- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Cant select from flowing list for 1099-b, how do I do it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cant select from flowing list for 1099-b, how do I do it?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cant select from flowing list for 1099-b, how do I do it?

There is a workaround that while maybe not ideal, should allow you to enter the information from your Form 1099-B and continue with your return.

Following the steps below should be of assistance to you:

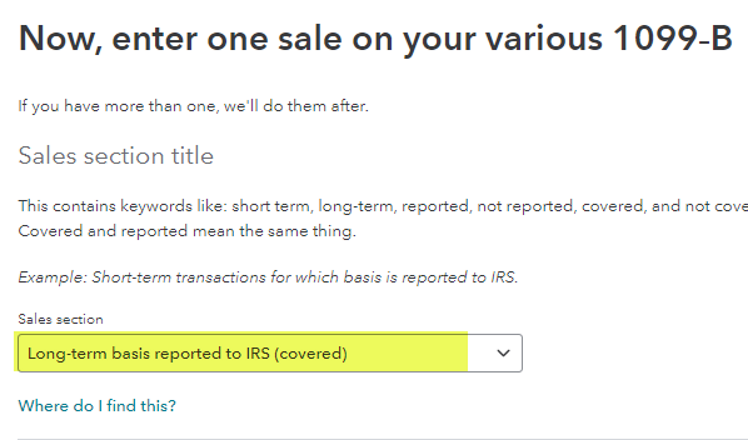

The 1099-B should guide you on what the treatment will be for including the trades on your return. Generally your 1099-B should show the caption for the type of trade that it was - Short-term covered with basis reported to the IRS, Short-term not covered, Long-term covered, Long-term not covered. Each section of the 1099-B needs to be entered separately. You are allowed to combine transactions as one provided they are from the SAME grouping. You enter the transactions in the Investment section of TurboTax as follows:

- On the left side of your TurboTax screen, click on Wages & Income

- Scroll down to "Investments & Savings" and click show more or edit/add

- Click on "Add Investments"

- Best thing to do here in my opinion is to click on "Enter a different way"

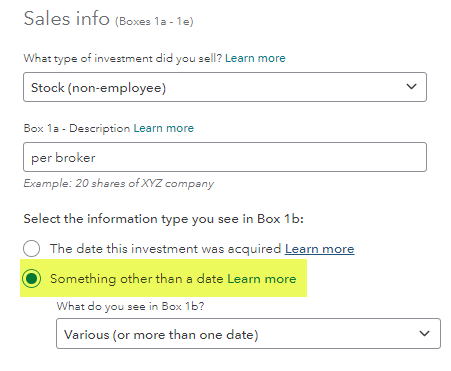

- Click on the box for Stocks, Bonds, Mutual Funds and then continue

- Enter your broker at the top and the account number and Payer's EIN if you so choose (not required)

- You can answer no if you are going to group the trades or if in fact there were less than 4

- Follow the remaining instructions and choices. Whichever way you answer you will receive additional instructions

Unless there is only one transaction or one date for sales, click in the circle for "Something other than a date" and then click on the down arrow for "Various"

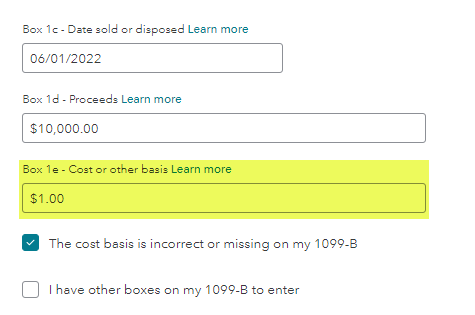

If there was only one sale date place that in the next box, if several sale dates, I suggest entering a date in the middle of the year, such as June 30, or so. Enter the cost basis that shows on the 1099-B. If the 1099-B does not show a cost basis you will need to enter one and tell the program the cost basis is incorrect or missing. I suggest entering $1 to avoid the program warnings. The numbers obviously are for example only. Click continue at the bottom.

The next screen is usually none of the above but check all the questions for accuracy if any apply, so click continue.

Click continue and you will return to the summary.

Follow the above steps for each of the sections of the 1099-B for stock transactions

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17645583867

Returning Member

starkyfubbs

Level 4

LJHMAZ

Returning Member

PC53

New Member

renda000

Returning Member