- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- 401k Cares Act Covid Withdrawal and Repayment?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401k Cares Act Covid Withdrawal and Repayment?

UPDATE

OK I was able to get thru that & do what u said.

Now when I run smart check it finds error on Form 8915E-T asking me to put in FEMA DISASTER number.

I do not have one & used Cares Act to withdraw $ for down payment on house.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401k Cares Act Covid Withdrawal and Repayment?

I think you entered this on the wrong screen because the COVID disaster is not the same thing as a Fema disaster. Here is how to enter the information if you do not have a 1099R. Completion of the step will ensure that you will fill out the 8915-E, which in turn will generate a 8915-F.

- Wages & Income > Retirement Plans and Social Security >

- IRA, 401(k), Pension Plan Withdrawals (1099-R) > Start, Revisit or Update > Continue

- First question that will be asked is Did you get a 1099-R in 2021? say no

- Answer Yes 'Have you ever taken a disaster distribution before 2021?

- Answer Yes, You had a 2020 Qualified Disaster Distribution

- Complete the Information using 8915-E generated in your 2020 Tax return > Continue

- Enter any amount you may have repaid in 2021, if applicable

- Finish the entry for your spouse if applicable or just click Continue

- Complete any additional retirement questions as you move through this section

@Caseyblue

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401k Cares Act Covid Withdrawal and Repayment?

Ugh-I am Not being asked Did u get a1098R in 2021?

Here is what I am seeing when I try to follow your instructions:

First question asked is Did u take any disaster distributions in prior years or repay any prior year distribution in 2021? YES

2nd question Did u take a Qualified Disaster Distribution ? YES

Then entered $ ants after next 2 questions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401k Cares Act Covid Withdrawal and Repayment?

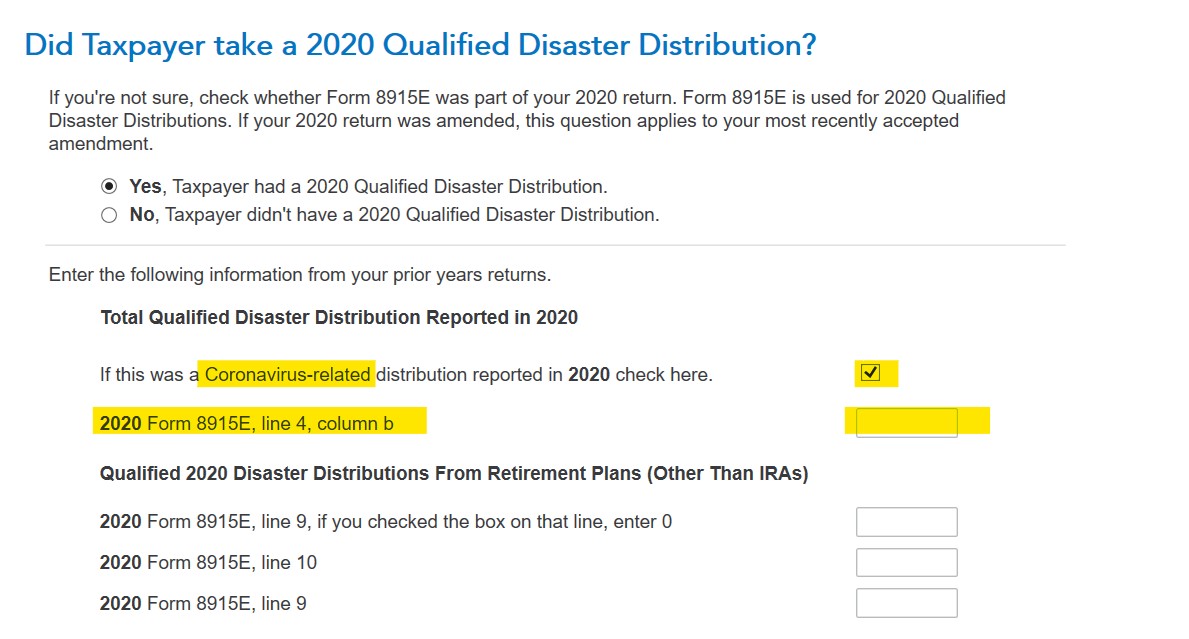

You are already past that question. You are entering your info in the correct spot. But when you get to Did you take a 2020 Qualified Disaster Distribution? screen, answer Yes. Then put a checkmark in the box that says 'This was a corona virus related distribution'. then you won't need the FEMA number. You will add the info requested from your 2020 Form 8915-E. Scroll down and click Continue.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401k Cares Act Covid Withdrawal and Repayment?

I have another 401k account just sitting out there from a previous employer. If I roll that account over into the 401k account that I withdrew money from under the Cares Act in 2020, will that count as repayment?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401k Cares Act Covid Withdrawal and Repayment?

No, that would be considered a rollover and not money replacing the disaster withdrawal from 2020.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401k Cares Act Covid Withdrawal and Repayment?

OK I was able to get thru that & do what u said.

Now when I run smart check it finds error on Form 8915E-T asking me to put in FEMA DISASTER number.

I do not have one & used Cares Act to withdraw $ for down payment on house.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401k Cares Act Covid Withdrawal and Repayment?

During Federal Review you may get a notice to check an entry. Clicking Check Entries takes you to the Check This Entry screen showing a box for entering a FEMA Disaster name. Put your cursor in the box (click in the box) and then click on the spacebar. Click on Continue On the following screen Run Smart Check Again click on Done.

The Form 8915-F you completed already has the box for the Coronavirus checked on Item D of the form.

As stated on the Form 8915-F -

If your disaster is the coronavirus, check this box ▶ Don’t list the coronavirus in item C.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401k Cares Act Covid Withdrawal and Repayment?

If I repaid 1/3 last year & intend to repay 1/3 this year, must it be repaid by April 18th

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401k Cares Act Covid Withdrawal and Repayment?

Yes, You will need to report 1/3 of the distribution this year as income in the 2021 tax year. If you owe taxes for your 2021 tax year, the tax due amount needs to be paid by April 18.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401k Cares Act Covid Withdrawal and Repayment?

Yes I understand that.

My question is do I till sometime after April 18th for the 1/3 repayment?

If so, till when?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401k Cares Act Covid Withdrawal and Repayment?

The third installment goes on tax year 2022 so you have until the end of this year for any repayment you wish to make. If you repay more than 1/3, you can amend prior year returns.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401k Cares Act Covid Withdrawal and Repayment?

I will be making my 2nd repayment.

When does that need to be done by?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401k Cares Act Covid Withdrawal and Repayment?

Your second payment was due in 2021. You are filing taxes in 2022 for events that happened in 2021.

Form 8915-F is used to report a disaster-related retirement distribution and any repayments of those funds. It also allows you to spread the taxable portion of the distribution over three years, if needed, and report prior year distribution amounts which are to be taxed in 2021.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401k Cares Act Covid Withdrawal and Repayment?

So 2nd repayment would need to be made by April 18th filing date?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Mandababy81

New Member

bbolsm82

Returning Member

rpruiz23

Returning Member

taxbear09

New Member

ladylogan81

New Member