- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Can turbotax tell me the maximum specific dollar amount I can contribute this year to a traditional IRA, just like it can for a SEP IRA? If so, where? If not, why not?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can turbotax tell me the maximum specific dollar amount I can contribute this year to a traditional IRA, just like it can for a SEP IRA? If so, where? If not, why not?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can turbotax tell me the maximum specific dollar amount I can contribute this year to a traditional IRA, just like it can for a SEP IRA? If so, where? If not, why not?

You can work with TurboTax to determine the maximum IRA deduction, deductible or non-deductible.

You will enter information into your return either with an amount you think you wish to contribute, or the maximum allowed contribution for your age. Then, go through the rest of the questions in that section of your return and there will be messages on the screen telling you what amount will be deductible and/or allowed (depending on the type of IRA contribution that you chose). Then you can take action suggested on the screen to change your contribution amount if required.

Use the following steps to get started:

- On the top row of the TurboTax online screen, click on Search (or for CD/downloaded TurboTax locate the search box in the upper right corner)

- This opens a box where you can type in “IRA contributions” and click the magnifying glass (or for CD/downloaded TurboTax, click Find)

- The search results will give you an option to “Jump to IRA contributions”

- Click on the blue “Jump to IRA contributions” link and enter your information

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can turbotax tell me the maximum specific dollar amount I can contribute this year to a traditional IRA, just like it can for a SEP IRA? If so, where? If not, why not?

The maximum IRA contributions for 2020 is $6,000, or $7,000 if you’re age 50 or older by the end of the year; or your taxable compensation for the year which ever is less.

(Taxable compensation is generally wages that you worked for - W-2 or net self-employed income minus the deductible part of the SE tax, but can include commissions, certain alimony and separate maintenance, and nontaxable combat pay ).

See IRS Pub 590A "What is compensation" for details:

https://www.irs.gov/publications/p590a#en_US_2018_publink1000230355

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can turbotax tell me the maximum specific dollar amount I can contribute this year to a traditional IRA, just like it can for a SEP IRA? If so, where? If not, why not?

Thank you macuser22, but your response only repeats what I read on turbotax before I posed my question. It does not answer my question, though I know you meant well.

I previously read HOW to calculate the specific maximum dollar amount. But I would like turbotax to tell me that $ amount, without me being required to know what is meant by "net self-employed income" (net of what?) and what is "the deductible part of the SE tax". It's ambiguous.

Turbotax does calculate, and present to the turbotax user, the specific maximum $ amount one can contribute to a 401k or SEP IRA. Does turbotax do the same for contributions to a traditional IRA? If so: where? If not, why not?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can turbotax tell me the maximum specific dollar amount I can contribute this year to a traditional IRA, just like it can for a SEP IRA? If so, where? If not, why not?

You can work with TurboTax to determine the maximum IRA deduction, deductible or non-deductible.

You will enter information into your return either with an amount you think you wish to contribute, or the maximum allowed contribution for your age. Then, go through the rest of the questions in that section of your return and there will be messages on the screen telling you what amount will be deductible and/or allowed (depending on the type of IRA contribution that you chose). Then you can take action suggested on the screen to change your contribution amount if required.

Use the following steps to get started:

- On the top row of the TurboTax online screen, click on Search (or for CD/downloaded TurboTax locate the search box in the upper right corner)

- This opens a box where you can type in “IRA contributions” and click the magnifying glass (or for CD/downloaded TurboTax, click Find)

- The search results will give you an option to “Jump to IRA contributions”

- Click on the blue “Jump to IRA contributions” link and enter your information

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can turbotax tell me the maximum specific dollar amount I can contribute this year to a traditional IRA, just like it can for a SEP IRA? If so, where? If not, why not?

Thanks AnnetteB6. As you explained, it was not evident until several screens later (only after entering a contribution amount) that turbotax does tell the user the maximum contribution dollat amount that is deductible. You were astute in realizing I was asking about maximum deductible amount.

Amoung the questions that turbotax asks prior to presenting this amount is: "Are you covered by a retirement plan at work?" If my only income is from self employment, and my only retirement plan is an old SEP IRA, am I "covered by a retirement plan at work"?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can turbotax tell me the maximum specific dollar amount I can contribute this year to a traditional IRA, just like it can for a SEP IRA? If so, where? If not, why not?

