- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Contributed IRAs for 2021 and 2022 on 1/2022. Converted to Roth IRA later in 1/2022. Got 1099R and 5498 for Roth conversion of $12K; turbotax noted $6K as distrib. Fix?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Contributed IRAs for 2021 and 2022 on 1/2022. Converted to Roth IRA later in 1/2022. Got 1099R and 5498 for Roth conversion of $12K; turbotax noted $6K as distrib. Fix?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Contributed IRAs for 2021 and 2022 on 1/2022. Converted to Roth IRA later in 1/2022. Got 1099R and 5498 for Roth conversion of $12K; turbotax noted $6K as distrib. Fix?

A backdoor Roth IRA allows you to get around income limits by converting a traditional IRA into a Roth IRA. Contributing directly to a Roth IRA is restricted if your income is beyond certain limits, but there are no income limits for conversions.

You’ll receive a Form 1099-R with code 2 in box 7 (or code 7 if your age is over 59 ½) in the year you make your Roth conversion. You should report your conversion for the year you receive this 1099-R:

- If you received this form in 2022, complete both steps below to report it on your 2022 taxes

- If you'll receive this form in 2023, wait to report it on your 2023 taxes. In this case, only complete Step 1 below for your 2022 taxes. You’ll complete both steps next year when filing your taxes for 2023

Doing a backdoor Roth conversion is a two-step process.

Step 1: Enter the Non-Deductible Contribution to a Traditional IRA

- Sign in to your TurboTax account

- Open your return if it’s not already open

- Select Federal from the menu, then Deductions & Credits

- Locate the Retirement and Investments section and select Show more

- Select Start or Revisit next to Traditional and Roth IRA Contributions

- Check the Traditional IRA box and select Continue

- Answer No to the question, Is This a Repayment of a Retirement Distribution?

- On the screen, Tell Us How Much You Contributed, enter the amount contributed and select Continue

- Answer No on the screen Did You Change Your Mind?, then answer the questions on the following screens

- When you reach the Choose Not to Deduct IRA Contributions screen, select Yes, make part of my IRA contribution nondeductible, enter the amount you contributed, then select Continue

- Select Continue on Your IRA Deduction Summary

Step 2: Enter the Conversion from a Traditional IRA to a Roth IRA

- Select Wages & Income (this is Income & Expenses in TurboTax Self-Employed)

- Locate the Retirement Plans and Social Security section and select Show more, then select Start or Revisit next to IRA, 401(k), Pension Plan Withdrawals (1099-R)

- Answer Yes to Did you get a 1099-R in 2022?, then Continue

- If you land on the screen, Your 1099-R Entries, select Add Another 1099-R

- Select how you want to enter your 1099-R (import or type it in yourself) and follow the instructions

- Answer the questions on the following screens, until you reach Tell us if you moved the money through a rollover or conversion

- Select I converted some or all of it to a Roth IRA and Continue

- Next, choose Yes, all of this money was converted to a Roth IRA

- Continue answering questions until you come to the screen, Your 1099-R Entries

To check the results of your backdoor Roth IRA conversion, see your Form 1040:

- From the menu, select Tax Tools, then Tools (If you're currently using the TurboTax Mobile app, you'll need to sign in to the web browser version)

- Under Tools Center, select View Tax Summary

- From the side menu, select Preview my 1040

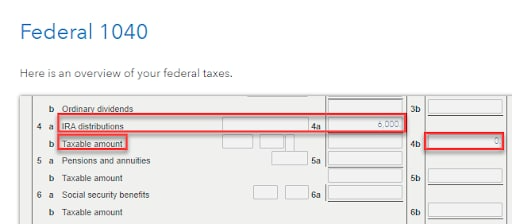

- Your backdoor Roth IRA amount should be listed on Form 1040, Line 4a as IRA distributions

- Taxable amount should be zero unless you had earnings between the time you contributed to your Traditional IRA and the time you converted it to Roth IRA, in which case the earnings would be taxable

- Schedule 1, Line 20, IRA deduction should be blank

- Select Back to return to where you left off in TurboTax

If your conversion includes contributions made in 2022 for 2021, you'll need to check your 2021 return to make sure it includes Form 8606, Nondeductible IRAs. If this form isn't included in your 2021 return, you'll need to fill out a 2021 Form 8606 to record your nondeductible basis for conversion, and mail this form to your designated IRS office. Don’t amend your 2021 return to record your basis. (Note: If you are required to file Form 8606 to report a nondeductible contribution to a traditional IRA, but don’t do so, you’ll be subject to a $50 penalty. This penalty can be waived if you can show reasonable cause.)

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Contributed IRAs for 2021 and 2022 on 1/2022. Converted to Roth IRA later in 1/2022. Got 1099R and 5498 for Roth conversion of $12K; turbotax noted $6K as distrib. Fix?

Did you fail to report the 2021 contribution on 2021 Form 8606? If so, you'll need to file that form where the amount on line 1 will propagate to line 14 to carry forward to line 2 of your 2022 Form 8606.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

altheaf

Level 1

acnorwood

New Member

rjkbuny

Returning Member

ChickenBurger

New Member

LMTaxBreaker

Level 2