- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- backdoor IRA contribution for year 2019 and IRA conversion

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

backdoor IRA contribution for year 2019 and IRA conversion

I know there have been many backdoor IRA questions but my situation is bit complex, so any answer would be greatly appreciated!

My timeline is

1. On july 2019, I rolled over my previous employer pre tax 401K to vanguard Traditional IRA (T IRA)

2. On Jan 2020, after learning about backdoor IRA, I rolled over my entire T ira to my current 401k plan , thus made the Tira balance to 0

3. On Feb 2020, I made a contribution of after tax amount of $12000 from my bank account to my T ira account, $6000 for 2019, and $6000 for year 2020

4. After one day, I converted entire $12000 to my Roth IRA

Considering my Traditional Ira balance was not 0 on 12/31/2019, and I made contribution of $6000 for year 2019 on 02/2020. can someone kindly show me the steps to fill in the form for 2019 tax return? any possibly 2020 tax return? thank you so much!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

backdoor IRA contribution for year 2019 and IRA conversion

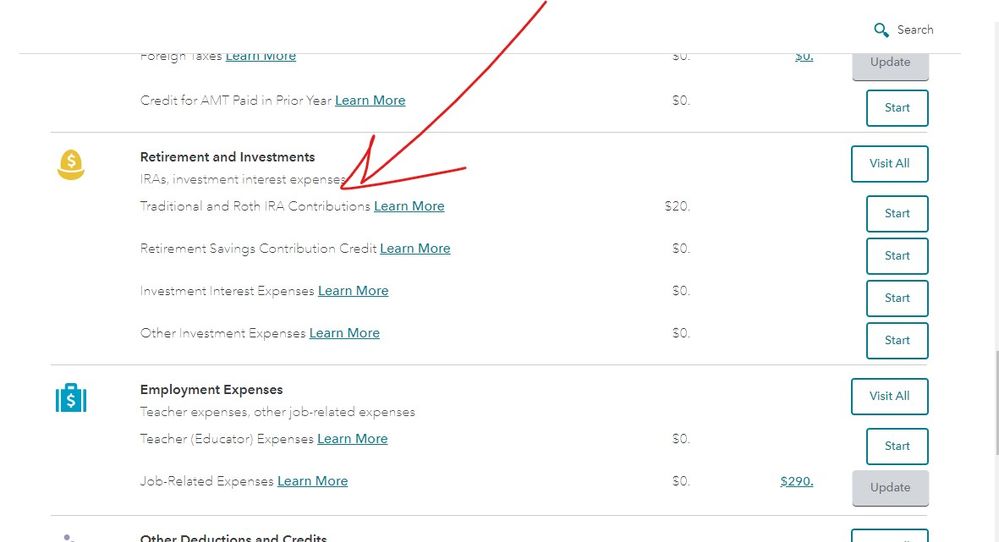

In the Deductions & Credits tab ... in the Retirement section ... follow the interview screens ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

backdoor IRA contribution for year 2019 and IRA conversion

You shroud have a 2019 1099-R for the 40(k) rollover so enter that in the 1099-R section.

Your 2019 year end balance is immaterial since the conversion happen in 2020 - it will be the 2020 year end balance that matters.

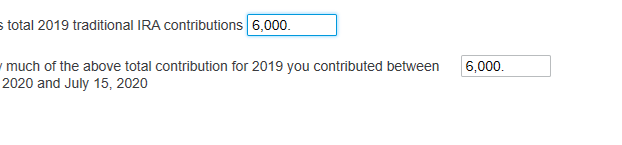

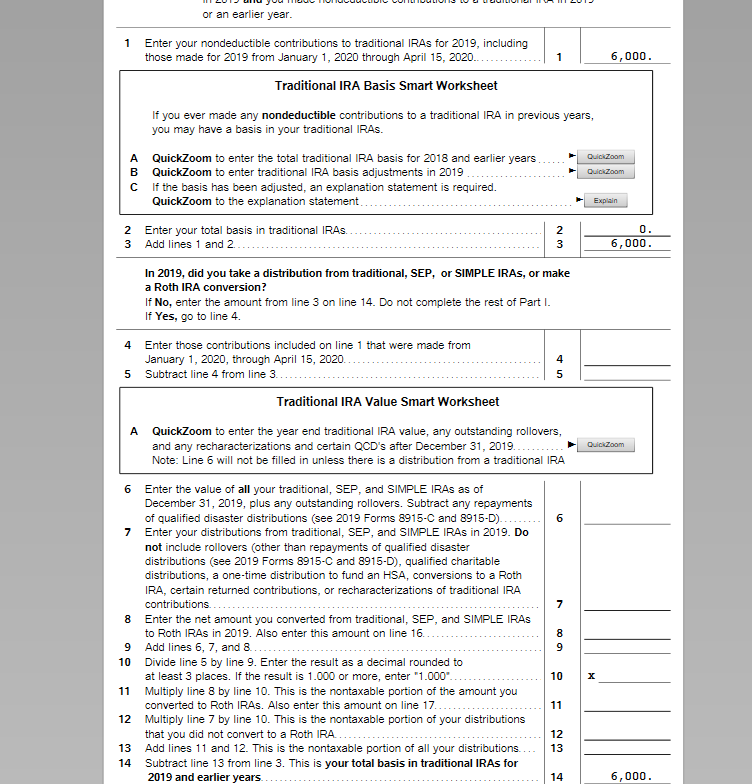

Enter your 2019 contribution on your 2019 tax return and be sure and show in the interview that it was contributed in 2020. If the interview asks say that you want the entire amount to be non-deductible (that question will not be asked if your income prohibits a deduction). That will produce a 8606 form with the contribution on lines 1,4 and 14.