If you have a SEP that you or your business contributed to in 2020 then yes. If no 2020 contribution then no.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can turbotax tell me the maximum specific dollar amount I can contribute this year to a traditional IRA, just like it can for a SEP IRA? If so, where? If not, why not?

@rifi wrote:

Thanks AnnetteB6. As you explained, it was not evident until several screens later (only after entering a contribution amount) that turbotax does tell the user the maximum contribution dollat amount that is deductible. You were astute in realizing I was asking about maximum deductible amount.

Amoung the questions that turbotax asks prior to presenting this amount is: "Are you covered by a retirement plan at work?" If my only income is from self employment, and my only retirement plan is an old SEP IRA, am I "covered by a retirement plan at work"?

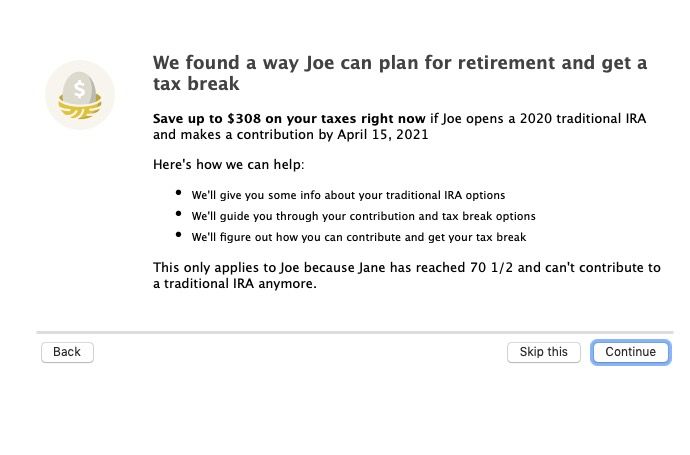

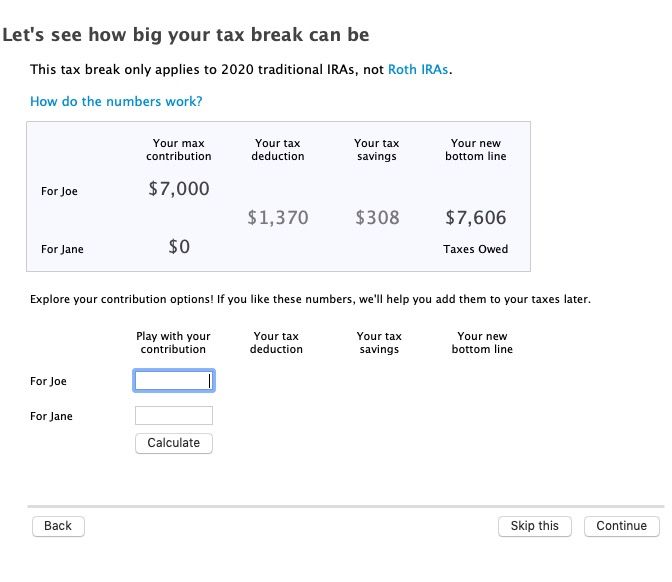

Actually there is a IRA calculator in TurboTax under "Other Tax Situations", Retirement Savings, IRA calculator tool.

I forgot about that because it was rather lame in prior years, but seems to be better now - I can't vouch for it's accuracy though and it sill thinks that 70 1/2 is the cutoff age for contributions - there is no cutoff age now.

In my example I used an income of $120,000 to be in the phase out range and it seems to do that.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can turbotax tell me the maximum specific dollar amount I can contribute this year to a traditional IRA, just like it can for a SEP IRA? If so, where? If not, why not?

Thanks macuser22. That's what I wanted to know (about "covered at work").

I'm suprised that turbotax doesn't provide guidance on the IRS definiton of "covered at work" right there - where the question is asked. Is it my imagination, or did turbotax previously provide guidance like on things like this up front (without having to jump thru hoops to get the answer)?

Seems like the software is less helpful this year - did turbotax do a "revamp" and let things fall thru the cracks? Is not Intuit a highly lucrative multi billion dollar company?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can turbotax tell me the maximum specific dollar amount I can contribute this year to a traditional IRA, just like it can for a SEP IRA? If so, where? If not, why not?

I could not find an "IRA calculator tool," for traditional IRAs, anywhere in "Other Tax Situations", or anywhere else in turbotax. I'm using turbotax online for mac.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

simoneporter

New Member

VAer

Level 4

VAer

Level 4

VAer

Level 4

VAer

Level 4