- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Contributed $7000 to my Roth IRA...I am over 50, but I get an "error" message from the Contribution Worksheet:Line 7c, Taxpayer should not be greater than $6500.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

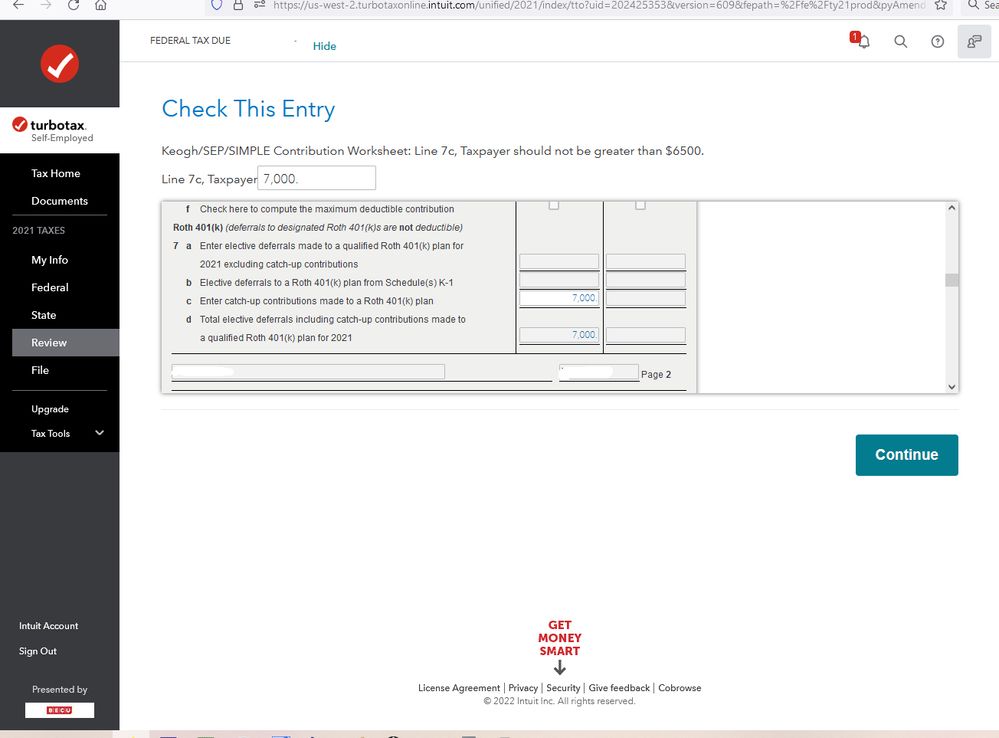

Contributed $7000 to my Roth IRA...I am over 50, but I get an "error" message from the Contribution Worksheet:Line 7c, Taxpayer should not be greater than $6500.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Contributed $7000 to my Roth IRA...I am over 50, but I get an "error" message from the Contribution Worksheet:Line 7c, Taxpayer should not be greater than $6500.

For the tax year 2021, if you are age 50 or older as of the last day of the tax year, then your contribution limit is up to $7000 instead of $6000 for IRA contributions, assuming other qualifications such as income limits have been met.

Try deleting your contribution and entering the information again to see if anything changes.

If you do meet the age qualification and you are working on a 2021 tax return, please respond back if the error message persists.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Contributed $7000 to my Roth IRA...I am over 50, but I get an "error" message from the Contribution Worksheet:Line 7c, Taxpayer should not be greater than $6500.

Deleted the $7000 contribution and saved and exited Turbo Tax.

Signed back into Turbo Tax and re-entered the $7000 for a Roth 401k contribution.

Still get the error as something I need to review.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Contributed $7000 to my Roth IRA...I am over 50, but I get an "error" message from the Contribution Worksheet:Line 7c, Taxpayer should not be greater than $6500.

Also check your Date of Birth in the Personal Info section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Contributed $7000 to my Roth IRA...I am over 50, but I get an "error" message from the Contribution Worksheet:Line 7c, Taxpayer should not be greater than $6500.

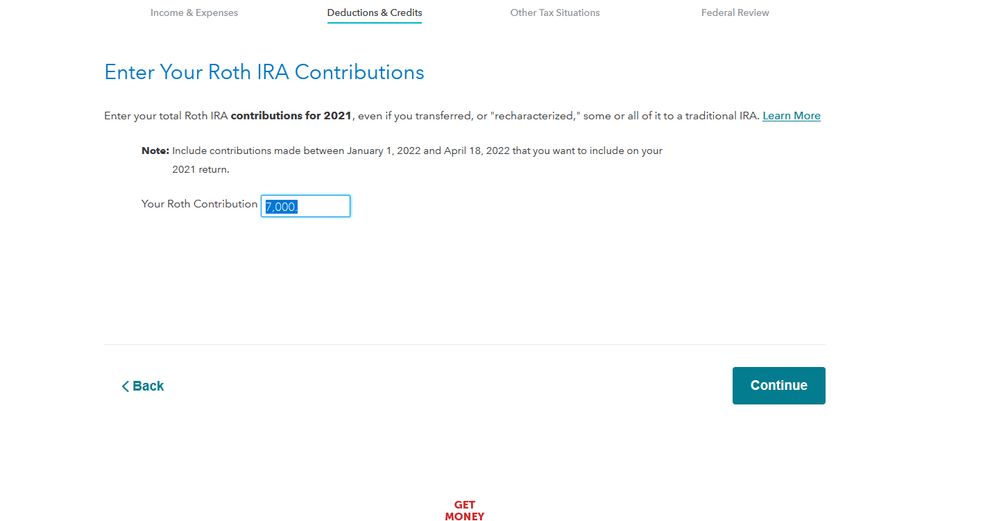

Your question says Roth IRA, but your screenshot post shows Roth 401(k). Please clarify.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Contributed $7000 to my Roth IRA...I am over 50, but I get an "error" message from the Contribution Worksheet:Line 7c, Taxpayer should not be greater than $6500.

it is correct...1954

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Contributed $7000 to my Roth IRA...I am over 50, but I get an "error" message from the Contribution Worksheet:Line 7c, Taxpayer should not be greater than $6500.

That is the only choice Turbo Tax gave me as I am self employed...is there a difference?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Contributed $7000 to my Roth IRA...I am over 50, but I get an "error" message from the Contribution Worksheet:Line 7c, Taxpayer should not be greater than $6500.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Contributed $7000 to my Roth IRA...I am over 50, but I get an "error" message from the Contribution Worksheet:Line 7c, Taxpayer should not be greater than $6500.

I found my mistake...there was a $7000 entry for a Roth 401k...thanks!!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

toddrub46

Level 4

binarysolo358

New Member

user17549435158

New Member

tianwaifeixian

Level 4

soccerfan1357

Level 1