- Community

- Topics

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Community

- Topics

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Can multiple 1099's be added to a single line of work? TurboTax seems to want me to break apart common expenses into different sections, but really it's one business.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can multiple 1099's be added to a single line of work? TurboTax seems to want me to break apart common expenses into different sections, but really it's one business.

I have a consulting business with multiple customers.

Topics:

posted

December 30, 2022

4:50 PM

last updated

December 30, 2022

4:50 PM

Connect with an expert

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

1 Best answer

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can multiple 1099's be added to a single line of work? TurboTax seems to want me to break apart common expenses into different sections, but really it's one business.

December 30, 2022

6:20 PM

3 Replies

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can multiple 1099's be added to a single line of work? TurboTax seems to want me to break apart common expenses into different sections, but really it's one business.

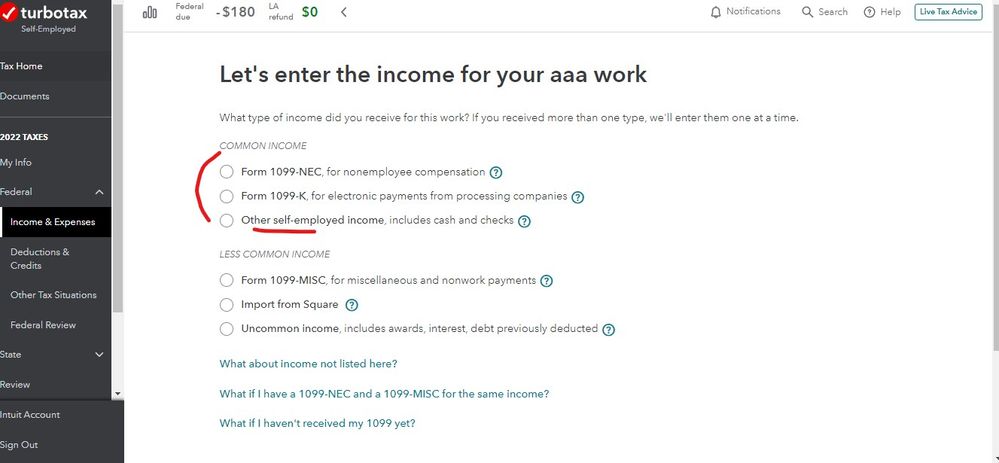

Actually I would just enter your total income as Other self employment income or as Cash or General income. You don't need to get a 1099NEC or 1099Misc or 1099K. Even if you did you can enter all your income as Cash. Only the total goes to schedule C.

How to enter income from Self Employment

December 30, 2022

4:51 PM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can multiple 1099's be added to a single line of work? TurboTax seems to want me to break apart common expenses into different sections, but really it's one business.

December 30, 2022

6:20 PM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can multiple 1099's be added to a single line of work? TurboTax seems to want me to break apart common expenses into different sections, but really it's one business.

Thanks, that works great!

December 30, 2022

6:30 PM

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

minhhieu0912

New Member

OldCarGuy

Level 4

Tamlyn74

New Member

rubiestoo

New Member

huntinad

Level 1