- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Annualized Income

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Annualized Income

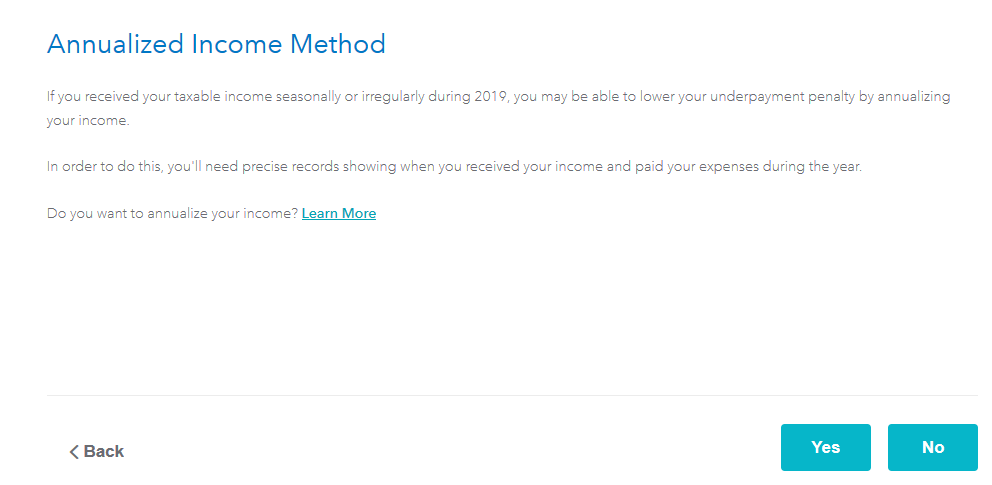

I started doing some 401K/IRA distributions and Roth conversions at the end of last year and made estimated tax payments in the corresponding quarter. Despite entering this distribution information in TurboTax it never even suggested entering Annualized Income information to avoid paying penalties on my taxes due to the 'lumpy' income. This seems like a very basic and common issue with retirement distributions and capital gains yet the information is buried away and not suggested as a possibility by the program. This seems like a glaring defect.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Annualized Income

Most people do not go through the entire Underpayment Penalty section of TurboTax to see if they can reduce their tax using the Annualized method. If you had a significant penalty, you can amend your return to get a reduction of penalty.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Annualized Income

I don't think I was shown that screen before I started searching for annualized income. Thanks for the information.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ajm2281

Returning Member

waynelandry1

Returning Member

Lukas1994

Level 2

jigga27

New Member

branmill799

New Member