- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

Yes, follow these steps:

If your income has not been excluded in your return, try these steps.

- Log into Turbo Tax

- Select the State Taxes tab

- As you navigate through the screens, you will see a screen that says Changes to Federal Income.

- Scroll down to Wage and Retirement Adjustments

- Locate Received Retirement income.

- Start/ Edit

- Retirement Distributions Summary

- Edit your distribution and answer any additional questions.

- Continue/ done

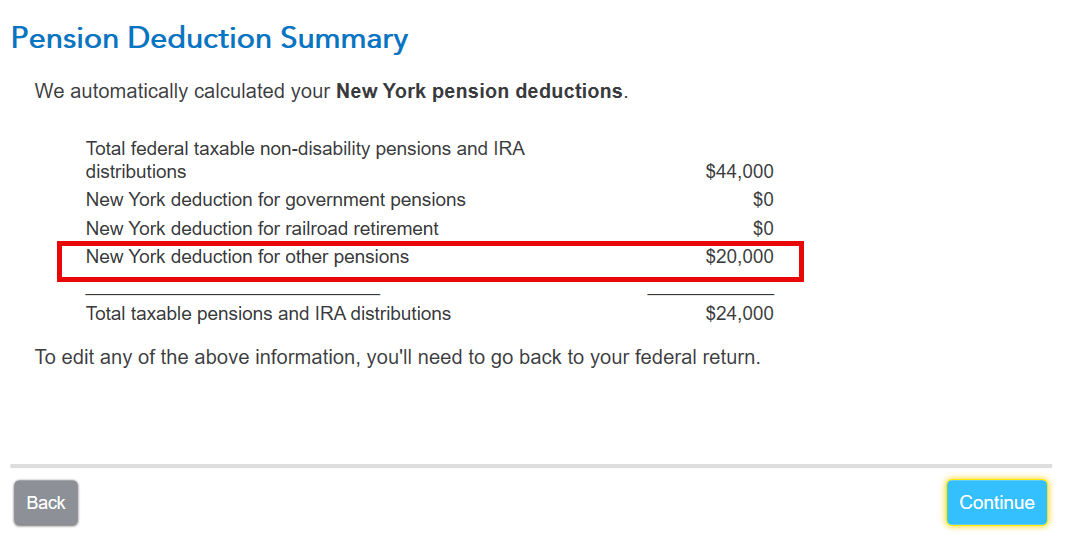

- The next screen will show you the Pension Deduction Summary

Your pension income is not taxable in New York State when it is paid by: New York State or local government. the federal government, including Social Security benefits and certain public authorities.

In addition, NY allows a $20,000 exemption if you are over the age of 59 ½ or turn 59 ½ during the tax year, you may qualify for a pension and annuity exclusion of up to $20,000. See Information for retired persons - Department of Taxation for full details. An IRA qualifies for the $20,000 exclusion according to Common questions and answers about pension subtraction | NY DOR states on page 2:

• TIAA/CREF Supplemental Retirement Annuities (SRA);

• 403B plans;

• Group Supplemental Retirement Annuities (GSRA);

•IRAs; or • Roth IRAs.

These distributions would qualify for the $20,000 pension and annuity income exclusion under Tax Law section 612(c)(3-a).

**Mark the post that answers your question by clicking on "Mark as Best Answer"