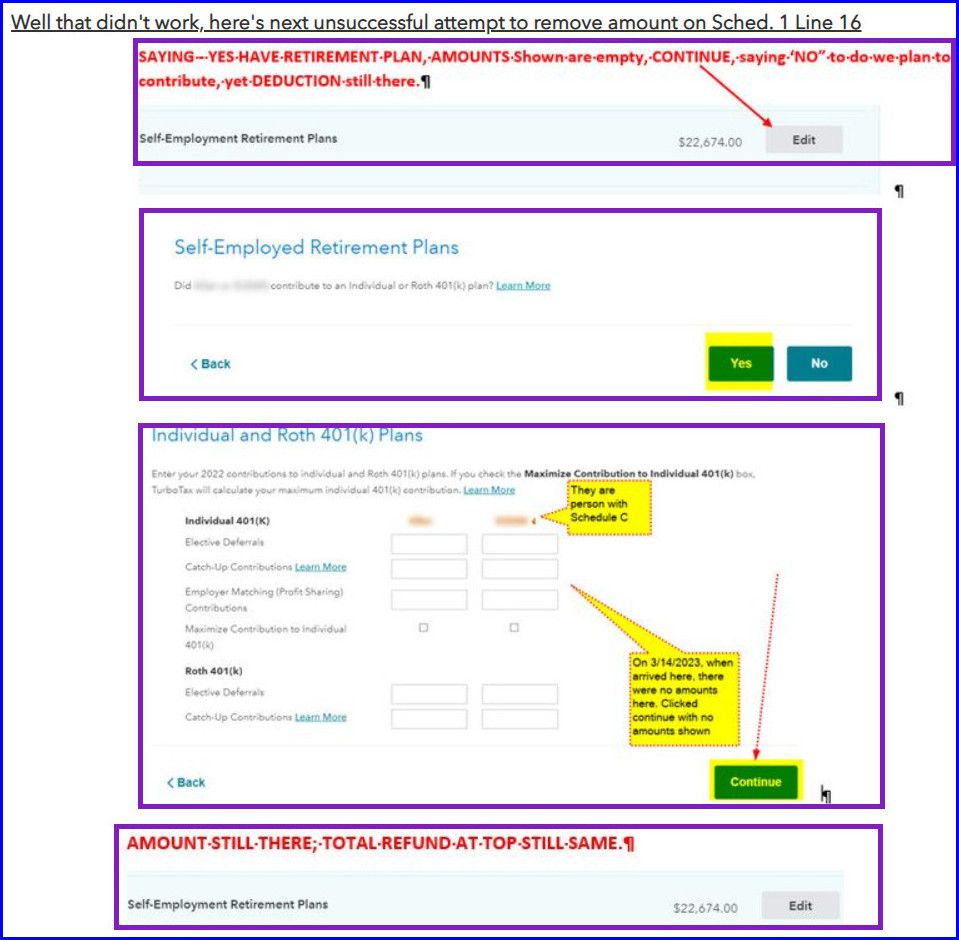

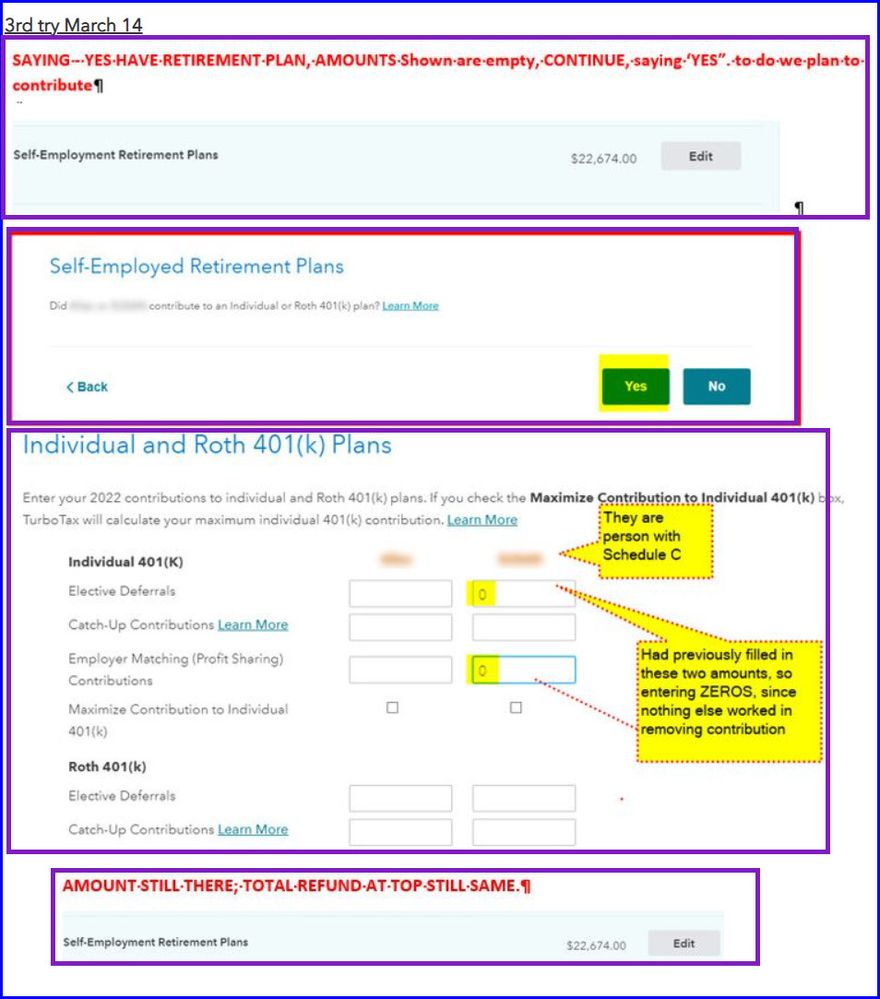

I can’t remove incorrect SEP donation amount for TurboTax Online Self-Employed version? Tried three different ways to remove the donation amount, none work. Thanks in advance.

@tagteam

@DanaB

@dmertz

@fanfare

@MinhT1

#HELP #STUCK #SEPDonation

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HELP! Can’t remove incorrect SEP donation amount for TurboTax Online Self-Employed version

Alternatively, you can delete the Keogh, SEP and SIMPLE Contributions Worksheet (Keogh/SEP Wks) to remove all self-employed retirement entries. In the online version of TurboTax, click Tax Tools -> Tools -> Delete a form, then click the Delete link next to the the name of the form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HELP! Can’t remove incorrect SEP donation amount for TurboTax Online Self-Employed version

Yes, you can remove that entry, but you have to take out the number that you entered and then backtrack to answer the first question No.

This is how to do that:

- Open your return and select Federal on the left side menu.

- Select Wages & Income, scroll down to Other Business Situations, expand the section.

- Find Self-Employment Retirement Plans, select Revisit to the right.

- Answer the first question No and the second question Yes.

- If a joint return, select which of you entered the contribution and click Continue.

- On the screen Your Contributions, delete the numbers, leaving everything blank.

- Click Back in the lower left hand corner until you get back to Self-Employed Retirement Plans.

- Answer the question No.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HELP! Can’t remove incorrect SEP donation amount for TurboTax Online Self-Employed version

Alternatively, you can delete the Keogh, SEP and SIMPLE Contributions Worksheet (Keogh/SEP Wks) to remove all self-employed retirement entries. In the online version of TurboTax, click Tax Tools -> Tools -> Delete a form, then click the Delete link next to the the name of the form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HELP! Can’t remove incorrect SEP donation amount for TurboTax Online Self-Employed version

Thanks

But I had tried all that, numerous times. I had to delete the form as the next person commented.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HELP! Can’t remove incorrect SEP donation amount for TurboTax Online Self-Employed version

I found on in the Home and Business version that if I checked the "Maximize Contribution"

box, it left that number in the calculations even if you said NO to the questions about actually contributing. I finally (per the above comments) went to the the SEP/Keogh form and unchecked the "maximize" box, which zeroed everything out. An odd lack of coordination between the different sections of their questions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HELP! Can’t remove incorrect SEP donation amount for TurboTax Online Self-Employed version

Unfortunately, this undesirable behavior of TurboTax has caught many people out.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tcondon21

Returning Member

WadiSch

Level 1

user17520162976

New Member

rei4brad

New Member

elmchugh6

New Member