- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Backdoor roth, Form 8606, left over money in traditional IRA

I am looking for help with getting my form 8606 correct on turbotax deluxe.

Last year I/we performed the back door roth for myself and spouse. During the time of waiting for funds to settle in traditional IRA, each $6000 contribution accumulated $3 of interest. I Initially converted $6000 from each traditional to the respective Roth accounts. I saw that it had accumulated interest and converted the remaining $3 from my own account, and unfortunately did not check wife's account until this month where I saw it had the remaining $3 in the traditional account.

I believe I have entered the information correctly into TTdeluxe.

For my own Form 8606 it shows $6000 contributed, $6003 converted, and taxable amount of $3 which is as expected.

My difficulty is getting my wife's Form 8606 correct.

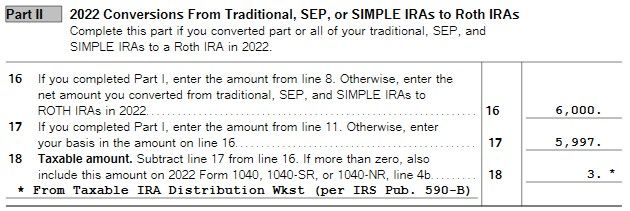

We converted all $6000 from the traditional to the roth last year. The remaining $3 I did not convert until today. This means she had $3 left in her traditional account, so now her 8606 looks as below:

Is this correct and how it should look due to Pro-Rata?

Does this mean that next year we will just have an total basis in traditional IRAs of $3 for her?

Thank you!