- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Contributing to a Roth IRA with Scholarship income - Is it Excess or not?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Contributing to a Roth IRA with Scholarship income - Is it Excess or not?

Hello,

What a PhD student gets grants/scholarship and they get only 1098T where they get paid more (box5) than the tuition and fees (box1). They have to show the difference as taxable income. And they are assessed to pay taxes after standard deduction which can be few thousand in taxes. There is no W2, only 1098T.

They are paying taxes, can they not save in IRA or RothIRA? If they contribute, will that be considered as excess contribution and pay penalty? Can you please clarify?

Thanks,

tapank

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Contributing to a Roth IRA with Scholarship income - Is it Excess or not?

1. Yes, they can contribute to an IRA.

2. No, there is no excess contribution if they stick to the rules.

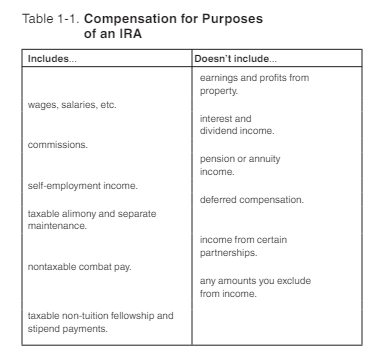

About Publication 590-A, Contributions to Individual Retirement Arrangements (IRAs) page 7 shows scholarship income does qualify as compensation for purposes of an IRA and you can review the rules for your situation and type of IRA.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Contributing to a Roth IRA with Scholarship income - Is it Excess or not?

Thanks you so much for your help.

My daughter is using H&R SW for this year's tax filing. The SW is showing that she can not contribute to IRA, amount = $0. Then Next year there will be a penalty as excess IRA payment. Can you kindly advice?

Thanks again.

tapank

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Contributing to a Roth IRA with Scholarship income - Is it Excess or not?

I can only think that either it wasn't taxable or you entered something differently. Again, the best thing to do is review your situation in the pub. Here is the chart from About Publication 590-A, Contributions to Individual Retirement Arrangements (IRAs) :

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

bjw5017

New Member

meltonyus

Level 1

xiaochong2dai

Level 3

march142005

New Member

jliangsh

Level 2