When you get your 2020 1099-R for the conversion next year you will need the 8606 line 14 amount. In 2021 when doing your 2020 tax return, enter the 2020 contribution and mark it non-deductible also. The enter the 2020 1099-R and answer the questions about your nondeductible contributions and the 2020 year end IRA value.

Enter IRA contributions here:

Federal Taxes,

Deductions & Credits,

I’ll choose what I work on (if that screen comes up),

Retirement & Investments,

Traditional & Roth IRA contribution.

OR Use the "Tools" menu (if online version under My Account) and then "Search Topics" for "ira contributions" which will take you to the same place.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

backdoor IRA contribution for year 2019 and IRA conversion

Thank you very much for you reply!

Can you please let me know which step in Turbtax shall I do "Enter your 2019 contribution on your 2019 tax return and be sure and show in the interview that contributed in 2020?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

backdoor IRA contribution for year 2019 and IRA conversion

In the Deductions & Credits tab ... in the Retirement section ... follow the interview screens ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

backdoor IRA contribution for year 2019 and IRA conversion

Thank you! the screenshot helps a lot!

In my interview question for " total 2019 traditional IRA contribution", should I enter $6000 or $6000 plus amount I rolled over from my previous 401k?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

backdoor IRA contribution for year 2019 and IRA conversion

No. A 401(k) rollover is NOT a contribution. But I will warn you that this so called "backdoor Roth" only works if the 2019 year end value of ALL Traditional IRA, SEP and SIMPLE accounts in aggregate is zero, otherwise the nondeductible basis must be prorated between the Roth conversion and the remaining year end value. If the 401(k) rollover was a large amount then only a small portion of the conversion will be non-taxable.

You can NEVER withdraw ONLY the nondeductible part - it must be prorated over the entire value of ALL Traditional IRA accounts which include SEP and SIMPLE IRA's. (For tax purposes you only have ONE Traditional IRA which can be split between as many different accounts as you want, but for tax purposes they are all added together).

For example using rough figures: if you had $60K of nondeductible contributions in an IRA with a total value of $600K (10:1 ratio), then when you take a $60K distribution from any IRA account $6,000 would be nontaxable and $54,000 would be taxable (same 10:1 ratio) , with the remaining $54K of basis staying in the IRA for future distributions. As long as there is any money in the IRA, there will be some basis.

TurboTax will ask for your non-deductible "basis" and then the *Total Value* of *all* Traditional IRA, SEP and SIMPLE accounts as of Dec 31, of the tax year. That is so the prorating of the basis can be properly proportioned between the current years distribution and the remaining IRA value. That is done on the 8606 form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

backdoor IRA contribution for year 2019 and IRA conversion

Thank you for the information!

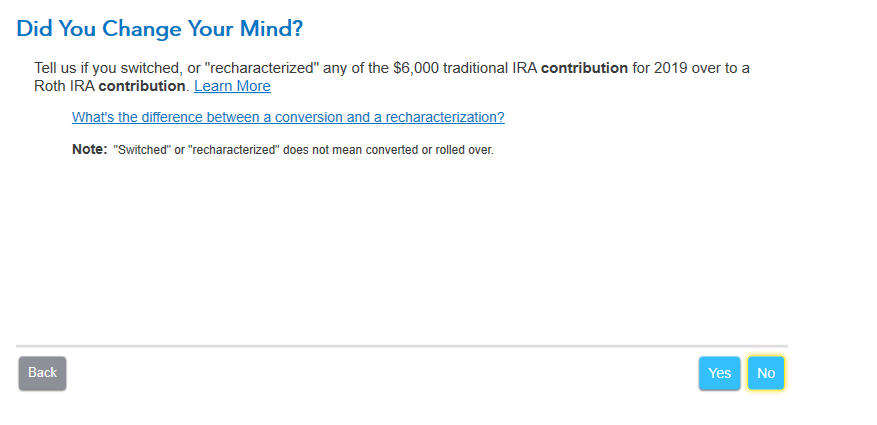

I have answered the interview questions as the following screen shot, however my 8806 form line 4 is not showing anything, @ macuser_22 mentioned that line 4 should also show the amount of $6000, did I do anything wrong?

No is selected here

No is selected here

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

backdoor IRA contribution for year 2019 and IRA conversion

That is a strange behavior of TurboTax when the 1099-R has not yet been entered that populates the rest of the 8606. Line 4 should show the contribution for 2019 when made in 2020 but it is immaterial unless there is a 2019 distribution also, then line 4 will be populated. Otherwise line 4 is not needed. That is probably a TurboTax bug because the 8606 form rules say it should be on line 4 whether there is a distribution or not, but practically it makes no difference.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

backdoor IRA contribution for year 2019 and IRA conversion

The Form 8606 is correct and as expected. The instruction above line 4 says that lines 4 through 13 are to be skipped since there were no distributions or conversions to report on line 7 or line 8.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tianwaifeixian

Level 4

tianwaifeixian

Level 4

gagan1208

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

tianwaifeixian

Level 4

tcondon21

Returning Member