- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Form 8606 Backdoor Roth issue

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8606 Backdoor Roth issue

Looking for help on my backdoor Roth and form 8606 with Turbotax.

In 2020 I made a 2019 traditional contribution of $6K and converted it the next day to a Roth

In 2020 I made a 2020 traditional contribution of $6K and converted it the next day to a Roth

I received one 1099R from my traditional IRA for $12,000.12

Using Turbotax my form 8606 shows I have $140 of taxable income. Why???

Line 1: $6k

Line 2: $6k

Line 3: $12,000

Line 4: blank

Line 5: $12,000

Line 6, 7, 8, 9: Blank

Line 10: x

Line 11 & 12: Blank

Line 13: $12,000

Line 14: 0

Line 15a: 2

Line 15b: Blank

Line 15c: 2

Line 16: $12,000

Line 17: $11,860

Line 18: $140!!!!!

Why do I have $140 of taxable conversion???

I am using the online version of Turbotax. I copied the info from the worksheets and posted them below. Form 8606 is the only place in my return where I see the amount $11,860. I can’t for the life of me figure out where that amount comes from. I guess I will have to call Turbotax unless anyone has an idea where it is coming from.

20200 Transactions – Contributions

Regular Roth IRA contributions: BLANK

Rollover from Roth 401(k) and Roth 403(b): BLANK

Conversion contributions taxable at conversion: $140

Conversion contributions not taxable at conversion$11,860

Repayments of qualified Roth reservist distributions

Balance c/over to 2021 (Basis – After 2020 Transactions)

Conversion contributions taxable at conversion: $140

Conversion contributions not taxable at conversion$11,860

Thanks!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8606 Backdoor Roth issue

Usually, if you had earnings or deductible contributions in your traditional IRA then each distribution/conversion will have a allocation of tax-free (from your basis) and taxable amount.

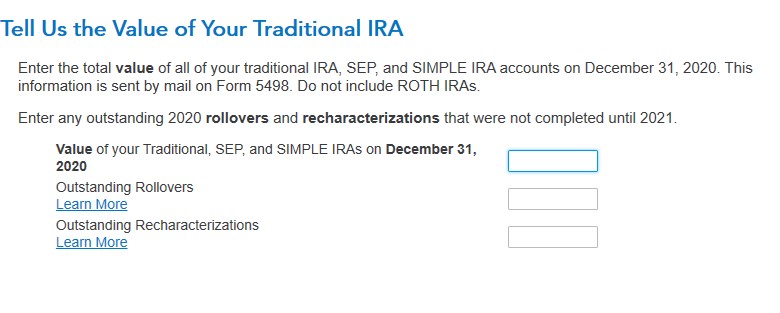

Please check what you enter for your value of your traditional IRA after you entered your basis on the "Tell us your value of your traditional IRA" screen.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

lkjr

New Member

tianwaifeixian

Level 4

tianwaifeixian

Level 4

tianwaifeixian

Level 4

gagan1208

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill