- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Backdoor roth, Form 8606, left over money in traditional IRA

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Backdoor roth, Form 8606, left over money in traditional IRA

I am looking for help with getting my form 8606 correct on turbotax deluxe.

Last year I/we performed the back door roth for myself and spouse. During the time of waiting for funds to settle in traditional IRA, each $6000 contribution accumulated $3 of interest. I Initially converted $6000 from each traditional to the respective Roth accounts. I saw that it had accumulated interest and converted the remaining $3 from my own account, and unfortunately did not check wife's account until this month where I saw it had the remaining $3 in the traditional account.

I believe I have entered the information correctly into TTdeluxe.

For my own Form 8606 it shows $6000 contributed, $6003 converted, and taxable amount of $3 which is as expected.

My difficulty is getting my wife's Form 8606 correct.

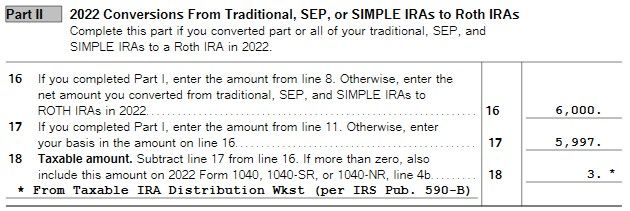

We converted all $6000 from the traditional to the roth last year. The remaining $3 I did not convert until today. This means she had $3 left in her traditional account, so now her 8606 looks as below:

Is this correct and how it should look due to Pro-Rata?

Does this mean that next year we will just have an total basis in traditional IRAs of $3 for her?

Thank you!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Backdoor roth, Form 8606, left over money in traditional IRA

Your wife's Form 8606 is correct. The $3 than remained in your wife's IRA is all basis in nondeductible traditional IRA contributions due to the proportionate way that basis is allocated to distributions and conversions.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tcondon21

Returning Member

Divideby7

Level 1

VAer

Level 4

VAer

Level 4

VAer

Level 4