- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Excess Roth IRA Contribution

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess Roth IRA Contribution

My wife and I determined that our modified adjusted gross income is too high to contribute to our Roth IRA. We are both under 60.

My Account:

- Opened Account 2020.

- Contributed $6,000 in calendar year 2021.

- Contributed $700 in calendar year 2022.

- Fair Market Value 12/31/20: $6,827.17

- Fair Market Value 12/31/21: $14,186.91

My Wife's Account:

- Opened Account in December 2021.

- Contributed $6,000 in calendar year 2021.

- Contributed $500 in calendar year 2022.

- Fair Market 12/31/21: $5,974.23

To avoid the 6% penalty each year you leave the money in the Roth IRA, I would like to withdraw the excess contribution from the Roth IRA, as well as any earnings. Here are my questions.

- I expect to remain over the income limit for 2022 as well. Can I treat both 2021 and 2022 contributions as my excess contributions for tax year 2021? (i.e. $6,700 for myself, $6,500 for my wife)? Or should I deal with 2021 calendar year now and wait until next year for the 2022 calendar year distributions?

- What is recommended sequence on actions to take?

- Withdraw ONLY Contribution Amount for 2021/Contribution Amount for 2021 + 2022

- Obtain 1099-R to figure out earnings from those contributions , proceed to take more money out OR

- Estimate earnings and take out contribution + estimate earnings.

- For my account, would estimated earnings be as simple as the following: [Value as of 12/31/21] - [(Value as of 12/31/2020) + (2021 Contributions)]

- For my wife's account, the total distributed is less than current value. Would I just remove the entire value of the account then?

Any guidance on all of this and the steps to take would be much appreciated.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess Roth IRA Contribution

1. You will request to withdraw the excess contribution plus earnings for 2021 and 2022. The 2021 excess plus earnings have to be removed by the due date of the 2021 return and the 2022 excess plus earnings have to be removed by the due date of your 2022 return.

Therefore, you can decide if you want to wait to remove the 2022 excess but please be aware the 2022 earnings will be taxable in 2022 and are subject to the 10% early withdrawal penalty if you are under 59 1/2. The earnings from your 2021 excess will be reported on your 2021 tax return.

Even if you request to have both excess contributions plus earnings withdrawn at the same time in 2022 you will get two 2022 Form 1099-R on for the 2021 excess contributions with code P and J (belongs on the 2021 return) and one for the 2022 excess contribution with code J and 8 (belongs on the 2022 return).

2. You will request the withdrawal of the excess contribution plus earnings and your financial institution should be able to calculate the earnings for you.

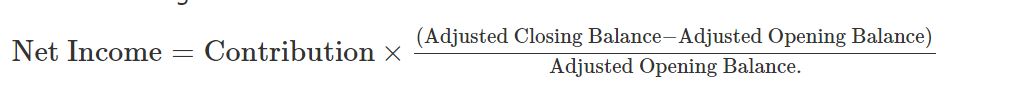

3. The earnings are calculated: Contribution x (Adjusted Closing balance - Adjusted Opening balance)/ Adjusted Opening Balance

4. Yes, you will withdraw the whole amount. If your wife had a loss then your distribution will be less than the contribution amount but you will enter the full contribution amount as withdrawn on the TurboTax penalty screen during the IRA contribution interview.

Please review What happens if I made an excess Roth IRA contribution for additional options.

You will get a 1099-R 2022 in 2023 with codes P and J for the withdrawal of the 2021 excess contribution and earnings. This 1099-R will have to be included on your 2021 tax return and you have two options:

- You can wait until you receive the 1099-R 2022 in 2023 and amend your 2021 return or

- You can report it now in your 2021 return and ignore the 1099-R when it comes unless there is Box 4 Federal Tax withholding and/or Box 14 State withholding. Then you must enter the 2022 1099-R into the 2022 tax return since the withholding is reported in the year that the tax was withheld. The 2022 code P will not do anything in 2022 tax return but the withholding will be applied to 2022.

To create a 1099-R in your 2021 return please follow the steps below:

- Login to your TurboTax Account

- Click on the "Search" on the top right and type “1099-R”

- Click on “Jump to 1099-R”

- Answer "Yes" to "Did you get a 1099-R in 2021?"

- Select "I'll type it in myself"

- Box 1 enter total distribution (contribution plus earning)

- Box 2a enter the earnings

- Box 7 enter J and P

- Click "Continue"

- On the "Which year on Form 1099-R" screen say that this is a 2022 1099-R.

- Click "Continue" after all 1099-R are entered and answer all the questions.

- Continue until "Did you use your IRA to pay for any of these expenses?" screen and enter the amount under "Another reason" if you are over 59 1/2 (if you under 59 1/2 click "Continue")

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

bjw5017

New Member

mailsaurin

New Member

meltonyus

Level 1

lkjr

New Member

user17549435158

New Member