in Education

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- 1099R gross distribution RMD over the NYS $20k exemption

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099R gross distribution RMD over the NYS $20k exemption

can a tax expert from TurboTax give me advice on how to enter this in TurboTax?

thank u

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099R gross distribution RMD over the NYS $20k exemption

Yes, follow these steps:

If your income has not been excluded in your return, try these steps.

- Log into Turbo Tax

- Select the State Taxes tab

- As you navigate through the screens, you will see a screen that says Changes to Federal Income.

- Scroll down to Wage and Retirement Adjustments

- Locate Received Retirement income.

- Start/ Edit

- Retirement Distributions Summary

- Edit your distribution and answer any additional questions.

- Continue/ done

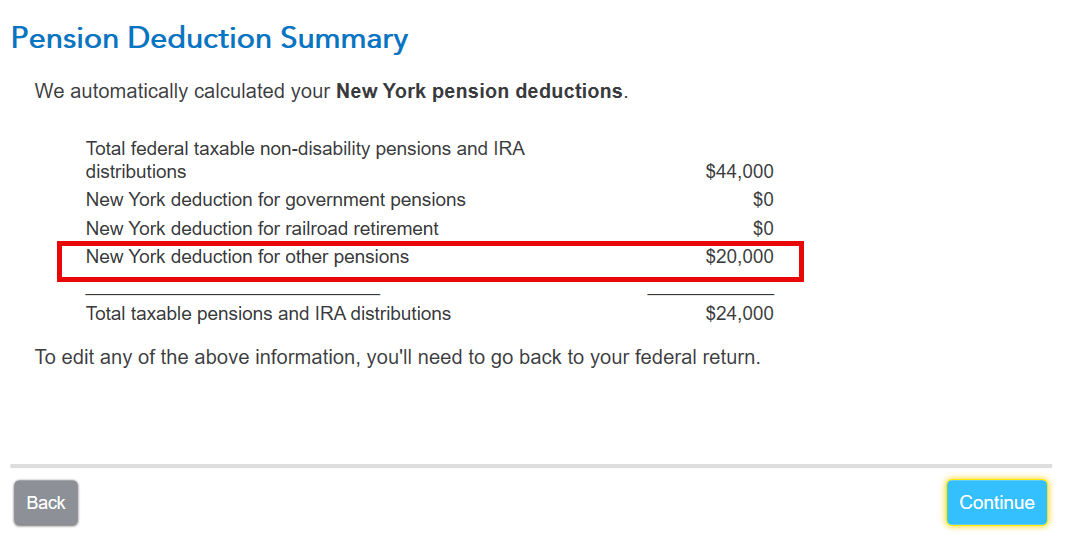

- The next screen will show you the Pension Deduction Summary

Your pension income is not taxable in New York State when it is paid by: New York State or local government. the federal government, including Social Security benefits and certain public authorities.

In addition, NY allows a $20,000 exemption if you are over the age of 59 ½ or turn 59 ½ during the tax year, you may qualify for a pension and annuity exclusion of up to $20,000. See Information for retired persons - Department of Taxation for full details. An IRA qualifies for the $20,000 exclusion according to Common questions and answers about pension subtraction | NY DOR states on page 2:

• TIAA/CREF Supplemental Retirement Annuities (SRA);

• 403B plans;

• Group Supplemental Retirement Annuities (GSRA);

•IRAs; or • Roth IRAs.

These distributions would qualify for the $20,000 pension and annuity income exclusion under Tax Law section 612(c)(3-a).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

marcilyday

New Member

keeponjeepin

Level 2

janak4x4

New Member

EKrish

Level 2

fdjct

Level 1