- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

@rifi wrote:

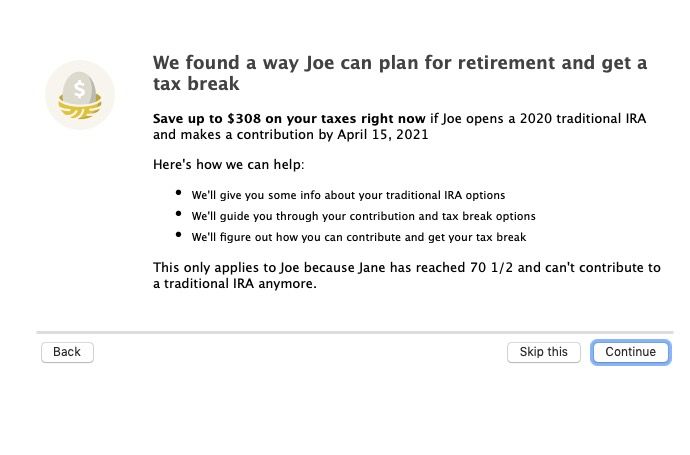

Thanks AnnetteB6. As you explained, it was not evident until several screens later (only after entering a contribution amount) that turbotax does tell the user the maximum contribution dollat amount that is deductible. You were astute in realizing I was asking about maximum deductible amount.

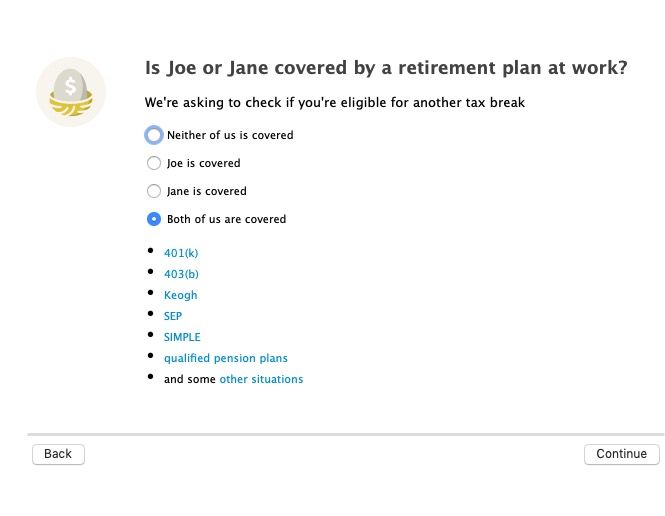

Amoung the questions that turbotax asks prior to presenting this amount is: "Are you covered by a retirement plan at work?" If my only income is from self employment, and my only retirement plan is an old SEP IRA, am I "covered by a retirement plan at work"?

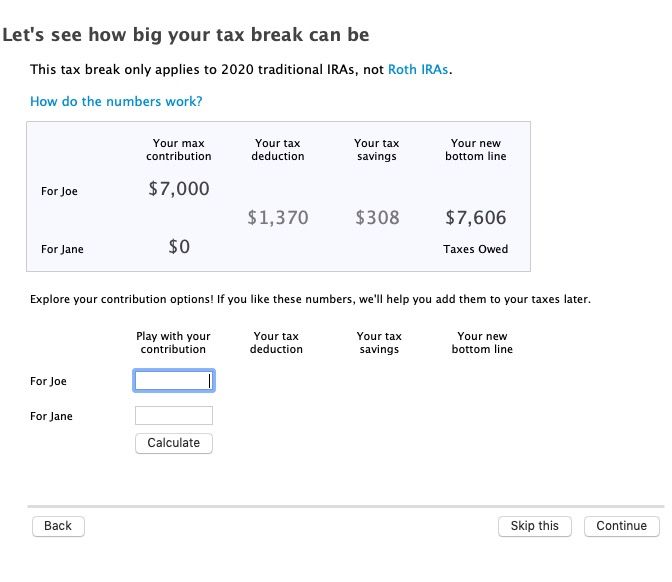

Actually there is a IRA calculator in TurboTax under "Other Tax Situations", Retirement Savings, IRA calculator tool.

I forgot about that because it was rather lame in prior years, but seems to be better now - I can't vouch for it's accuracy though and it sill thinks that 70 1/2 is the cutoff age for contributions - there is no cutoff age now.

In my example I used an income of $120,000 to be in the phase out range and it seems to do that.