- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Can I stop TT wrongly double-reporting municipal bond income as U.S. income on Virginia Sch. ADJ, line 2B - income correctly on Line 1, incorrectly re-reported on 2B?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I stop TT wrongly double-reporting municipal bond income as U.S. income on Virginia Sch. ADJ, line 2B - income correctly on Line 1, incorrectly re-reported on 2B?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I stop TT wrongly double-reporting municipal bond income as U.S. income on Virginia Sch. ADJ, line 2B - income correctly on Line 1, incorrectly re-reported on 2B?

I am not able to duplicate your issue. It would be helpful to have a TurboTax token. The token provides a sanitized version of your return. We will be able to see the numbers but not any personal information such as your name, SSN, or address.

If you would like to do this, here are the instructions:

In TurboTax Online, go to the black panel on the left side of your program and select Tax Tools.

- Then select Tools below Tax Tools.

- A window will pop up which says Tools Center.

- On this screen, select Share my file with Agent.

- You will see a message explaining what the diagnostic copy is. Click okay through this screen, and you will get a Token number.

In TurboTax CD/Download versions, go to the black panel on your screen and select Online.

- Scroll down and select Send tax file to Agent.

- You will see a message explaining what the diagnostic copy is. Click send through this screen, and you will get a Token number.

Reply to this thread with your Token number.

We will then be able to see precisely what you are seeing, and we can determine what exactly is going on in your return and provide you with a resolution.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I stop TT wrongly double-reporting municipal bond income as U.S. income on Virginia Sch. ADJ, line 2B - income correctly on Line 1, incorrectly re-reported on 2B?

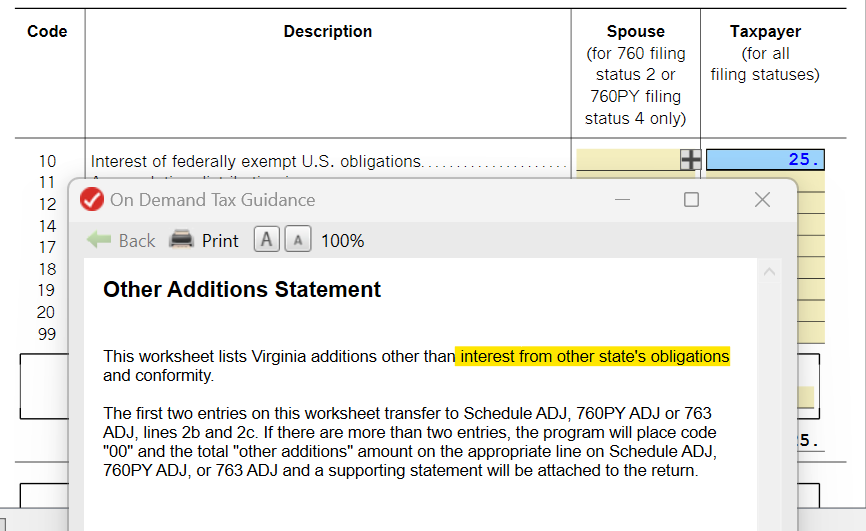

I am seeing the same thing on my 2023 return. Muni bond interest (on states other than VA) is correctly reported as an addition to income, but then an entry equal to muni bond interest appears also as "Interest of federally exempt US obligations" with Code 10 on line 2b. But I have no interest from US obligations. I assume this is an error and will override the incorrect amount on my Virginia return.

Does anyone else see this also? I checked last year's return and did not find the same error.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I stop TT wrongly double-reporting municipal bond income as U.S. income on Virginia Sch. ADJ, line 2B - income correctly on Line 1, incorrectly re-reported on 2B?

I just tried to troubleshoot the problem by deleting all of my municipal bond interest entries. However, TurboTax STILL adds $15,000.00 of U.S. obligations interest to my Virginia return. I have no entries, interest (US obligations, banks, or muni bonds) or otherwise, of $15,000.00 on my return. This is really strange. Be sure to check your Virginia returns for additions to income that you cannot explain.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I stop TT wrongly double-reporting municipal bond income as U.S. income on Virginia Sch. ADJ, line 2B - income correctly on Line 1, incorrectly re-reported on 2B?

The program will move things it knows about. If you have no additional income that needs to be added back, you should not have anything listed under the income that is handles differently.

The wording is awkward in the program. Looking at the line 10 statement in the program, the other states are mentioned and should not be on line 10.

You could have data stuck since you deleted everything and still see the issue. Of course, the program won't delete information it thinks is important so you may not have deleted the information.

Follow these steps:

Desktop version:

- Delete the form

- Save your return while closing the program.

- Update the program

- Open

- Enter the information again.

Online version:

A full or corrupted cache can cause problems in TurboTax, so sometimes you need to clear your cache (that is, remove these temporary files).

For stuck information follow these steps:

- Delete the form/ worksheet- if possible, see How to Delete

- Log out of your return and try one or more of the following:

- Log back into your return.

- Enter the information again.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Benjamine

Level 4

edmarqu

Returning Member

ahulani989

New Member

karunt

New Member

odunham

New Member