- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- After inputs, I'm being taxed 24%, however, I'm married/filing jointly and our combined income does not equate to or fall within this tax bracket ($190,751 to $364,200.)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After inputs, I'm being taxed 24%, however, I'm married/filing jointly and our combined income does not equate to or fall within this tax bracket ($190,751 to $364,200.)

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After inputs, I'm being taxed 24%, however, I'm married/filing jointly and our combined income does not equate to or fall within this tax bracket ($190,751 to $364,200.)

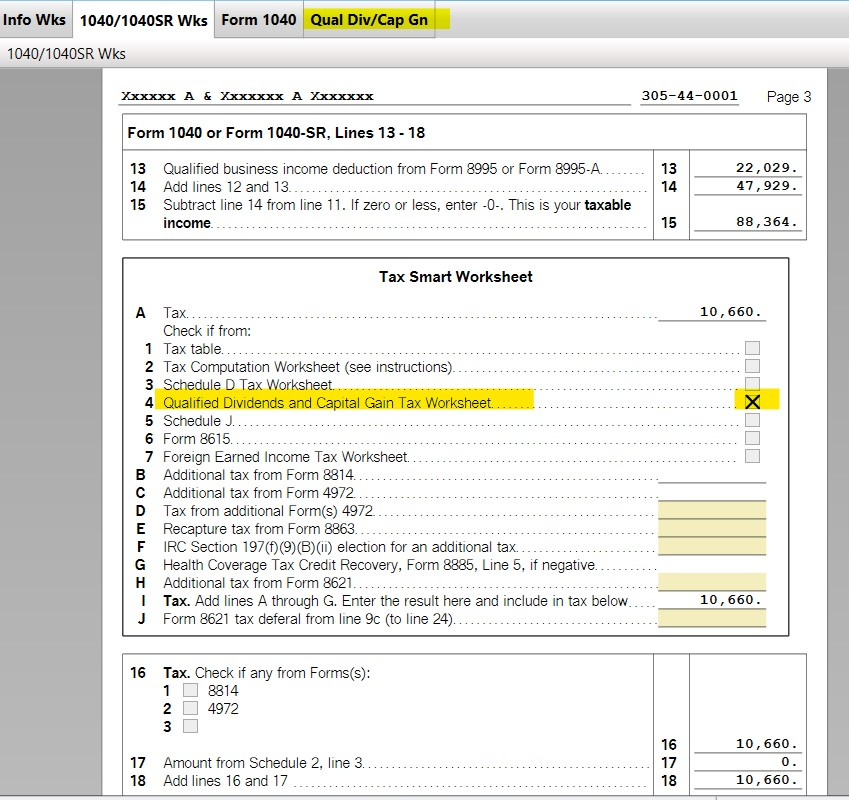

Take a look at this article to see how tax brackets work. And not all income is taxed the same. Some income is taxed at different rates (Qualified Dividends/Long-Term Capital Gains are taxed at a lower rate than ordinary income). If you have any of the following included in your return, the tax table doesn't give you accurate results:

- Qualified Dividends and Capital Gain Tax Worksheet

- Schedule D Tax Worksheet

- Schedule J

- Form 8615

- Foreign Earned Income Tax Worksheet

The tax calculation can be found on the worksheet titled Form 1040/1040SR Wks. The tax computation is on the Tax Smart Worksheet which is located between Line 15 and Line 16. If A1 is checked, your tax liability came from the tax tables. But if any other line has a checkmark, you will have to go to the corresponding worksheet to see the tax calculation. In the example below, you would need to look at the Qualified Dividend/Capital Gains Wks to see how the tax was calculated.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

a_nicolet0201

Level 1

dnorment29

New Member

da2024

Level 1

katyo2000

New Member

MDuerst

New Member